Business

Page: 32

Trending on Billboard

Country singer Jameson Rodgers allegedly hurled a “full, unopened beer can” into a concert crowd and hit a fan during a 2022 festival on the Jersey Shore – and an appeals court now says Sony Music must continue to face the resulting lawsuit filed by the injured woman.

Samantha Haws sued Rodgers, Sony and others, claiming the incident at the 2022 Barefoot Country Music Festival in Wildwood, NJ, had left her with “severe and permanent injuries.” She even sued MillerCoors because it was a can of Miller Lite that Rodgers allegedly threw.

Related

Sony wants to be dismissed from the case, arguing that it cannot be sued in New Jersey because it isn’t based in the state and didn’t operate the festival. But a lower judge denied that request last year – and a New Jersey appeals court upheld that ruling on Wednesday.

In recent years, there’s been a disturbing trend of objects being thrown at concert performers. NBA YoungBoy stopped a show earlier this month after fans threw objects, Luke Combs was hit in the face during a July concert, and Bebe Rexha needed stitches after being hit with a smartphone, leading to criminal charges against the offender.

But there’s also been multiple incidents involving objects thrown by the artists, often resulting in legal action. 50 Cent was sued last year over an incident in which he threw a microphone off-stage in frustration, allegedly hitting a stagehand. Cardi B hurled a mic at a fan who threw a drink at her at a 2023 Las Vegas concert, resulting in another lawsuit.

In her July 2024 case, Haws claims that Rodgers and/or others “threw full, unopened cans of Miller Lite beer from the stage into the crowded audience” at the Barefoot Festival. She says one struck her “violently and without warning in the head and facial area,” leaving her with “severe, painful and permanent bodily injuries.”

Sony, named as a defendant in the case because Rodgers is signed to Columbia Nashville, immediately moved to exit the case. The company argued that it didn’t organize or market the festival or pay for or provide security for it. But a judge said last year that Rodgers had potentially performed at the festival as Sony’s agent, which could legally put the company on the hook for his actions.

In Wednesday’s decision, the New Jersey appeals court rejected Sony’s appeal of that ruling. It said there was “no error” by the lower judge because Haws had established a “business relationship between Sony and Rodgers related to live performances” and the label “would be subject to specific jurisdiction if Rodgers was acting on Sony’s behalf at the time Haws was injured.”

The ruling does not mean Sony is liable to Haws, or that her allegations will ultimately be proven. Instead, it merely sets the stage for more litigation over whether Sony was sufficiently involved to face the lawsuit. Reps for Sony, and both reps and an attorney for Rodgers did not immediately return requests for comment on Thursday.

Trending on Billboard

Irving Azoff recently slammed YouTube as “by far the worst offender” when it comes to paying creators fairly. As one of the largest and most successful managers of artists in history, his opinion carries a great deal of weight.

Songwriters specifically are paid through a complex, regulated environment, so digital services have myriad ways of manipulating the system. Those who care about creators often hear about how these platforms mistreat them — and if you ask 10 industry leaders who is the worst, you might get 10 different answers.

Related

To make sense of who is friend or foe, here is a ranking based on what they’re doing for and against songwriters today. Beyond their public relations and industry parties, it is essential to understand how these services actually treat the creators they depend on*,* so here are the broad criticisms.

One must start with Spotify, the largest music-focused streaming service. While Mr. Azoff ranks YouTube as enemy number one, when it comes to songwriters, no one comes close to Spotify.

Last year, the streaming giant revealed — months after imposing the scheme — that it had unilaterally added audiobooks to premium subscriptions so that it could attempt to qualify for paying a lower royalty rate — since music was now part of a “bundle.”

This scheme is currently being challenged in court by the Mechanical Licensing Collective (MLC), which pays streaming royalties to rights holders. The NMPA has also pushed for a Federal Trade Commission (FTC) investigation into this as an unfair business practice, as once Spotify imposed this bundle on its users, it raised prices and made it virtually impossible to return to a music-only premium plan.

Related

Spotify also has fought for extremely low royalty rates at the trial that determines streaming royalties, which takes place every five years in Washington, D.C. And when we, alongside NSAI, won a significant royalty increase in 2018, Spotify spent years appealing that decision. Eventually, they lost that appeal — but songwriters were denied much-needed income throughout the process. Justice delayed is justice denied.

The platform also has added insult to injury through tone-deaf PR stunts like its “Secret Genius” campaign — honoring the very songwriters whose genius is no secret — while it simultaneously fought them in court.

Another significant swipe at songwriters is its free service. Instead of being a free trial period or an on-ramp to encouraging users to pay for music, millions of users can listen to unlimited songs for free without ever signing up. This service delivers the most minuscule royalties to songwriters — it’s almost incalculable.

Mr. Azoff’s opinion about YouTube is shared by many in the industry. The service is notorious for using hardball tactics in negotiations. Since the YouTube platform largely involves synchronization (video) royalties — which are in a free market for songwriters — there is even more opportunity cost. The general perception for years has been that YouTube benefits much more from the music on its service than it pays.

Related

Amazon is complex in that music is only part of its much larger ecosystem. Unfortunately, it has also recently taken advantage of lower rates by bundling music with other services. However, it has not been as brazen as Spotify and has generally been more concerned with its relationship with songwriters. There are opportunities for the platform to improve, and we are hopeful that it continues to keep conversations open with the end goal of seeing music creators as business partners instead of pawns.

TikTok leads the world in social media music consumption — it is essential to the platform’s success. While deals have been struck in the past, the service has used its size to pressure songwriters and artists to return to the platform when there were attempts to negotiate fairer rates. Songwriters suffer disproportionately from this dynamic. While artists receive exposure on the service that can be monetized through touring and merchandise, songwriters need direct compensation, so holding out for more is essential, and thus far has been largely unsuccessful.

Apple Music continues to stand alone in several areas. When other services appealed the aforementioned royalty rate increase in 2018, Apple did not. Additionally, as Apple Music head Oliver Schusser announced at our Annual Meeting in Manhattan earlier this year, the platform will never give music away. “I think it’s crazy that 20 years in, we still offer music for free,” Schusser said. “We’re the only service that doesn’t have a free service. As a company, we look at music as art, and we would never want to give away art for free.” While we will still push for higher rates from Apple, this sentiment must be appreciated and amplified.

Related

Satellite radio shouldn’t be counted out. SiriusXM — which now owns Pandora — has a troubling history of paying extremely low rates to songwriters. In fact, today digital radio pays significantly more to artists annually than AM/FM radio pays songwriters. Think about that. The radio relationship has completely flipped. Songwriters used to make a large percentage of their income from terrestrial radio, and now they make less than artists make from satellite radio — which is dwarfed by interactive streaming — alone.

So who is the worst offender? The answer depends on who is in a current contract negotiation or a rate-setting proceeding. However, when entering into any of these marketplace or regulatory environments, it is crucial to understand where the players stand and how they have historically positioned themselves.

The Super Bowl of all of this starts in a few months before the Copyright Royalty Board in Washington, D.C. At that time, the major streaming services will put forth their proposals for how they want to pay songwriters for 2028–2032. This will be illuminating, and all creators and advocates must seriously consider what they put forth. We will make sure songwriters know what they propose.

There is an opportunity for digital platforms to make serious headway in terms of their relationships with songwriters at this proceeding. So pay close attention, and we will adjust rankings after they reveal their positions. Stay tuned.

David Israelite is the president and CEO of the National Music Publishers’ Association (NMPA). Founded in 1917, NMPA is the trade association representing all American music publishers and their songwriting partners.

Trending on Billboard

Rayna Bass and Selim Bouab have been appointed executives-in-residence at the Warner Music/Blavatnik Center for Music Business at Howard University in Washington, D.C. The pair are the co-presidents of 300 Entertainment and Atlantic Records Hip-Hop, R&B and Global Music.

Bass and Bouab’s appointment is in keeping with the center’s goal to connect Howard University’s students with top executives in the global music industry. The program provides one-on-one mentorship, master classes and practical insights about executive leadership, creativity and the future of the business.

Related

In the press release announcing the duo’s new roles, Jasmine Young, MBA, director of the Warner Music/Blavatnik Center for Music Business at Howard University, commented, “Rayna Bass and Selim Bouab are two of the most visionary leaders in the industry, and we are honored to welcome them as executives-in-residence. Our students will benefit directly from their knowledge, creativity and commitment to breaking barriers. This appointment reflects our mission to provide Howard students with direct access to the highest levels of leadership in the global music industry.”

“Howard University, together with the Warner Music/Blavatnik Center for Music Business, has a strong legacy of cultivating bold, creative leaders,” said Bass and Bouab in a joint statement. “That mission aligns with what we do at our label, and we’re excited to share our experiences and help raise up the next generation of music business innovators.”

Bass took on an expanded role within the Atlantic Music Group earlier this year when she was appointed co-president of Atlantic Records Hip-Hop, R&B and Global Music. She initially joined 300 Entertainment as its first marketing hire in 2014. Promoted to senior vp of marketing in 2019, Bass was elevated to co-president of 300 Entertainment in 2022. A Billboard Women in Music and R&B/Hip-Hop Power Players honoree, Bass has helmed campaigns for Megan Thee Stallion, Young Thug, Gunna, Mary J. Blige and PinkPantheress, among other artists.

Related

Since joining 300 Entertainment as well in 2014, Bouab later served as the label’s senior vp and head of A&R before being named co-president with Bass in 2022. Then again alongside Bass, Bouab added the co-president post at Atlantic Records Hip-Hop, R&B and Global Music this year. Along the way, he has signed, developed and collaborated with artists including Megan Thee Stallion, Fetty Wap and Tee Grizzley as well as Young Thug, Gunna and Jordan Adetunji. Bouab, who’s also established his own Unauthorized Entertainment label, is a multiple-year Billboard R&B/Hip-Hop Power Players honoree.

“Rayna and Selim embody what it means to lead with both innovation and integrity,” stated Julian Petty, executive vp and head of business/legal affairs for Warner Records and the Warner Music/Blavatnik Center’s Visionary. “Their careers represent the possibilities for our students, and their willingness to pour into the next generation is what makes this partnership so special. The center continues to set the standard for excellence in music business education, and I am thrilled to see Rayna and Selim take on this role.”

Trending on Billboard

KiTbetter, the South Korean company behind the KiTalbum hybrid physical-digital format, is opening a manufacturing facility in Los Angeles to better reach consumers in the U.S. The first KiTalbums produced in the U.S. are expected to reach retail and fans in early 2026.

“As we expand globally, and with growing interest from artists, labels, and retailers across North America and Europe in particular, we’re increasing capacity to support more titles and meet rising international demand,” says Jennifer Sullivan, president, North America and chief marketing officer.

Related

The KiTalbum is a proprietary format that includes a physical album stored in a jewel case and a small “KiT” device that uses a U-NFC (ultrasonic near-field communication) signal to unlock music, videos, lyrics and album credits on the KiTalbum app for iOS and Android devices. The square-shaped jewel box typically contains printed materials such as stickers and cards.

A relative unknown in the U.S., the KiTalbum format is best known in the company’s home country. Not only are KiTalbum’s original manufacturing facility and offices in Korea, but the company also launched a flagship retail store in the country. Sullivan says that since 2017, KiTbetter has produced 10 million KiTalbums, with K-pop titles being the best-selling.

But now, the company is targeting a wider range of genres and artists in North America and Europe. “We’re seeing strong international demand that continues to drive the need for additional production capacity,” adds Sullivan. Having a facility in Los Angeles will cut down on the turnaround time compared to shipping products from South Korea.

In recent years, KiTbetter has released titles on metal label Earache Records (Napalm Death and Carcass, for example) and Rhino Records (Alanis Morissette’s Jagged Little Pill and B-52s’ Cosmic Thing, among others). Rap icons Public Enemy released a KiTalbum version of its latest album, Black Sky Over the Projects: Apartments 2025. Metal greats Megadeth will offer a KiTalbum version of its final album that’s due out in January.

Related

KiTalbums typically come with exclusive or bonus content. The upcoming reissue of Devo’s 1980 album Freedom of Choice, for example, includes cover versions of the band’s hit song “Whip It” by the bands Teen Mortgage! and Scowl. Stone Temple Pilots’ Purple comes with seven music videos and acoustic sessions for “Big Empty” and “Pretty Penny.”

Independent artists can also create KiTalbums for their releases through the KiTbetter self-service website. Sullivan says prices start around $9 apiece and drop to about $7 per unit for orders of 300 units. Artists can sell their KiTalbums in the KiTbetter shop or through their own online stores. “A lot of artists like to have product on hand at shows,” says Sullivan.

KiTbetter isn’t the first company to attempt to enhance digital content. Yoto sells Yoto Cards, credit card-sized pieces of plastic, that are inserted into a screen-free audio player for children. Weverse, the social media platform owned by K-pop giant HYBE, offers Weverse Albums that include digital photo cards and animated album covers. Going further back in time, record labels embraced enhanced CDs in the 2000s to help combat falling album sales. Enhanced CDs added data to an audio CD and frequently included videos, wallpapers and links to web pages.

While the KiTalbum remains a niche product in the U.S., KiTbetter’s expansion corresponds with the music industry’s increased interest in collectibles and selling physical items to superfans. With streaming dominating music consumption, perhaps the KiTalbum will become an intriguing option for fans who prefer digital music but want a tangible item.

Trending on Billboard

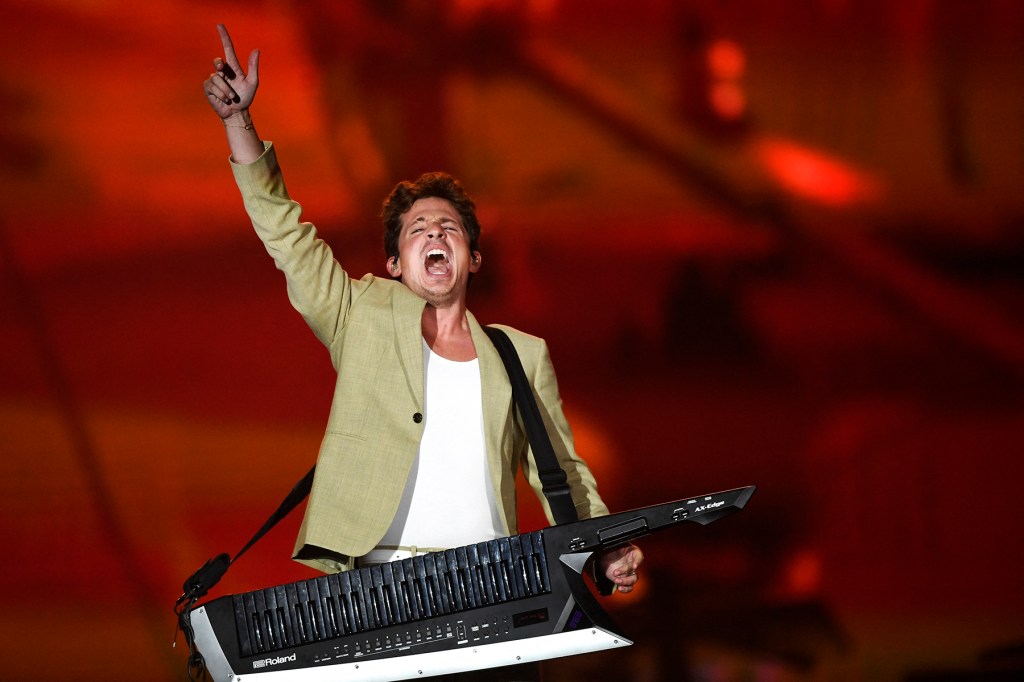

Fresh off the release of his new single “Changes,” Charlie Puth is ready to be part of the change in protecting the Amazon rainforest by joining the lineup of Global Citizen Festival: Amazônia, taking place next weekend in Brazil, Billboard can exclusively reveal.

Puth will join previously announced performers Anitta, Seu Jorge, Gilberto Gil, Gaby Amarantos, Chris Martin of Coldplay, Eric Terena, Kaê Guajajara and Djuena Tikunal. It’s all going down Saturday, Nov. 1, at Belém’s Estádio Olímpico, also known as Mangueirão, in Pará, Brazil.

“I’m thrilled to be coming to Belém for the first Global Citizen Festival in Latin America,” Puth said in a press release announcing his addition. “As a Global Citizen ambassador, I’m honored to be part of such an important cause for our planet and can’t wait to see you on November 1st.”

Also announced Thursday (Oct. 23): Brazilian singer Vivi Batidão will perform during the festival’s pre-show, and Alane Dias, Ricardinho and Luiza Zveiter have joined the lineup of presenters. The festival will be co-hosted by Regina Casé, Mel Fronckowiak, Hugo Gloss and Isabelle Nogueira, with appearances by Rodrigo Santoro and Estêvão Ciavatta.

Any fans not attending in person can visit globalcitizen.watch to tune in live on Nov. 1 at 6 p.m. ET, and the fest will also broadcast on Globo across Brazil.

The event will focus on amplifying the voices of indigenous peoples and local communities in the Amazon rainforest and aim to raise $1 billion to protect, restore and rewild the Amazon rainforest. Global Citizen Festival: Amazônia will be a zero carbon footprint festival, in alignment with Global Citizen’s campaign to Protect the Amazon rainforest; find the full details of the Protect the Amazon campaign here.

Puth will likely perform some of his newest music at the festival, after announcing his fourth studio album, Whatever’s Clever!, last week and dropping the lead single “Changes” alongside a music video that doubled as a pregnancy announcement for him and his wife Brooke. Puth just wrapped a 16-show residency at Blue Note Jazz Club in New York and Los Angeles, where he also live-debuted “Beat Yourself Up” from the new project, due March 6 via Atlantic Records.

Billboard’s Live Music Summit will be held in Los Angeles on Nov. 3. Find details about tickets and more information here.

Trending on Billboard

Melbourne, Australia — Paul Dainty is embarking on a new voyage in artist management.

The legendary Australian concert promoter joins forces with his son, Sam Dainty, on Voyager Management Group, which launches proper with its first signing, Charly Oakley.

Voyager was initially created with Brian Walsh, the late publicist and executive director of television at pay-TV platform Foxtel, and is completely separate to TEG Dainty, which Paul Dainty continues to lead.

The new venture serves to oversee several agencies, including IMC and Mark Gogoll Artists, and Monument Management, explains Sam Dainty, a film and TV professional who came on to board in 2022 to help operate the business and was mentored largely by Walsh, who passed in 2023.

Related

“Charly is the first artist Paul has managed and the first artist signed to us,” Sam Dainty tells Billboard. “We had hoped to do this further down the line but when we discovered Charly we were just so impressed and wanted to get moving.”

Paul Dainty knows something about talent. The U.K.-born impresario has forged an impressive career in his adopted homeland, producing tours and concerts with the world’s leading rock and pop artists, and selling more than 50 million tickets along the way.

The Melbourne-based executive established the Dainty Group/Dainty Corporation in the early 1970s, and got on a roll early on with the Bee Gees, Diana Ross, Cat Stevens and the Jackson Five. Dainty produced the Rolling Stones’ tour of 1973, a visit that would set up the success that followed.

It was Dainty who produced ABBA’s 1977 tour of Australia, a visit that remains the stuff of legend. Through the friendships made on that trip, ABBA’s Benny Andersson and Björn Ulvaeus entrusted Dainty to tour Mamma Mia! 25 years later.

Dainty has also produced tours for the likes of Paul McCartney, U2, Guns N’ Roses, Eminem, David Bowie, George Michael, Prince, Katy Perry, and Britney Spears, and expanded the business into international markets.

He continues to serve as president and CEO of TEG Dainty, which, since 2016, has been a part of the TEG Group. The following year, he was appointed a Member of the Order of Australia (AM), and in 2023, he was appointed Officer of the Order of Australia (AO) for his “distinguished service to the community”. Upcoming TEG Dainty shows include national treks by Ricky Martin, Oprah, and Richard Marx.

A 22-year-old pop singer and songwriter, Oakley celebrates their new deal with the release of a debut single “Against The Odds” through AWAL. Oakley will support the release with a launch show next Thursday, Oct. 30 at Night Cat in Fitzroy, Melbourne.

Oakley is a special artist with the world at their feet, Sam Dainty reckons.

“We believe that Australian talent is extremely under-represented on a global stage, we have ambition for Charly in the future to be a huge name and figure in the music world,” Dainty says. “We have been able to give Charly the platform to receive feedback, help and guidance from not only us but huge names in the music industry and they have confirmed out belief in the artist and now it is time for the world to begin to hear the music.”

Trending on Billboard

Women In CTRL, a non-profit advocacy group, announced Thursday (Oct. 23) that more than a dozen British live music organizations have signed a pledge designed to strengthen inclusion targets across the industry.

The Seat at the Table Inclusion Pledge, the first of its kind in the U.K., is centered around a new sector-wide commitment to achieving gender-balanced leadership by 2030.

Related

Signees of the pledge include ATC Live and Ginger Owl, and companies including AEG and The O2. All 15 LIVE (Live Music Industry Venues & Entertainment) organisations have also signed up, including the Association of Independent Festivals, Featured Artists Coalition and Music Managers Forum.

As supporters of the pledge, industry allies will contribute to case studies, share learning across the sector, and participate in future roundtables and peer learning sessions. Women In CTRL says this collaboration will be key to strengthening accountability across the live music ecosystem.

Signatories will also be required to commit to submitting an annual check-in to show progression across key focus areas, such as strengthening governance and board diversity through reviews or term limits.

In April, Women In CTRL and LIVE released a landmark report titled Seat at the Table: LIVE Edition. Its findings highlighted progress in some areas — including the finding that 61% of the Music Venue Trust board identifies as women or non-binary — while also revealing disparities in wider leadership representation.

Related

Forty-one percent of board members across LIVE and its 15 member organisations are women or non-binary people, the report stated. LIVE has since released its 2030 inclusion targets, which include 50% women and non-binary representation and 16% women from global majority backgrounds in senior leadership roles.

Elsewhere, the report revealed that women’s representation on U.K. music trade association boards rose from 32% in 2020 to 52% in 2024.

Gaby Cartwright, head of partnerships at LIVE, said in a press release at the time the report was released, “As an industry, it’s clear that we must do more to improve gender representation at the highest levels… Reaching this goal will require collective effort, accountability, and meaningful action — but momentum is building. This report provides crucial insight into the challenges we face, and the concrete steps needed to drive lasting change.”

Nadia Khan, founder of Women In CTRL, added at the time, “We know from experience that what gets measured, gets done. This report is an essential first step; by setting a clear benchmark, we are providing the industry with a roadmap for action, not simply reflection.”To read the full Seat at the Table: LIVE Edition report, visit the Women In CTRL website here.

Trending on Billboard

Luke Combs and Opry Entertainment Group (OEG) will bring a new Category 10 entertainment venue to the Flamingo Las Vegas next fall. Inspired by Combs’s chart-topping 2017 hit “Hurricane,” the Category 10 brand’s flagship venue opened in Nashville in late 2024.

The three-story venue will feature Hurricane Hall, a main dining hall that will include three bars, a central stage and dance floor, as well as state-of-the-art video, acoustics and lighting. Hurricane Hall will offer curated artist lineups daily and host the brand’s free line dancing lessons. The second floor will include The Still, inspired by Combs’s songwriting talents, which will offer a more intimate area with a view of the stage, as well as an extensive collection of bourbons hand-selected by Combs. The Still will also have an adjacent outdoor patio space.

Related

The third level will hold The Eye Rooftop, a covered rooftop space featuring a DJ booth, dance floor and bar with views of the Las Vegas Strip. The venue will also feature the Beautiful Crazy Women’s Lounge, located inside the women’s restroom on the first floor, which will offer a champagne bar, makeup counters, soft seating and Hollywood vanity mirrors.

Combs said in a statement, “I am stoked about having a second Category 10 location in Las Vegas. 2026 was already going to be an awesome year, but this takes it to the next level. I can’t wait for Bootleggers to have their own place to party on The Strip.”

Combs is set to headline more than 20 dates in Europe and North America next year on his My Kinda Saturday Night stadium tour. He was recently named the highest RIAA-certified country artist in history, with more than 168 million units sold.

Related

“With Luke’s enormous international appeal, securing the right Las Vegas location for Category 10 has been a priority since we first announced the partnership back in 2023,” Colin Reed, executive chairman of OEG parent company Ryman Hospitality Properties, said in a statement. “The United Kingdom ranks as the leading market for international visitors to Las Vegas outside North America. Combined with the UK’s continued embrace of country music and Luke, this is an ideal moment to bring Category 10 to one of the world’s great entertainment playgrounds.”

Reed continued, “We have formed a wonderful relationship with Caesars Entertainment through our Ole Red Las Vegas location, and we look forward to bringing more country music experiences to the market.”

“The addition of Category 10 continues to build on the momentum of a tremendous year transforming Flamingo Las Vegas,” added Dan Walsh, senior vp and general manager of the resort. “With exciting new experiences like the Go Pool, Pinky’s by Vanderpump, Gordon Ramsay Burger and Havana 1957, we’ve brought a whole new level of energy to our iconic resort. Category 10 elevates that energy even further, bringing one of the biggest names in music to the Flamingo and offering live performances with great food and cocktails at the best location on The Strip.”

Trending on Billboard

More than 550 entertainment industry leaders gathered in Los Angeles on Sunday (Oct. 19) for Creative Community for Peace’s (CCFP) seventh annual Ambassadors of Peace gala to promote dialogue and unity through the arts. The event was held at the Beverly Park residence of Haim Saban, chairman and CEO of Saban Capital Group.

This year’s honorees were Bruce Resnikoff, president/CEO of Universal Music Enterprises; Jonathan Strauss, CEO of Create Music Group; David Kohan, showrunner and executive producer of Will & Grace and Mid-Century Modern; his wife, Blair Kohan, partner and board member at United Talent Agency; and actor Jerry O’Connell.

Related

The event featured a performance by John Mellencamp, who said, “I don’t like to call it antisemitism. It’s too polite a word for what it really is. Hatred is what it really is. And I may just be a guy with a guitar and sing some songs, but I promise this to the Jewish people: I will remain a staunch ally to you guys as long as I’m on this earth. And to the Jewish haters, I say f—k you.”

“In order to make a difference, sometimes we need to get out of our comfort zone, and that’s what I’m doing tonight,” Resnikoff said. “In the Jewish community, especially during an epidemic of undeniable and widespread antisemitism, we will always need more voices, and particularly in the music industry. CCFP brings caring people together to help amplify our voices, and I’m proud to do my part tonight.”

Strauss added, “Great companies and great cultures are not built in an echo chamber. Disagreement doesn’t mean division; it means engagement. And there’s nothing worse than apathy.”

CCFP chairman and co-founder David Renzer opened the event and said, “We have to push back. We have to educate. We believe in coexistence. We believe in the power of music and arts and culture to help build bridges and that it should not be shut down.”

Related

Ari Ingel, CCFP executive director, added, “Jewish pride means knowing where we come from and taking control of where we are going. It means speaking Hebrew with joy, wearing your Magen David in the open, loving Israel, not with blind nationalism, but with eyes wide open, with commitment, with critique and care.”

Among those paying tribute to this year’s honorees were Ringo Starr, Def Leppard, Paul Rudd, Nick Kroll, Rebecca Romijn, Howie Mandel, Mayim Bialik, Debra Messing, Greg Berlanti, Kelly Ripa and Mark Consuelos.

Artists and entertainment leaders in attendance included Gene Simmons of KISS; Berry Gordy, founder of Motown Records; Gary Barber, co-founder Spyglass Media Group; Suzanne de Passe, co-chairwoman of de Passe Jones Entertainment Group; Jody Gerson, CEO of Universal Music Publishing Group; Jacqueline Saturn, president of Virgin Music; Michael Rotenberg, founder and partner at 3 Arts Entertainment; David Zedeck, global co-head of Music at UTA; Jacob Fenton, UTA partner; Larry Rudolph, founder and CEO of 724 Entertainment; and Phylicia Fant, global head of music industry & culture collaborations at Amazon Music.

Previous Ambassador of Peace honorees include Recording Academy CEO Harvey Mason jr., Grammy-winning songwriter Diane Warren, reggae star Ziggy Marley, music mogul Scooter Braun, chairman & CEO of Sony Music Latin America Afo Verde, and CEO and co-chairman of Warner Records Aaron Bay-Schuck.

More information on Ambassadors of Peace can be found on the event’s website.

Trending on Billboard The Recording Academy’s immersive pop-up experience, Grammy House, will expand globally in 2026 with the launch of Grammy House Giza in Egypt. Previous Grammy House activations have occurred in Los Angeles and New York. Related Grammy House Giza will unite artists, producers, songwriters and industry leaders from around the world for several […]

State Champ Radio

State Champ Radio