Business

Page: 38

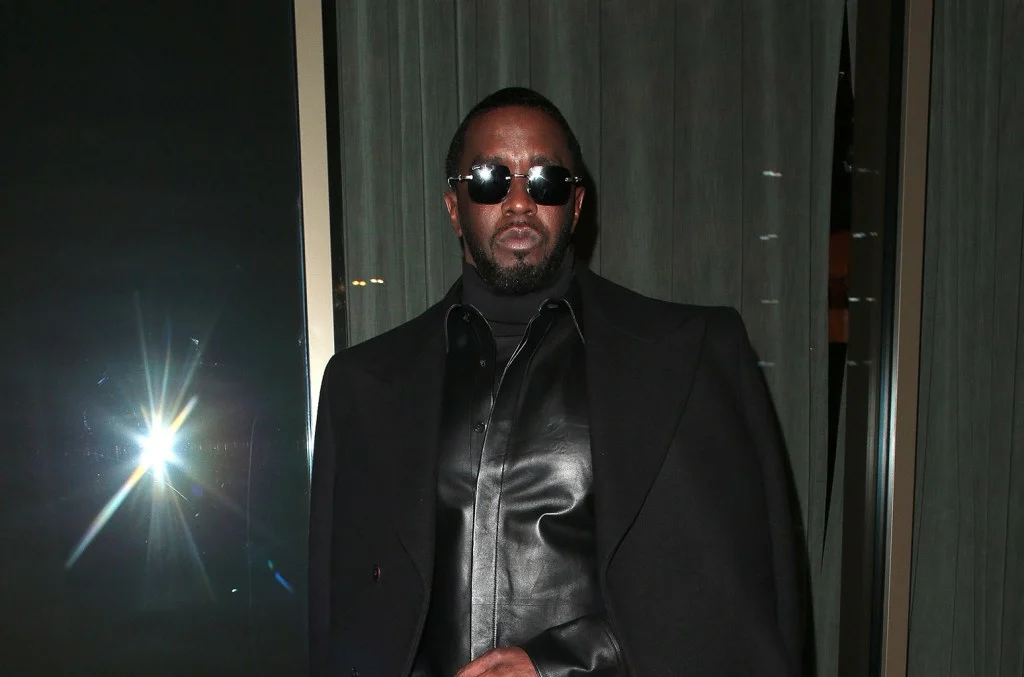

The judge in Sean “Diddy” Combs‘ sex trafficking trial has formally dismissed a juror for giving inconsistent answers about where he lives, rejecting warnings by the rapper’s defense attorneys about a “thinly veiled effort to dismiss a Black juror.”

Prosecutors moved to remove the juror last week, citing a “lack of candor” in his answers before he was picked for the trial. The defense blasted the move, arguing in a court filing over the weekend that he was “one of only two black men on the jury” and that Diddy would be “severely prejudiced” by his removal.

But at the start of Monday’s proceedings Judge Arun Subramanian said it was “inappropriate to consider race” in deciding whether the juror had been truthful in his answers, according to ABC News.

Trending on Billboard

“The record raised serious concerns as to the juror’s candor and whether he shaded answers to get on and stay on the jury,” Subramanian said. “There’s nothing the juror could say at this point to put the genie back in the bottle.”

The judge replaced the juror, a 41-year-old Black man, with a member of the alternate pool, a 57-year-old white man.

Combs is standing trial over accusations that he ran a sprawling criminal operation aimed at facilitating “freak-offs” — elaborate events which he allegedly forced his ex-girlfriend Cassie Ventura and other women to have sex with male escorts while he watched and masturbated.

Prosecutors also say the star and his associates used violence, money and blackmail to keep victims silent and under his control. (Read Billboard‘s full explainer of the case against Diddy here.) Combs has pleaded not guilty to the charges, which include on racketeering and sex trafficking; if convicted, he faces a potential sentence of life in prison.

Five weeks into a trial that’s expected to run until early July, prosecutors moved to dismiss Juror No. 6, citing alleged inconsistencies about where he lives. During jury selection, the man said he lives in the Bronx, but he later revealed that he had been living some of the time in New Jersey – a residence that would make him ineligible to sit on the jury.

Diddy’s team, which criticized prosecutors during jury selection for striking several Black candidates, vehemently opposed the removal. In court last week, defense attorney Xavier Donaldson called it a “thinly veiled effort to dismiss a Black juror.” And in a motion filed with the judge on Sunday, Diddy lawyer Alexandra A.E. Shapiro said the government had a “discriminatory motive” and was seizing an opportunity to “strike yet another black male from the jury.”

“The fairness of the trial depends in part on having jurors with backgrounds similar to Mr. Combs share their perspectives on the evidence with other jurors from diverse backgrounds during deliberations,” Shapiro wrote. “Removing this particular juror will deprive Mr. Combs of that important perspective.”

In the filing, Shapiro warned that removing the juror “at this late stage” would warrant a mistrial: “There is no question Mr. Combs would be severely prejudiced if the juror in question were removed,” she wrote. “Their pretextual motion to dismiss [the juror] is just one more attempt to gain an unfair advantage at the expense of Mr. Combs’s right to a fair trial — which is all we ask this Court to preserve.”

At Friday’s proceedings, Judge Subramanian tentatively dismissed the juror, though he vowed to consider the defense’s objections over the weekend. On Monday, he stuck by his earlier decision, including rejecting the complaints about race: “This jury does not raise those concerns.”

After blockbuster testimony last week from an alleged victim known as “Jane,” the Diddy trial will now continue into its sixth week. Prosecutors are expected to wrap up their case by the end of the week, allowing Combs’ team to begin presenting their own witnesses. A verdict is expected by July 4th.

Few artists fib as sweetly as Zach Top. On breakout hit “I Never Lie,” he sings about his life as a model citizen — an unfailingly punctual teetotaler who always gets a full night’s rest and remains impervious to heartbreak. It’s only at the end of the chorus that the illusion is shattered. “I wish I could say I miss you,” Top croons. “But you know I never lie.” The last falsehood is impossible to believe, and the rest of them fall like dominoes.

“I Never Lie,” which sounds like it could have been released in Nashville in the 1980s — maybe around 1987, when George Strait turned his own series of fibs into the hit single “Ocean Front Property” — cracked the Billboard Hot 100 for the first time in September. It has climbed the chart at a stately pace, peaking at No. 24 in May, an impressive accomplishment for Top — and for Leo33, the fledgling independent label who made the singer their first signing in the summer of 2023.

“We knew that he was an important signing for us for a lot of reasons,” Katie Dean, label head at Leo33, says of Top. “We had a great plan, and Zach is absolutely a once in a lifetime kind of artist. But you can hope and dream — to have the audience react this way has been unbelievable. And to have the success with him that we’ve had has also helped put our stamp on, ‘These are the kinds of artists that we want to sign.’”

Trending on Billboard

Dean spent close to two decades at labels in the Universal Music Group family, specializing in radio promotion, before helping to launch Leo33 in April 2023. Like many veterans of the majors who transition to the independent sector — and some veterans who are still working at the majors — she worries that the artist development process has “fallen to the wayside” as those companies prioritize “picking up what’s popping and running with it.”

“Majors are sort of designed to do high volume: It’s signing a lot of artists and taking a lot of shots,” Dean says. “I wanted to be in an environment where we could really focus and know everybody who was touching the project at any given time, rather than walking into a boardroom where there’s a bunch of new faces from week to week.”

Dean joined Universal Music Group in 2005, eventually rising to senior vp of promotion at MCA Records Nashville. During that time, she worked with George Strait, Reba McEntire, Taylor Swift, Sam Hunt and Kacey Musgraves, among others. Her resume was part of the reason Top signed with Leo33. “It meant a good bit to me that Katie Dean had worked on a bunch of records that had made me fall in love with country music,” he told Billboard last year.

She launched Leo33 along with Rachel Fontenot, former vp of marketing and artist development at UMG Nashville; Daniel Lee, former president of artist development company Altadena; and Natalie Osborne, former Downtown Music Nashville senior creative director. Leo nods to the constellation of the same name; Fontenot said in 2023 that it was meant to signify lion-like traits, namely courage and agility. (She left a few months after the label was born.)

Katie Dean

Courtesy of Leo33

At a time when labels who have not previously shown interest in country music are storming into Nashville, a newcomer needs to be able to offer competitive advances. Leo33 has backing from Firebird and Red Light Ventures, which provide “fantastic resources and additional marketing support,” according to Dean. Firebird, which has invested in labels, management companies and publishers, also serves as Leo33’s distribution partner, as well as “another voice” advocating for the label’s artists at the streaming services.

Dean promises singers plenty of direct attention. “We are all on group texts with each of the artists, so anyone is available at any point,” she says. On top of that, “We don’t have the luxury as a new label to rely on 30 years of catalog. Success is the only option.”

That hunger appealed to Top. He was being pursued by other record companies, but “the fact that [Leo33 executives] are all veterans in this industry and they are trying this new [label], it feels like they are at square one again just as much as I am and have everything to prove,” he said.

Osborne, an A&R executive at Leo33, had gone to Whiskey Jam in Nashville to see another act when she stumbled on a performance by Top, a bluegrass artist turned country singer. She played his music at the Leo33 office the next morning before setting out to find Top’s manager.

Dean was also “immediately smitten” by what she heard. “He made the kind of music that made me fall in love with this format,” she says. And Leo33 executives believed “there is an audience of people who are craving that kind of music,” precisely because it has been out of favor in the country mainstream.

Top co-wrote his debut album, Cold Beer & Country Music, with Carson Chamberlain, who had a hand in No. 1 hits for legends like Strait and Alan Jackson. Leo33 picked the uptempo dance number “Sounds Like the Radio” — which references Jackson in its very first couplet — as the lead single. It serves as a manifesto of sorts: “It sounds like the radio/ Back in ’94, ya know.”

Roughly three months after releasing “Sounds Like the Radio,” when it was hovering just inside the top 40 on Billboard‘s Country Airplay chart, Top put out the rest of his album. “With most major labels, that would not have been the case,” Dean explains. “It would have been, ‘Wait for multiple singles to come out, wait for enough of a consumption threshold to be met.’ But we all felt really strongly internally that if somebody discovered Zach, they would want to discover more than a few songs.”

Their faith was rewarded when listeners started to gravitate to “I Never Lie,” streaming it and using it in TikTok videos. The album’s other high points include “Bad Luck,” which plays like a sequel to “I Never Lie,” where the protagonist finally catches a break; and “Use Me,” a slow-burn ballad about a one-night stand.

The rest of Leo33’s roster includes Jenna Paulette, who lives on a working ranch in Texas and shares Top’s appreciation for fiddle and pedal steel guitars; Jason Scott & the High Heat, whose ramshackle rock sprouts with sweet harmonies; Ashland Craft, who favors a rugged country sound; and a fifth signing that the company hasn’t yet announced.

In addition to reaching the top 25 on the Hot 100, “I Never Lie” peaked at No. 2 on Billboard‘s Country Airplay chart in May. Top’s catalog has earned 798,000 equivalent album units to date in the U.S., according to Luminate, including 963.9 million on-demand streams.

Leo33 now has eight full-time employees. In March, Ana Shabeer joined as director, business intelligence; and Joseph Manzo started as a marketing coordinator.

Jason Scott & the High Heat put out American Grin in March, and Ashland Craft just released her debut album on Leo33, Dive Bar Beauty Queen. Top will follow Cold Beer & Country Music with Ain’t In It For My Health on August 29. The lead single, “Good Times & Tan Lines,” was promptly put into rotation by 50 country radio stations, making it the most added track of the week in the format.

Billboard Canada Power Players is back for a second year, and it comes at a pivotal time for Canadian music. Canadian Content regulations — a principle that built the domestic industry — are up for review for the first time in a generation, with ongoing hearings taking place with the CRTC. The Online Streaming Act, meanwhile, is attempting to regulate major foreign streaming services to contribute to CanCon as the CRTC once did for radio — but companies like Spotify, Amazon and Apple Music aren’t taking it without a fight.

Those issues shadow the industry, which has recently seen both struggles and successes. The country was recently named the 8th largest music market in the world by the IFPI, and Toronto has emerged as a marquee live music market. That’s been reflected in the successes of and investments in new venues by companies like Live Nation Canada, MLSE and Oak View Group, who all appear on the list.

Trending on Billboard

As top execs at Live Nation Canada, Erik Hoffman, Riley O’Connor and Melissa Bubb-Clarke are orchestrating one of the most ambitious stretches in the company’s history. Together, the trio claims the No. 1 spot on Billboard Canada Power Players 2025. Already the biggest players in the Canadian music business, Live Nation is just getting bigger — and it’s on track for a record-breaking summer.

In the new Billboard Canada cover story, the three talk about their ambitious plans — including the about-to-open Rogers Stadium in Toronto, which will bring Oasis, Coldplay and BLACKPINK to the city this summer and triple the number of stadium shows.

Derek “Drex” Jancar of OVO Wins the Impact Award

As part of Billboard Canada Power Players, Derek “Drex” Jancar took the No. 1 spot in the Foundations category and accepted the Impact Award at the celebration in Toronto on Wednesday (June 11).

In the mid-2000s, Drex, Gavin Sheppard and Kehinde Bah co-founded The Remix Project, a community initiative that continues to influence global culture. Now, he’s doing it again as CEO of October’s Very Own (OVO).

On Wednesday night (June 11), Derrick Ross of Slaight Music presented Drex with the Impact Award as part of Billboard Canada Power Players 2025, with a donation to the Remix Project — a testament to the immense influence Drex has had within Canadian music and culture.

In an interview, Drex tells Billboard Canada about the impact of the Toronto community on all the work he does.

“It’s the nucleus of everything. It’s the thing you constantly come back to and think about: ‘Does this represent us, honestly and authentically?’” he says. “It’s where everyone worked on their skills and put blood, sweat and tears into their career paths. We obviously are global thinkers, but we’re always coming from that place. That’s our identity. It’s shaped us and it’s what makes us unique.”

Drex recalls meeting the key figures at OVO at Remix, including Oliver El-Khatib, Future The Prince, Niko Carino and Drake. The dedication that they poured into Drake’s burgeoning career in the late 2000s created a special energy in Toronto. He was already the hottest artist in the city, Drex recalls, but you could feel he was on the verge of becoming a global phenom — all while wearing his local connections on his sleeve.

“You could see what was happening behind the scenes, and it was really special to see everyone rally around and build such an amazing brand around him,” Drex says. “It was a time where you really started to believe in the city and the talent and the potential in the city and you were like, ‘Anyone can do anything from here. This is possible, it’s happening right in front of us.’”

The First Canadian Edition of Managers to Watch

Also this week, Billboard Canada unveiled its first Music Managers to Watch list.

Managers are the unsung heroes of the music industry. They are the hard-working decision makers behind some of the country’s most beloved artists. They make deals, orchestrate partnerships and make key strategic decisions. And though fans rarely know their names, they are key to the success of Canadian musicians. They don’t do it for personal glory, but to fulfill artistic visions that can break barriers and move millions.

These talented managers on the rise have helped some of the biggest artists tour stadiums, stun at the Met Gala or go gold without any label support. That’s an extra feat in Canada, where managers often have to navigate a tight-knit industry and geographic barriers to breakout success. In the feature, they share their tips for people new to the business and those who want to help introduce their artists to a global audience.

The list includes managers for Kaytranada, Jessie Reyez, Charlotte Cardin, Connor Price and more.

The Beaches’ manager, Laurie Lee Boutet, was named Manager of the Year. In an interview, she talks about how she helped navigate the Toronto band’s 2023 viral moment into sustained momentum on its way to its first hometown arena tour this fall.

Sony Music CEO/chairman Rob Stringer spoke to investors on Friday (June 13) about his vision for how generative AI can be integrated into his business, stating that the company is “going to do deals for new music AI products this year with those that want to construct the future with us the right way.”

To date, Stringer says the major music company has “actively engaged with more than 800 companies on ethical product creation, content protection and detection, enhancing metadata and audio tuning and translation amongst many other shared strategies.” He went on to say that he believes “AI will be a powerful tool in creating exciting new music that will be innovative and futuristic. There is no doubt about this,” but later added: “So far, there is too little collaboration, with the exception of a handful of more ethically minded players.”

Stringer’s statements about the emerging tech, which he made at Sony Group’s 2025 Business Segment Presentation, arrived just a week after news broke that Sony — and its competitors Universal Music Group and Warner Music Group — were engaged in talks with generative AI music companies Suno and Udio about creating a music license for their models. Suno and Udio are currently using copyrighted material, including music from the three majors, to train their models without a license. This spurred the trio to file blockbuster lawsuits against Suno and Udio in June 2024, in which they alleged copyright infringement on an “almost unimaginable scale.”

Trending on Billboard

In his remarks on Friday, Stringer likened the current AI revolution to “the shift from ownership to streaming” just over a decade ago. “We will share all revenues with our artists and songwriters, whether from training or related to outputs, so they are appropriately compensated from day one of this new frontier,” he said.

“I do think that what AI is based on, which is learning models and training models based on existing content, means that those people who have paved the way for this technology do have to be fairly treated in terms of how they get recompense for that usage in the training model,” Stringer continued. “We have been pretty clear on this since day one that there is absolutely no backwards view as to what this technology will do. There will be artists, probably there will be young people sitting in bedrooms today, who will end up making the music of tomorrow through AI. But if they use existing content to blend something into something magical, then those original creators have to be fairly compensated. And I think that’s where we are at the moment.”

There are challenges ahead to figure out proper remuneration for musical artists from generative AI, as Billboard recently described in an analysis of the Suno and Udio licensing talks. While the AI license could borrow the streaming licensing model by having AI firms obtain blanket licenses for a company’s full musical catalog in exchange for payment, it remains to be seen how the payments would be divided up from there. On streaming services, it’s simple to determine how often any given song is consumed and to route money to songs based on their popularity. But for generative AI, the calculation would be far more complicated. To date, Suno and Udio do not offer guidance as to which tracks were used in the making of an output, and experts are divided on whether or not the technology needed to figure that out is ready yet.

Also on Friday, Stringer expressed a desire to come to agreements with AI companies in a free market, stating: “With deals being carried out, it will be clear to governments that a functioning marketplace does exist, so there is no need for them to listen to the lobbying from the tech companies so heavily.”

Today, many AI companies don’t believe they need to license music or other copyrights at all, citing a “fair use” defense. But in his statements, Stringer was optimistic that this would change, citing the recent position of the U.S. Copyright Office, which said that “making commercial use of vast troves of copyrighted works, especially where this is accomplished through illegal access, goes beyond established fair use boundaries.” One day after publishing this position about the value of copyrights in the AI age, however, the Register of Copyrights, Shira Perlmutter, was fired by President Donald Trump. (Perlmutter sued soon after, calling Trump’s move “unlawful and ineffective.”)

“We are between us and the AI tech platforms trying to find common ground,” Stringer continued. “And that common ground is not going to take a minute. It’s going to take a moment, and then it’s going to take the trial and error process, and we are in that era right now.”

Smokey Robinson claims in a new court filing that the former housekeepers suing him for rape are trying to slow-walk the lawsuit to gain maximum leverage for an extortionate settlement payout, including by dealing a financial blow to the Motown legend’s ongoing tour.

Lawyers for the 85-year-old singer made this argument in a Thursday (June 12) motion to require the deposition of one of the four anonymous former housekeepers who allege he forced them to have sex at his Los Angeles-area home dozens of times over nearly two decades. Robinson adamantly denies the claims and has countersued the women for extortion, defamation and elder abuse.

Robinson’s attorney, Christopher Frost, says in the new court filing that the housekeepers are refusing to participate in evidence collection. He claims that the women’s lawyer, John Harris, allegedly informed him that he wants to delay all discovery until they’ve litigated a motion to strike Robinson’s counterclaims, a lengthy process that could take months.

Frost claims the housekeepers, who he says demanded $100 million from Robinson and his wife Frances before suing them both in May, are doing so as a tactic to maximize settlement leverage. According to the motion, this strategy is aimed at cutting into profits from Robinson’s ongoing international tour celebrating the 50th anniversary of his album A Quiet Storm.

“Plaintiffs have effectively conceded that their intention was to file a salacious lawsuit, do nothing to prosecute it, neuter the Robinsons’ ability to defend themselves, and let the lawsuit linger publicly while the Robinsons have to live every day under the unfair specter of public opinion and while Mr. Robinson’s tour is negatively affected,” Frost writes.

“This plays into plaintiffs and cross-defendants’ strategy to exact leverage on Mr. and Ms. Robinson,” Frost adds. “The longer Mr. Robinson’s livelihood is harmed, the more pressure there is for the Robinsons to give in to plaintiffs’ and cross-defendants’ extortionate demands.”

Frost is asking for a court order requiring one of the four housekeepers, identified in court filings as “Jane Doe 2,” to sit for a deposition at his Los Angeles law office within two weeks of the motion being heard. Frost says the women should also foot the bill for nearly $5,000 in legal fees the Robinsons have run up bringing this motion.

“If plaintiffs and cross-defendants are not sanctioned for their abusive behavior, they will expect that they can continue this behavior during the pendency of this case, which will only create more delays and more motion practice,” writes Frost. “The utilization of this strategy must be nipped in the bud.”

The housekeepers’ lawyers did not immediately return a request for comment on the motion on Friday (June 13).

In addition to the civil lawsuit, the former Robinson housekeepers have also filed a police report against the singer. The Los Angeles County Sheriff’s Department is now investigating the women’s sexual assault claims.

Universal Music Group (UMG) and WTSL, an investment firm run by ex-Endeavor executive chairman Patrick Whitesell with backing from Silver Lake, have formed a joint venture to “unlock opportunities” for UMG’s biggest artists across film, TV, fashion, consumer products, branded experiences and more, the companies announced on Thursday (June 12).

This certainly isn’t new ground for UMG, whose chairman/CEO Lucian Grainge called superfandom “the core component of music economics” at the company’s capital markets day last September. Indeed, the music giant has been a force behind projects like ABBA‘s smash hit avatar show; become a major investor in blockbuster artist-led brands including Dr. Dre‘s Apple-acquired company Beats; and even opened a UMusic hotel in Madrid back in 2023. But the joint venture announced on Thursday aims to create fan experiences and artist opportunities on a grander scale than any of those projects, the companies say.

The partnership reflects a shift in how the biggest stars and entertainment companies are approaching monetizing music rights. Home to superstars like Taylor Swift, UMG is looking to bring atypical entrepreneurial opportunities to its biggest artists. In Whitesell, they found an entertainment mogul who is known, as the Financial Times once wrote, for having helped rewrite “the Hollywood script.”

Trending on Billboard

“This is about building the future of artist [intellectual property] with the scale and ambition it deserves,” Whitesell, who co-founded the global talent company WME, said in a statement about the deal.

The joint venture, which serves as WTSL’s debut, did not disclose any projects it currently has in the works. What’s clear is that it aims to leverage UMG’s talent and WTSL’s networks to create commerical opportunities in film, TV, fashion, consumer products, branding and other ventures that rely on music rights to “build long-term enterprises, expanding from one-off licensing into owned, repeatable, and equity-driven ventures,” according to a statement.

“We exist at the center of a vibrant ecosystem of partners from the worlds of technology, brands, retailers and media who recognize the power of our artists to shape culture globally,” Grainge said in a statement. “With this new venture we will be able to leverage Patrick’s deep experience in successfully creating non-traditional business models with world-class IP to accelerate the expansion and monetization of our ecosystem to the benefit of our artists and partners.”

Blake Lively is fighting Justin Baldoni’s continued attempts to see her texts with Taylor Swift in the It Ends With Us litigation, saying the movie’s director and co-star shouldn’t be allowed to drag Swift into the court battle just to generate “sensational headlines.”

Lively filed a motion on Friday (June 13) asking a federal judge to shut down Baldoni’s discovery request seeking all communications between the actress and Swift, her longtime close friend, related to It Ends With Us or Lively’s lawsuit alleging Baldoni sexually harassed her on the film’s set and then orchestrated a smear campaign in retaliation for her complaints.

Baldoni and his production company, Wayfarer Studios, previously sought these communications via subpoenas to Swift and her lawyers. But the pop superstar’s reps vehemently opposed the subpoenas as “tabloid clickbait,” and Baldoni withdrew the requests last month.

Trending on Billboard

According to the Friday filing, Lively’s team is unsure whether Swift handed over any texts as part of a deal with Baldoni to get the subpoenas dropped. Though Swift’s attorney advised them that “no documents are being produced,” the same day, a Daily Mail article quoted an “insider” stating that the Wayfarer team got “exactly what they were seeking” from the pop star.

Lawyers for Lively say this “insider” quote, published by a Daily Mail reporter with known ties to Baldoni’s publicists, could be interpreted either to mean that Swift produced documents or that the hefty tabloid coverage of Swift’s subpoena was enough to achieve Baldoni’s aims.

“Either interpretation of the reason the Wayfarer parties withdrew the subpoenas warrants the entry of a protective order,” write Lively’s attorneys. “If the Wayfarer parties received documents from Ms. Swift such that they have ‘exactly what they’ need, then the discovery sought … is cumulative and duplicative, and need not be produced again by Ms. Lively.”

“If, on the other hand,” Lively’s lawyers continue, “the Wayfarer parties were ‘seeking’ only sensational headlines by serving the subpoenas rather than materials to support their claims and defenses, they are not entitled to the information… The purpose of civil discovery is to obtain information relevant to claims and defenses in court, not to prop up a public relations narrative outside of court.”

Some of the ”sensational headlines” generated by the Swift subpoena revolved around allegations from Baldoni’s lawyers that Lively had asked Swift to delete text messages and tried to extort her into voicing public support for the sexual harassment lawsuit. These claims, attributed to an anonymous source and denounced by Lively’s team as “categorically false,” were struck from the case’s docket after Judge Lewis J. Liman determined they were improper, irrelevant and “potentially libelous.”

Judge Liman dealt another loss to Baldoni earlier this week when he threw out the actor-director’s defamation countersuit, which alleged that Lively conspired with the New York Times, her husband Ryan Reynolds and publicist Leslie Sloane to fabricate the sexual harassment and retaliation claims.

A rep for Lively cited this dismissal ruling in a statement to Billboard regarding Baldoni’s continued pursuit of the actress’ communications with Swift.

“The ongoing attempts to once again try and use the world’s biggest star as a PR tactic in this matter reflects a public unraveling of epic proportions — and serves only to distract from the fact that Justin Baldoni’s lawsuits against Ms. Lively, Ryan Reynolds, their publicist and the New York Times have been entirely dismissed,” said a Lively spokesperson on Friday (June 13).

Reps for Baldoni and Swift did not return requests for comment.

The continued fight over the Swift text messages comes as Lively is serving her own subpoena on the singer’s public opponent, Scooter Braun. Lively wants to know what Braun knows about the alleged smear campaign orchestrated by publicity firm The Agency Group PR, a controlling stake of which is reportedly owned by Braun’s company, HYBE America.

Consumer demand for live and out-of-home entertainment remains high, but Generation Z consumers — born between 1996 and 2020 — are particularly motivated to pay extra for convenience, upgraded experiences and sustainable options, according to a new EY survey. Perhaps not surprisingly, Gen Z is less patient than the average consumer. Nearly two-thirds (66%) of Gen Z respondents plan to buy a “fast pass” or priority pass to theme parks in the next year compared to 59% of all consumers, according to the inaugural EY Media & Entertainment (M&E) Pulse Poll, which surveyed 4,000 consumers across the U.S., U.K., Western Europe and the Asia-Pacific region. According to Javi Borges, EY global media and entertainment sector leader, companies that build convenience into their experiences can take advantage of consumers’ comfort with smartphone apps that offer digital ticketing and contactless payment and check-in. “When you look at the Millennials and Gen Z, there’s an expectation of a certain level of tech enablement and frictionless experience,” he says. “And even older generations post-pandemic, that maybe had never ordered Uber Eats until the pandemic, now they’re just much more accepting of the apps and the frictionless experience.” Speaking of Uber Eats, consumers’ desire for faster service is also reflected in a new McKinsey study, which found that delivery’s share of global food spending increased from 9% in 2019 to 21% in 2024, while takeaway’s share was flat and in-person dining fell to 55% from 69%. Though respondents weren’t polled specifically about music, this same trend toward speed and convenience can be traced in terms of modern-day music consumption habits, where streaming accounts for 69% of global music consumption in 2024 vs. 56% in 2019, according to the IFPI. And on the live front, concert promoter Live Nation says it now expects VIP offerings to account for 30% to 35% of its amphitheater business. Overall, McKinsey predicts that consumer tolerance for inconvenience will continue to decline as their desire for speed and service increases. Despite news headlines that consumers are at a financial breaking point, local entertainment (i.e., entertainment that doesn’t require travel) and live entertainment were purchased by 48% and 46% of respondents, respectively, according to EY’s poll. The poll focuses on companies’ pursuit of consumers’ “fun money,” which Borges calls the 10% to 15% of income people set aside for leisure activities. This segment of discretionary spending goes toward everything from music and video streaming services to concerts and vacations. “Globally, but especially in the U.S., we have more options battling for our fun money than ever before,” says Borges. Spending on live music, which offers an increasing menu of VIP options that provide greater convenience than basic offerings, is especially strong. As Billboard noted in May, a Bank of America study found that U.S. consumers spent an average of $150 a month on entertainment — such as live music and theme parks — from May 2024 to April 2025. Over the same period, credit card holders spent double that amount on live event tickets, racking up an average of $300 per month. In the same study, a third of respondents said they plan to attend more events this year than last year. Indeed, the trend in consumer spending — especially for the young, and especially since the COVID-19 pandemic — is toward experiences over material items. That said, people are willing to pay extra to make their experiences more pleasant or special. EY found that about half (49%) of respondents who visited theme parks or went on a cruise paid extra for premium options, while about a third did so for sporting events and casino/resorts. Younger demographics are also willing to spend a premium of 26% or more on sustainable features when it comes to buying entertainment experiences. For example, 12% of all consumers will spend more on carbon offsetting compared to 25% of Gen Z and 15% of Millennials. Willingness to spend extra based on water conservation practices also splits the age groups: 11% of all consumers globally, but 23% of Gen Z and 15% of Millennials. Live music has made strides to satisfy Gen Z’s preference for sustainable consumerism. Festivals are turning to batteries, sometimes powered by biodiesel or solar panels, instead of diesel-powered generators. That should be music to Gen Z ears: EY found that 24% of Gen Z would pay more for entertainment options that use renewable energy sources (versus 11% of all consumers) and 22% of Gen Z would pay a premium for lower energy consumption (versus 10% of all consumers). Looking ahead, Americans are more likely to spend money at a casino in the next year than people in other regions surveyed (66% versus 49% globally), while Asia-Pacific respondents have a greater preference for theme parks (74% versus 65% globally). About half (48%) of respondents expect to spend the same amount of money on live entertainment in the next 12 months as the past 12 months. The percentage of people who expect to spend more and spend less is almost equal at 21% and 20%, respectively.

With week five of the Diddy trial now in the books, Billboard is recapping the biggest moments you might have missed this week — from Jane’s blockbuster testimony to Kanye’s surprise appearance to the mysterious mention of an unnamed rapper.

The trial, expected to last until early July, will decide the fate of Sean “Diddy” Combs, who federal prosecutors say coerced ex-girlfriend Cassie Ventura and others to take part in freak-offs — drug-fueled sex marathons with male escorts for his entertainment. He has denied the charges; his attorneys say the events were consensual and part of a “swinger” lifestyle.

Combs is charged with five counts, including racketeering and sex trafficking, over those accusations. If convicted on all of the charges, he faces a potential sentence of life in prison.

If you weren’t following along for every moment this week, here are the five big developments you need to know.

Jane On The Stand

The week was dominated by testimony from “Jane,” an anonymous former girlfriend of Combs who says she was forced to participate in the freak-offs with male prostitutes.

Like Ventura, Jane told jurors about a complex romantic relationship, according to NPR — one that included real affection for the superstar, but also coercion and manipulation, including through promises of more time together or of financial support.

During cross-exam, defense attorneys tried to show Jane as a willing participant in the events, per The New York Times, by showing jurors a trove of text messages in which she appeared to have positive thoughts about the freak-offs. But she insisted she was simply telling Combs what he wanted to hear and was “putting on a show” during the events.

Mystery Rapper

At one point during her testimony, Jane described a night she allegedly spent with another famous rapper in January 2024 — setting off a debate between the legal teams over whether the mystery celebrity could be revealed.

On the night in question, per USA Today, Jane told jurors that she traveled to Las Vegas with the rapper and ended up watching what amounted to a freak-off — a male prostitute having sex with a woman — in the celebrity’s hotel room. She said the event later sparked rage in Combs, who demanded to know: “How could you go to another man’s freak-off?”

Prosecutors quickly urged the judge to bar any reveal of the rapper’s name, warning that it might threaten Jane’s anonymity if the name were divulged. Judge Arun Subramanian ultimately agreed to keep the name hidden, but defense attorneys gave clues — calling him an “icon in the music industry” and someone with a close relationship to Combs.

Jane v. Teny

Midway through cross-examination, Jane got into a heated exchange with Teny Geragos, one of Combs’ defense attorneys, over designer handbags.

According to TMZ, it started when Geragos asked if Jane, like another Combs girlfriend, received a Chanel bag from the rapper. Jane quickly shot back: “I only got trauma.” When Geragos then asked her what a Bottega bag was, Jane replied, “I’m sure you have one.”

“How much does it cost?” Geragos quickly asked her. “How much does my body cost?” Jane fired back.

The tense exchange highlighted Jane’s unusual position in the case. As reported by the Times, she dated Combs right up until his September arrest, didn’t participate in the criminal investigation until she was subpoenaed, and met with his defense attorneys repeatedly before the trial began. She also confirmed on the stand that he’s currently paying both her rent and her legal bills related to the case.

When she wrapped up her six days on the witness stand on Thursday, per CNN, Jane made an unusual move: She hugged the attorneys who had been questioning her, including prosecutor Maurene Comey and Geragos.

Ye Stops By

Ye, the rapper formerly known as Kanye West, dropped in on the trial on Friday (June 13), telling reporters he was there to support Combs.

Dressed in all white, Ye arrived at the courthouse late in the morning and spent about 40 minutes at the trial. Per the Associated Press, he didn’t make it into the main courtroom where the judge, jury and attorneys are arguing the case, instead watching testimony on a closed-circuit monitor in an overflow room.

Though hardly in the same kind of hot water as Combs, Ye has faced his own controversies in recent years — including posting antisemitic rants to social media, running Super Bowl ads for swastika t-shirts, and making outrageous claims about Jay-Z and Beyoncé’s children.

This wasn’t the first support Ye has shown for Combs, a longtime friend. In February, he posted to X (formerly Twitter) asking President Donald Trump to “please free my brother Puff.” And in March, he dropped a song called “Lonely Roads Still Go to Sunshine” that appeared to feature Combs’ voice on a phone-call recording.

When asked if he might testify on Combs’ behalf when the defense begins presenting its case, Ye didn’t respond.

Mistrial Denied

Early in the week, Judge Arun Subramanian denied a motion for mistrial filed by Combs’ lawyers over juicy testimony — a small but important moment.

Attorneys for the embattled hip-hop mogul had argued that prosecutors knowingly introduced false testimony by Bryana Bongolan, the witness who claimed that Combs dangled her from a 17-story balcony in 2016.

But at the start of Tuesday’s proceedings, Judge Subramanian said the alleged issue did not rise to the level of a trial-ending error: “This is not fodder for a mistrial. This is the adversarial process at work,” Subramanian said from the bench, according to ABC News.

R. Kelly’s attorney claims the disgraced R&B star and convicted sex offender has been placed in solitary confinement as retaliation for publicizing bizarre allegations that prison officials tried to solicit a fellow inmate to kill him.

Kelly’s solitary confinement is the subject of a court filing late Thursday (June 12) from lawyer Beau Brindley, who earlier in the week petitioned a federal judge in Chicago to cut short the 30-plus-year prison sentence imposed on the singer (Robert Sylvester Kelly) for two sets of sex crime convictions.

Brindley claimed on Tuesday (June 10) that prison officials at the Federal Correctional Institution in Butner, N.C., are trying to have Kelly killed to keep him from divulging prosecutorial misconduct he’s supposedly uncovered since his trials. Brindley said a member of the Aryan Brotherhood prison gang was tasked with Kelly’s murder.

Now, Brindley says Kelly is facing retaliation for publicizing his strange allegations. The defense lawyer claims Kelly was placed in solitary confinement within hours of filing the motion for release, without access to a phone to call his family or lawyers.

“Mr. Kelly has spiders crawling over him as he tries to sleep,” writes Brindley. “He is alone in the dark in miserable conditions.”

According to Brindley, Kelly has not eaten since being sent to solitary because he’s afraid that prison officials might have his food poisoned. Guards won’t let the singer access the peanut butter and crackers he previously purchased from the jail’s commissary, Brindley says.

Brindley’s filing reiterates his request to have Kelly immediately released on a temporary furlough or transferred to home detention.

Spokespeople for both the Federal Bureau of Prisons and the U.S. Attorney’s Office in Chicago declined to comment on Brindley’s allegations on Friday (June 13).

While prosecutors have not yet responded to the substance of Brindley’s murder plot claims, they criticized the defense lawyer earlier this week for naming one of Kelly’s anonymous child victims in the Tuesday motion. The judge in the case made Brindley re-file the motion with proper redactions, and prosecutors are due to file their response on Monday (June 16).

Brindley, meanwhile, has been publicly asking President Donald Trump to pardon Kelly in conjunction with the long-shot allegations about a government conspiracy. In a statement earlier this week, Brindley said, “This is precisely the kind of prosecutorial corruption that President Trump has vowed to eradicate. We believe he is the only one with both the power and the courage to do it.”

Kelly was convicted in 2021 and 2022 at two separate federal trials, one in New York and one in Chicago, on a slew of criminal charges including racketeering, sex trafficking, child pornography and enticing minors for sex.

The former R&B star was sentenced to 30 years in prison for the New York conviction and 20 years in the Chicago case, although the vast majority of the second sentence will overlap with the first. Both convictions have been upheld on appeal.

State Champ Radio

State Champ Radio