Business

Page: 41

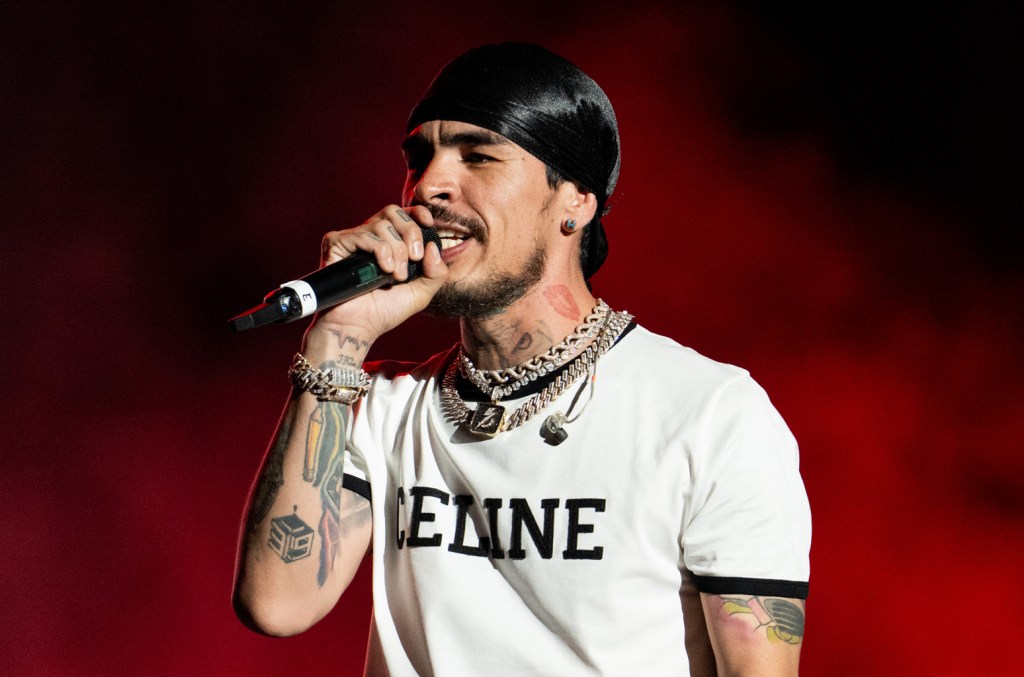

Fabio Gutiérrez — father of rising star Xavi and co-writer of several of his biggest hits — has signed a global administration deal with Warner Chappell Music, the company announced Wednesday (June 11).

WCM will administer future output and select tracks in Xavi’s repertoire, including “La Diabla,” “Corazón de Piedra,” “Sin Pagar Renta” and “En Privado” with Manuel Turizo — all co-written by Gutiérrez.

“It means a lot, it’s a dream for any songwriter,” Gutiérrez says over Zoom about his first-ever admin deal. Father to música mexicana star Xavi and emerging singer-songwriter Fabio Capri, Gutiérrez began writing as a teen but never fully developed his own career as an artist.

Trending on Billboard

“I became a father at 16 and I had to work for the family so I went into construction and had since worked as an electrician. I emigrated from Sonora to Phoenix and lived the whole American dream,” he says. “I didn’t make it as an artist because I didn’t have the maturity or the support, but I learned to do everything that Xavi would need when his time came.”

While being an electrician was his main source of income, Gutiérrez had always been passionate about music. As a young teen, he was part of a dance group and continued writing and producing songs on his own in his home studio. “My kids didn’t know I was doing [music] after work,” he says. But that all changed during the pandemic, when Gutiérrez decided he would teach Xavi how to write songs.

“That’s really how it all started,” he remembers with a smile on his face. “I was just being a dad, teaching him something new in life, just like you teach them how to walk, it’s been a lot of work and it’s all happened very fast.”

Signed to Interscope, Xavi — known for his style of corridos tumbados — topped the 2024 Year-End Top Latin Artist – New chart. His single “La Diabla” not only earned him his first No. 1 on a Billboard chart, but it also became the first champ of the year — crowing Hot Latin Songs for 14 consecutive weeks. Xavi’s success on the charts also made him the new artist of the year winner at the 2024 Billboard Latin Music Awards.

“Besides being my dad, he’s played a huge role in everything I do musically,” Xavi said in a statement. “He’s my partner in crime! We write together, come up with crazy ideas, and there’s this cool chemistry between us. Honestly, it feels like we can read each other’s minds. We’re connected by blood and music.”

Gutiérrez remembers that when “La Diabla” went viral, he got a call from Xavi. “He was like, ‘Hey, what are you doing?’ And I was really busy at work, carrying things around. Then he said, ‘How do you feel with everything going on with the song?’ And I remember I told him, ‘I feel normal. You?’ He answered, ‘Yeah, I feel normal too.’ I told him that’s the way it always has to be, regardless of what happens. We are human beings and we simply dedicate ourselves to doing something with a lot of love and it feels nice to write music that connects with an audience.”

“Signing Fabio Gutiérrez is incredibly special for our team,” Delia Orjuela, head of creative Mexican music/música mexicana, Warner Chappell Music. “His creative partnership with both his sons Fabio Capri and Xavi, has helped shape one of the most exciting new voices in Latin music today. Their journey is a testament to the magic that happens when family, culture, and artistry come together.”

Besides songwriting, Gutiérrez also co-manages the careers of Xavi and Fabio Capri. “Everything is possible if you work hard, no matter where you come from. I didn’t have my dad but if I had my dad, I would have achieved more things,” Gutiérrez adds. “The job of being a parent is to discover the talent of your children and do anything you can to support whatever that talent is.”

LONDON — The U.K. government shared its spending review on Wednesday (Jun. 11), Labour’s first since it won 2024’s parliamentary election. The U.K. music industry, however, has raised concerns that funds are not being prioritized for the sector and warned that “action is needed now” to ensure its stature on the global stage.

The review has been keenly anticipated as sectors look to Labour to stimulate the economic growth promised in its election manifesto. The last full spending review was issued by the previous Conservative government in 2021, but in July 2024 Reeves claimed the Conservative party had overspent by £21.9 billion ($29.6 billion) and that “a necessary and urgent decision” on budgets was required. The review sets out day-to-day budgets for government departments for the next three years, and details long-term investment plans until the end of the decade.

In the new review, chancellor Rachel Reeves shared spending plans for the NHS (National Health Service), and across housing, defense, transport and more. In recent months, the U.K.’s stakeholders have lobbied the Labour government for additional funds for the music industry, but their calls appear to have gone largely unheard.

Trending on Billboard

Last Thursday (May 29), an open letter from the PRS Foundation called on the government to pledge £10 million ($13.5 million) per year for music export and exchange, with the goal of promoting the U.K. music scene on a global stage. The letter was signed by over 350 figures in the industry, including Glastonbury boss Emily Eavis, Beggars Group founder and chairman Martin Mills and rock band Nova Twins. The signatories said the fund would “stimulate the long-term growth of the U.K. music industry” and pointed to South Korea and Australia as nations that had seen successful export programs in recent years.

Gee Davy, chief executive of AIM (Association of Independent Music), said in a statement to Billboard U.K.: “The U.K.’s music is a key element of our soft power, which creates jobs and value for the economy beyond some sectors receiving help in the government spending review. But a combination of economic shocks has hit our sector, with an amplified effect on grassroots and independent music.”

She added, “To regain our position on the global stage we urgently need the government to step in with an ambitious export strategy and commit to long-term investment, alongside incentives to boost music creation with a tax credit scheme similar to that in film. Action is needed now.”

There’s also concern about the Labour government’s commitment to alleviating the live music scene’s struggles in recent years. Recent data from the MVT (Music Venues Trust) indicates that two grassroots venues are closing every month in the U.K. and that the wider night time scene – including bars, clubs and suppliers – is suffering.

Michael Kill, chief executive of the NTIA (Night Time Industry Associations) says that while the government’s commitment to long-term energy infrastructure was a positive step, “venues are struggling to keep the lights on today” due to rising costs in operation. He outlined that the night time industry contributes £153 billion ($207 billion) to the U.K. economy every year, and employs 2.1 million people, but that businesses need “clarity” on what to expect in relation to business rates and potential tax hikes in the near future.

“We need a budget that understands our value, not one that inadvertently accelerates decline,” Kill said. “The government must work in partnership with us. The capital investment plans may look bold, but the devil is in the detail. We need immediate support, clear fiscal strategy, and genuine engagement ahead of the Autumn budget if we are to safeguard a safe, thriving, and sustainable night time economy.”

Music in education settings has also been a key area of focus in recent months with huge talent throwing their weight behind the cause. At the BRITs in March, rising star Myles Smith used his winners’ speech to call on the government to make music education more accessible in state schools. Ed Sheeran, meanwhile, led a campaign backed by Elton John, Harry Styles and Coldplay that called for additional funding for lessons and instruments.

Damian Morgan, employability and industry lead at dBs Manchester, says that the “U.K.’s global success in music is no accident – it’s the result of years of investment, opportunity and education. But right now, we’re at a critical tipping point.” The dBs institutes in Manchester, Bristol and Plymouth offer professional training for students with an interest in music technology, game design and the creative industries.

Morgan adds, “Without serious and sustained support, we risk leaving behind a generation of talent that simply can’t afford to access the opportunities others take for granted. We need the government to take this seriously: invest in music education, protect it in the curriculum, and ensure young people from all backgrounds can find their way into our world-leading music industry.”

CMAT’s newest single, “Take A Sexy Picture Of Me,” has a lightning-in-a-bottle quality that nothing she had released previously could quite compare.

The track, which will feature on the country-pop songwriter’s third LP Euro-Country (due Aug. 29 via AWAL), is bright, hooky and possessed of a subtle emotional pull. Under a soulful, spacious melody, the tone shifts continually: from self-reflection to blame-laying, from denial to weariness, frustration and regret.

So as much as this irresistible earworm encapsulates the Song of the Summer ethos with its easy, forthright and effortlessly cool arrangement, it also in a way defies it. It offers a pained and pointed depiction of body image struggles in a world of constant online commentary — evoking a sunlit mood with lyrics rooted in a wider, meaningful conversation. CMAT (an acronym of Ciara Mary-Alice Thompson) recently explained to BBC 6 Music that the track is about the mental anguish she has experienced, having previously received a flood of “nasty comments” on her physical appearance.

Trending on Billboard

Since its release last month, “Take A Sexy Picture Of Me” has taken on a life of its own, picking up significant traction on TikTok while also translating into real-world success. What started as a playful dance challenge by app user Sam Morris, a 37-year-old content creator based in Brighton, has snowballed into a trend. The routine follows along with the words of the second verse — “I did the butcher/ I did the baker/ I did the home and the family maker/ I did schoolgirl fantasies” — with participants miming chopping and baking actions.

Dubbed the “Woke Macarena” in reference to its simple choreography, the song has soundtracked over 28,000 TikTok videos in recent weeks, with stars such as Lola Young and Julia Fox getting involved. CMAT, meanwhile, is currently in the midst of an extensive festival run: at the end of May, she thrilled a Main Stage crowd at London’s Wide Awake festival, while a Pyramid Stage slot at Glastonbury is on the horizon. Last week (June 6), she supported Sam Fender at London Stadium in front of an audience of 82,500 — the venue’s biggest sold-out show to date.

Prior to this, CMAT and her band delivered an electrifying rendition of “Take A Sexy Picture Of Me” on Later… With Jools Holland, kicking off the Euro-Country campaign in earnest. The performance proved that she wants viewers to understand what she’s singing about on the deepest level possible, and if that requires theatrical emotions and dancing, she is more than willing to oblige. It wouldn’t be remiss, then, to suggest that prestige slots on U.S. late night shows may soon come along.

“CMAT is firmly and deservedly positioning herself as one of this summer’s breakout stars,” says Adam Read, music programs manager at TikTok UK. “This is a track that speaks directly to identity, self-image and transformation, all while being incredibly catchy. The fact that the choreography took shape organically and is now being performed at live shows by entire crowds is exactly the kind of cultural crossover we love to see.”

Unlike this time last year, when Sabrina Carpenter’s smash hit “Espresso” was dominating the British (and global) airwaves, there arguably hasn’t been a Song of the Summer frontrunner just yet. Alex Warren’s ballad “Ordinary” has remained firmly at the summit of the Official U.K. Singles Chart for the past 12 weeks — the longest-running U.K. No. 1 of the 2020s — yet its sighing, plaintive melody doesn’t quite speak to the easy-breezy feel of the season.

Read and the team at TikTok UK, however, have predicted “Take A Sexy Picture Of Me” as a contender, alongside Afrobeats star Darkoo’s “Like Dat” and Charli xcx’s “Party 4 U.” The latter is a 2020 fan favorite that peaked at No. 42 on the Billboard 200 last month (May 31), with Atlantic Records having pushed it towards U.S. contemporary hit radio over the spring.

With over 575,000 video creations under the #SongOfTheSummer hashtag, TikTok is a key launchpad for new music at this time of the year. CMAT, meanwhile, has gained over 26.6 million content views in the past month alone, leading to a 71% growth in her follower count and, in turn, pushing her monthly Spotify listeners over the 1 million mark. The song is continuing to climb Spotify’s Viral 50 — Global chart and is approaching 4 million streams on the service.

That begs the question: is this CMAT’s crown to take? The Dublin-raised musician has perhaps never been better primed to make a mainstream crossover. Her second LP, 2023’s Crazymad For Me saw her break the Top 40 on the Official U.K. Albums Chart for the first time (No. 23), while also scooping Mercury Prize, BRIT and Ivor Novello nominations; the former is a notable feat, given that 2022 debut If My Wife New I’d Be Dead failed to crack the Top 75.

Shrewd marketing from the Sony-owned AWAL, meanwhile, has also played a role in the success of “Take A Sexy Picture Of Me”; the track recently landed a glowing feature in The New York Times. “We realized very quickly that this would be an opportunity to broaden her out to new audiences,” says Victoria Needs, senior vp at AWAL. Having announced a worldwide deal with CMAT four years ago, Needs adds that the label’s vision for 2025 revolves around “solidifying her positioning in the U.K., Ireland and the rest of Europe,” as well as making “further inroads” in the U.S. with a North American headline tour booked for September.

CMAT finds herself in fine company on the world stage, with fellow Irish exports Fontaines D.C. and Kneecap having also pushed the needle forward in 2025. All three acts are making music with rich, defiant messaging, an attribute that chimes well with TikTok audiences, where songs can take off if they are attached to a particular story or movement; in this case, “Take A Sexy Picture Of Me” rings true with the collective female experience.

“CMAT is a great example of a real artist who has put in the work and has earned this moment,” AWAL CEO Lonny Olinick tells Billboard U.K. “Across three album campaigns, we have been fortunate to partner with her and do the hard artist development work that AWAL is known for, building her fan base from the ground up. We are all excited to see this powerful record connect with audiences globally.”

Karol G and Universal Music Group (UMG) are firing back at a copyright lawsuit over a track from her chart-topping Mañana Será Bonito – including arguing that a producer’s Instagram comment about the alleged similarities was posted “sarcastically” and wasn’t an admission of guilt.

The case, filed earlier this year, claims that the singer (Carolina Giraldo Navarro) and her co-writers stole key elements of her 2022 song “Gatúbela” from an earlier track called “Punto G,” released by producers Ocean Vibes (Jack Hernandez) and Alfr3d Beats (Dick Alfredo Caballero Rodriguez).

But in their first response to the case on Tuesday, Karol G and Universal Music Group flatly denied all of the lawsuit’s allegations. They said a musicologist report cited by the accusers, which claimed the songs were “extremely similar,” was “biased” and “patently improper.”

Trending on Billboard

“Defendants deny that they have interpolated, sampled, used, or copied plaintiffs’ work,” the Colombian star’s lawyers write. They also say they’ll be able to prove that “Gatúbela” was “independently created,” which could mean they have evidence that Karol G’s song was actually created first.

Released in February 2023, Mañana Será Bonito was a critical and commercial success, winning album of the year at the Latin Grammy Awards and reaching No. 1 on the Billboard 200 — the first all-Spanish language album by a woman to do so. “Gatúbela” was a hit in its own right, reaching No. 37 on the Billboard Hot 100 and No. 4 on the Hot Latin Songs chart.

Hernandez and Rodriguez sued in March, claiming they “immediately recognized” the song’s similarities to “Punto G,” which they say was released two months earlier: “By every method of analysis, ‘Gatúbela’ is a forgery.”

In one passage, the lawsuit cited an Instagram exchange in which Alfr3d confronted one of Karol’s producers (DJ Maff) over the alleged similarities. In screenshots in the complaint, Maff responded by commenting “don’t tell anybody,” followed by a laughing emoji. The accusers claimed this meant he had “shockingly admitted” to stealing their song.But in Tuesday’s response, attorneys for Karol G and the other defendants said the Instagram exchange had been taken out of context – and that a joking social media post was hardly an admission of copyright infringement.

“Defendants admit that DJ Maff promoted ‘Gatúbela’ in an Instagram post dated August 26, 2022 and that DJ Maff sarcastically posted the comment appearing in the screen shot,” write Karol’s defense attorneys. “Defendants otherwise deny the allegations contained in paragraph 4 of the Complaint, including Plaintiff’s characterization of DJ Maff’s Instagram comment.”

The case over “Gatúbela” is still in the earliest stages. Karol G and UMG will likely soon file a motion to dismiss the case entirely, after which Hernandez and Rodriguez will respond. The judge will then decide if the case can move forward toward an eventual trial.

In a statement to Billboard, an attorney for the accusers said the complaint filed in March “speaks for itself” and reiterated its allegations: “At the end of the day, we believe that artists and producers should be properly credited with and compensated for the works that they create,” said Chester R. Ostrowski. “That is all plaintiffs are looking for in this case, and they eagerly await their day in court.”

The Coca Cola Company and Universal Music Group have partnered on the launch of a new imprint, Real Thing Records. or rtr.

The venture will focus on signing and developing emerging talent from around the world, with the label focused on all genres. The first signees are French-New Zealand artist Max Allais, who clocked a hit this year with his single “When The Party Ends.”

Real Thing Records. has also signed Indian singer, songwriter and producer, Aksomaniac, whose music fuses jazz, hip-hop and R&B with traditional Carnatic music.

Each new signing will be a joint effort between Real Thing Records. and a Universal Music Group label counterpart in each artist’s respective territory, to provide both local support and global growth. For Allais these frontline labels will be Better Now Records and Universal Music Germany) and for Aksomaniac they will be Def Jam Recordings India/Universal Music India.

“The Coca-Cola Company has a rich legacy, one of deep human connection and cultural resonance—breaking barriers and bringing people together across borders and generations,” says Joshua Burke, The Coca-Cola Company’s global head of music and culture.

Trending on Billboard

“Real Thing Records. is designed to unlock greater potential for artists, fans, and our brands—where creativity fuels growth and the combined power of our network and key global music partners create value greater than the sum of its parts,” Burke continues. “It’s our intention to let artists shine and give them the flexibility to develop their identities with the support of global reach and expertise. It’s a long-term commitment to music—enabling us to reinvest in our programs, champion the next generation of talent, and stay rooted in what matters most: music and fandom.”

This is not the first partnership between The Coca Cola Company and UMG, with UMG also previously serving as the label partner for Coke Studio, an initiative that has recruited superstar artists like Usher, Tyla, Karol G, Peggy Gou and NewJeans to participate in projects like original songs, festival experiences and live performances.

“For years, Universal Music Group and The Coca-Cola Company have shared a belief in the power of music to spark connection and shape meaningful experiences,” says Universal Music Group for Brands executive vice president Richard Yaffa. “With the launch of Real Thing Records., we are taking that vision further – joining forces to build a modern label that champions artistry and amplifies emerging voices on global and local stages, while giving fans the cultural moments they crave.

“Both companies recognize the long-term value of investing in artistic innovation,” Yaffa continues, “and our past work together has consistently demonstrated how music can move people and create lasting impact. The evolution and continued success of our several collaborations stands as a testament to what’s possible when we align creativity with cultural relevance.”

To draw his K-pop fan army onto the new OpenWav app, pop singer Kevin Woo schooled his nearly 4.4 million social-media followers on how it works. Then he sold stuff to them: $10,000 worth of hoodies and water bottles and $1,200 worth of tickets to a Los Angeles listening party in March for his single “Deja Vu.”

“It’s very refreshing,” says Woo, formerly of hit boy band U-KISS. “It gives me so much freedom to do what I want and not have to stress about ‘Where am I going to get my next paycheck? How do I know when the label’s going to pay me out?’”

OpenWav, co-created by tech entrepreneur Jaeson Ma, who co-founded influential label 88rising and was an early investor in what became TikTok, launches Wednesday (June 11) with a splashy Indie Music Week party in New York attended by Ma and artist/OpenWav executive Wyclef Jean. It’s one of many platforms designed to help indie artists reach their most devoted followers and participate in a superfan market that Goldman Sachs predicted could reach $4 billion over the next five years. The app joins a crowded market that includes SoundCloud’s “fan-powered royalty” system and a long-promised Warner Music Group (WMG) app that launched a test version starring Ed Sheeran in April.

Trending on Billboard

Ma’s invention, which has drawn $30 million from investors such as WMG and CAA’s Connect Ventures, has an all-in-one smartphone interface that allows artists to stream new songs and videos, sell tickets and quickly design (through the use of AI tools), sell and ship merch. Ma spent two years setting up an international network of 200 factories that accommodate orders of any size. “I can put my design on a premium hoodie that’s like Yeezy off-white level, and if one fan buys that hoodie, we will make it and ship it to their doorstep directly — with zero inventory,” Ma says. “It’s pretty crazy what we’ve been able to do.”

“I call this the Gen-Z Sears catalog,” Ma says on a Zoom as he scrolls through the custom golf balls, water bottles and other products available through the app. “I don’t want to say we’re faster than Amazon or Alibaba — we’re not faster. We’ve built a similar supply-chain ecosystem and made it specifically to be on-demand for artists and creators.”

In a music business where few artists can make a living from streaming revenue alone, and must tour, sell merch and develop sizable loyal fanbases to buy their products, “superfan” has become a gold-rush buzzword. (OpenWav fits this category even though Ma avoids using the term “superfan app.”) In March, Australian producer Alan Walker launched an app designed to interact more directly with fans than he could on Instagram or TikTok; Boston metal band Ice Nine Kills’ app, Psychos Only, offers exclusive merch and exclusive ticket pre-sales with a $7 monthly membership fee.

“This started out several years ago with Patreon, and we learned that for premium content, fans will pay if you create something valuable,” says Dan Tsurif, vp of digital marketing for 10th Street Entertainment, Ice Nine Kills’ management company.

Ma’s bet for OpenWav is that dedicated fans will pay $10 a month — “a Starbucks coffee,” he says — and 1,000 of them will provide each participating artist with $120,000 in annual salary. But some in the music business wonder whether such artist-to-fan tools will be relevant for a broad range of artists. K-pop stars like Woo benefit from a loyal fanbase built meticulously over years of savvy music-company marketing, and veteran touring stars from Taylor Swift to Umphrey’s McGee have spent decades building fanbases on the road, but everyone else may struggle on this kind of app.

“In K-pop, they’re already obsessive about collecting things and buying merch. With a touring artist, they’re used to buying VIP [tickets] or merch,” says Aidan Schechter, a partner at management and publishing company 1916 Enterprises and founder/CEO of management music-tools venture Patchbay. “I don’t think artists and artist teams are able to keep up with the demands of consistent posting and exclusive content creation on a lot of these apps. Artists and their teams don’t have enough stamina.”

For Woo, 33, who came up in the South Korean K-pop industry, OpenWav is a crucial tool for remaining independent. The app, which he has been beta-testing most of this year, pays 80% of merch and ticket sales to the artist and keeps 20%. Woo says OpenWav allows him access to all his sales data and analytics — he has used it, for example, to discern that he has a surprisingly large listener base in Austin, Texas, leading him to a recent South by Southwest showcase.

“I’ve been in a K-pop boy band for over a decade, and knowing how the whole system worked, I wanted to start my own venture,” he says. “As I started to learn more about the app, I fell in love with how easy and seamless it was. It’s like TikTok meets Spotify.”

R. Kelly is asking to cut short his 30-plus-year sentence for racketeering, sexual abuse and child pornography based on strange new claims that jail officials tried to solicit a fellow inmate to kill him.

The disgraced R&B star made the eyebrow-raising allegations in a Tuesday (June 10) court filing asking to be released from the Federal Correctional Institution in Butner, N.C., where he’s serving multiple decades after being convicted in two separate criminal cases.

Kelly claims he’s no longer safe behind bars because prison officials are trying to have him killed to keep from revealing prosecutorial misconduct he recently uncovered — namely, that his pre-trial cellmate stole his attorney-client communications and shared these private messages with prosecutors.

According to the motion, prison officials tried to stop this damaging information from getting out by soliciting fellow inmate Mikeal Glenn Stine, a member of the Aryan Brotherhood prison gang, to kill Kelly. Kelly’s lawyers say that while Stine ultimately did not go through with the alleged assignment, the threat still lingers.

“More A.B. members are accumulating at his facility,” reads the filing. “More than one has already been approached about carrying out his murder. One of them will surely do what Mr. Stine has not, thereby burying the truth about what happened in this case along with Robert Kelly.”

The motion includes signed declarations from both Stine and Kelly’s former cellmate. In a statement shared with Billboard, Kelly’s attorney, Beau Brindley, said, “The evidence we have before us demonstrates the weaponization of the D.O.J. to pursue a public figure through corrupt and criminal means.”

Brindley added that Kelly’s legal team is seeking clemency from President Donald Trump, saying Trump “is the only one with both the power and the courage” to curb such alleged prosecutorial corruption.

Prosecutors did not immediately return a request for comment on the motion, but they quickly filed papers of their own asking Judge Martha M. Pacold to strike Kelly’s filing, which contained the name of a child victim who was anonymized during his trial.

“Robert Kelly is a serial sexual predator,” wrote prosecutors. “He even documented his sexual abuse of children on film — creating child pornography — such that the abuse would live on in perpetuity. That abuse and harassment continues with defendant’s latest filing.”

Judge Pacold struck the motion as requested and ordered Kelly’s team to refile it with the victim’s name properly redacted. The judge set a hearing on the matter for Wednesday (June 11) in Chicago.

Kelly was convicted of a slew of sex crimes at two separate federal trials. A New York jury found him guilty of racketeering and sex trafficking in 2021, and he was convicted of child pornography and enticing minors for sex in Chicago in 2022.

The former R&B star was sentenced to 30 years in prison for the New York conviction and 20 years in the Chicago case, although the vast majority of the second sentence will overlap with the first. Both convictions have been upheld on appeal.

Música mexicana singer-songwriter Codiciado has filed a lawsuit against his old record label, Rancho Humilde, and former bandmates in the ensemble Grupo Codiciado, claiming they stole his intellectual property by getting the band back together under the name Los Codicia2 after he went solo.

Codiciado (Erick de Jesús Aragón Alcantar) made the accusations in a federal lawsuit filed Tuesday (June 10) against Rancho Humilde; the label’s trio of co-founders, Jaime Humilde, Jose “JB” Becerra and Roque “Rocky” Venegas; and former Grupo Codiciado members Alexis Aguirre, Ivan Ramirez and Giovanni Rodriguez Meza.

Grupo Codiciado formed in Tijuana in 2015 and later signed with Rancho Humilde; it reached No. 8 on the Regional Mexican Albums chart with Miro Lo Que Otros No Miran in 2018. The group disbanded in 2021, after which its lead singer, Codiciado, went solo, returning to the Billboard charts with his song “Vamos Aclarando Muchas Cosas” in 2023 and launching a successful tour the following year.

Trending on Billboard

The trouble started when Aguirre, Ramirez and Rodriguez Meza debuted a new group called Los Codicia2, pronounced “Los Codiciados,” under Rancho Humilde at the beginning of 2025. Codiciado claims the group’s name infringes his own trademarked moniker.

“The infringing mark adopted and used by defendants is practically identical to plaintiff’s marks,” wrote Codiciado’s lawyers. “This mark differs from plaintiff’s ‘CODICIADO’ mark only in that the final letter is ‘S’ and in the preceding term ‘LOS.’”

Codiciado says Rancho Humilde and his former bandmates are purposefully trying to mislead fans into thinking he’s affiliated with or endorses the new group, stating in the lawsuit that they’re attempting to “trade on the goodwill of plaintiff’s marks, cause confusion and deception in the marketplace and divert potential sales of plaintiff’s products to defendants.”

According to Codiciado, this alleged wrongdoing has persisted despite his sending multiple cease-and-desist letters to the label and band. He’s now seeking a court injunction to make them stop, plus monetary damages for trademark infringement, trademark dilution and unfair competition.

“Defendants’ acts are causing and, unless restrained, will continue to cause incalculable damage and immediate irreparable harm to plaintiff and to his valuable reputation and goodwill with the consuming public for which plaintiff has no adequate remedy at law,” the lawsuit reads.

Representatives for Codiciado declined to comment on the claims. Rancho Humilde did not immediately return requests for comment.

A federal judge has issued a gag order in Megan Thee Stallion’s defamation lawsuit against gossip blogger Milagro Gramz over the Tory Lanez shooting, citing warnings from the star’s lawyers that ongoing posts about Megan could “incite violence.”

The ruling came in a lawsuit Megan filed against Gramz (Milagro Cooper) last year, claiming the YouTuber had been “churning out falsehoods” on behalf of Lanez, who is currently serving a 10-year prison sentence for shooting Megan in 2020.

At a court hearing last week, Megan’s attorneys warned the judge that Gramz had continued to post “derogatory statements” about the superstar even after she sued her. Attorneys for Gramz argued back that she was merely responding to statements from Megan.

Trending on Billboard

In a ruling issued Tuesday (June 10), Magistrate Judge Lisette M. Reid settled the spat by simply ordering both sides to stop discussing the case publicly — a decision that came with a reminder that “the First Amendment right to free speech is not absolute.”

“Both plaintiff’s and defendant’s social media postings have been viewed by their large following and plaintiff’s counsel expressed concern that defendant’s posts have generated severely critical and derogatory comments about plaintiff by defendant’s social media followers and could incite acts of violence,” the judge wrote. “As such, further extrajudicial statements by plaintiff and defendant could taint the jury pool.”

Neither side immediately returned requests for comment — unsurprisingly, given that they are now subject to a gag order.

Lanez (Daystar Peterson) was convicted in December 2022 on three felony counts over the 2020 shooting, in which he shot at the feet of Megan during an argument following a pool party at Kylie Jenner’s house in the Hollywood Hills. In August 2023, he was sentenced to 10 years in prison. He has filed an appeal, which remains pending.

In an October civil lawsuit, Megan’s attorneys accused Gramz of repeatedly spreading falsehoods about that criminal case, including questioning whether Megan was even shot at all and claiming she was “caught trying to deceive the courts.” More recently, they said Gramz had pushed the “outlandish claim” that the gun Lanez used in the shooting had gone missing from evidence.

The lawsuit claimed the blogger made those claims because she was serving as a “mouthpiece and puppet” for Lanez as the singer sat behind bars. In an updated version of the lawsuit filed in December, Megan’s attorneys said prison call logs suggested that Lanez and his father had arranged to pay Gramz.

In February, a judge ruled that the case could move ahead. Denying a request by Gramz to dismiss the lawsuit, the judge said Megan had made a “compelling case” that the blogger had defamed her by claiming the star lied during Lanez’s trial and that she was “mentally retarded.”

“Plaintiff’s claims extend far beyond mere negligence — they paint a picture of an intentional campaign to destroy her reputation,” the judge wrote. “That is more than enough to [deny the motion to dismiss].”

In her gag order Tuesday, Judge Reid said that neither Megan nor Gramz “nor anyone acting on either parties’ behalf” can discuss the case “in any public forum or manner” while it remains pending. And she warned that violators of the order could be held in contempt of court.

Jon Loba, president of Frontline Recordings for BMG Americas, has been named the recipient of Country Radio Broadcasters (CRB) Inc.’s 2025 CRB President’s Award. The honor is presented to people who have displayed “exceptional dedication and played a vital role in shaping the success of the Country Radio Seminar and its mission to advance the […]

State Champ Radio

State Champ Radio