Business

Page: 19

Trending on Billboard

AXS is ramping up its European ambitions with two senior executive hires designed to accelerate the ticketing company’s growth across the region. The company has appointed Peter Quinlan as managing director of Europe, and Hannah Rouch as vp of marketing in Europe — both newly created roles that will operate out of London and report to AXS’s international division.

Quinlan will oversee all European operations and lead the company’s regional strategy, reporting to Blaine Legere, president of AXS International. Rouch will report to Quinlan and spearhead marketing efforts across the continent, with a mandate to expand brand awareness and drive audience growth for the ticketing platform.

Related

“Europe remains a critical growth engine for AXS, and these appointments mark an important step forward in our continued evolution,” Legere said in a statement. “Peter’s global experience and operational acumen, combined with Hannah’s deep marketing expertise and track record of execution, will be instrumental as we continue to scale and deliver across the region.”

Quinlan joins AXS after 18 years at Live Nation Entertainment, where he held leadership roles across marketing, sponsorship, and ticketing. He most recently served in a global executive capacity at Ticketmaster, overseeing commercial partnerships, payments, fraud operations and other revenue initiatives. His new role puts him at the center of AXS’s European expansion strategy at a time when the company continues to compete with Live Nation’s Ticketmaster, CTS Eventim and other players across the territory.

“There’s tremendous opportunity for growth — especially in Europe, where promoters, venues and artists are looking for innovative, transparent partners with technology that can scale and deliver,” Quinlan said. “I’m excited to help lead that charge.”

Rouch joins AXS from Gumtree/eBay, where she led a brand repositioning for the marketplace and previously held marketing leadership roles at Motors.co.uk and Bauer Media. Her remit will include strengthening the AXS brand across all European markets and building a marketing infrastructure to support both promoter clients and consumer initiatives.

“I’m thrilled and energized to take on this role at a time of significant growth for AXS across Europe,” Rouch said. “Our focus will be on strengthening our brand and reach across Europe and building out marketing as a growth engine for the business – accelerating our ability to deliver for our clients and enhancing our efforts to ‘hold the hand of the fan’ from show discovery to live event.”

The hires come as AXS continues to grow its international footprint, with partnerships spanning festivals, arenas, sports franchises, and touring artists. The expansion also reflects the company’s broader strategy to scale its global technology platform and deepen its presence outside the U.S.

“These new appointments reflect AXS’s ongoing commitment to scale, unify, and empower our international teams,” Legere added. “With this expanded leadership structure, we’re better positioned than ever to deliver world-class support for our clients and partners.”

Trending on Billboard

Drake is appealing after a judge dismissed his defamation lawsuit against Universal Music Group (UMG) over Kendrick Lamar’s diss track “Not Like Us” — and some legal experts think it could be a closer case than one might expect.

Related

The appeal, filed last week, will seek to revive Drake’s case, which claimed that UMG defamed him by releasing lyrics that called him a “certified pedophile.” A judge tossed the case out last month, ruling that listeners would think Lamar was just lobbing hyperbolic opinions, not hard facts.

For many casual observers, the reaction to Drake’s decision to appeal was some version of the law of holes: If find yourself in one, stop digging. After taking a reputational hit from filing a lawsuit during a rap beef, and then quickly losing that case in court, why drag it out any further?

Because, some legal experts say, a court of appeal might be more open to siding with Drake than the court of public opinion. “I think there’s actually a good argument that ‘pedophile’ wasn’t meant metaphorically here,” says Benjamin C. Zipursky, a professor at Fordham Law School and an expert in defamation law.

Much of Judge Jeannette A. Vargas‘ ruling against Drake turned on context — that Kendrick’s lyrics came amid a “war of words” in which fans had seen repeated “inflammatory insults” from each side. In that setting, and within the art form of battle rap more generally, the judge said listeners would likely view the pedophile line as just one more “hyperbolic vituperation” rather than the kind of “sober facts” that could be proven true or false.

On appeal, Drake’s lawyers are likely to argue that Vargas got lost in that context-heavy approach and missed the actual reality of the case: That even if it came during a diss track, Kendrick accused Drake of a very specific type of wrongdoing. And some experts say that might gain traction at an appeals court.

“Is that a verifiable statement? Of course it is,” Zipursky says. “As opposed to calling somebody a ‘fascist’ or a ‘sh-thead’ or claiming they don’t love their family, the statement that ‘X is a pedophile’ falls more on the verifiable, falsifiable side. And that’s clearly what Drake’s lawyers are going to push.”

Zipursky stresses that Vargas had done an “artful” job crafting her ruling, taking into account layers of legal precedent and serious concerns about a chilling effect on free expression from letting a rich celebrity sue over art. But when dealing with the almost metaphysical complexity of speech law, he says an appeals court might still see things differently.

Related

“If I were Drake’s lawyers, I would absolutely try to pull apart some of these context issues,” Zipursky says. “I’d ask why it’s fine for rap musicians to tell lies about each other’s criminality when there’s nothing in New York law that says that.”

Another way for Drake’s lawyers to frame those issues could be to argue the case was simply tossed too soon. Judge Vargas dismissed the case on a so-called motion to dismiss — meaning at the earliest possible stage of a case. Under that rule, she said that even if Drake proved all his lawsuit’s defamation allegations were factually true, he still couldn’t win the case because the law itself was against him.

For Marina V. Bogorad, a veteran entertainment litigator at Munck Wilson Mandala LLP, that ruling smacks of blanket immunity for any statement made in the context of a diss track, even an accusation of heinous conduct that would obviously be defamatory if false.

“The statement on its face accuses Drake of a serious crime,” Bogorad says. “To find that you can lace rap songs with facially libelous statements with impunity as a matter of law is quite a holding.”

Of course, none of this means Drake’s appeal is a slam dunk. Other legal experts had predicted to Billboard that the case would be dismissed for exactly the reasons later cited by Judge Vargas. And scholars versed in hip hop also came out against the case, arguing that Drake’s effort to treat rap lyrics literally was both legally faulty and potentially dangerous.

Related

But reasonable legal minds can differ on something as complicated and nuanced as free speech and defamation — and Bogorad says the appeals courts might think Judge Vargas should have waited and allowed more discovery into the facts of the case, including into the falsity of the claim or how actual listeners understood Kendrick’s lyrics.

“Whether or not someone is a ‘certified pedophile’ is certainly a fact capable of being disproved,” Bogorad says. “It remains a question for the [appeals court] whether rappers have an instant immunity from these kinds of inquiries.”

Trending on Billboard

Over the last 12 years, Greg Harris has quietly, methodically steered the Rock & Roll Hall of Fame to massive financial growth despite a swamp of issues — from its lack of female inductees to Rolling Stone founder Jann S. Wenner’s abrupt 2020 departure as foundation chairman to Dolly Parton’s (temporary) refusal to accept her nomination. According to ProPublica, the Cleveland-based hall and museum’s revenue increased from $19.2 million in Harris’ first year as president and CEO in 2012 to $54.8 million in 2023, while its annual visitors recently hit 1.5 million. “We worked to grow the business so that we’d be more stable,” says Harris. “And we have an incredible group of donors.”

Talking to Billboard by phone from the museum’s I.M. Pei-designed pyramid — before he visited the construction site of its $135 million, 50,000-square-foot expansion — Harris previewed the 2025 Rock & Roll Hall of Fame ceremony to induct Outkast, Cyndi Lauper, Joe Cocker, The White Stripes and others. (The show, this Saturday Nov. 8, will be livestreamed on Disney+.) He also discussed the Hall of Fame’s six new board members, plus Chris Kelly, a partner at Cleveland law firm Jones Day, who became board chair in July. A former Philadelphia record-store owner, folklorist and top National Baseball Hall of Fame exec, Harris spoke of the common “emotional impact” of sports, music and folklore during the conversation, which you can read in full below.

Related

What accounts for the revenue growth since you’ve been president?

Harris: We’ve greatly increased our visitation in those years. We made the museum more experiential. Odds are, in the summer, there’s a live band onstage. You can play guitars and drums and things in new spaces that we’ve built and jam with other visitors. We’ve made a lot of investments in improving the visitor experience, and they’ve paid off.

What’s the greatest percentage of revenue? Is it the paid visitors, or something else?

Visitors, ticket sales and retail sales are incredibly important, and we have a lot of events and groups that do events. Our fundraising is what’s enabled us to do this massive expansion project.

It strikes me that the iconic names from the ’50s and ’60s have mostly been inducted, so the Hall of Fame has to update it with new generations. Is that difficult? Fun? Both?

It’s a healthy project to continue to look at different eras. And maybe going against your hypothesis is that Chubby Checker and Joe Cocker are going in, and you could extend that up to the ’70s and ’80s and ’90s with Warren Zevon.

Related

Do you get as many, “That’s not rock ‘n’ roll, that’s Dolly Parton, or [fill in the blank],” as much as you used to?

I believe that’s died down. This big tent of rock ‘n’ roll, that all these different genres and sounds and eras fit into it, has become much more widely accepted. It’s fun to tell these stories about how it all fits together rather than defend a decision here or there. It’s all rock ‘n’ roll. It all fits.

Everybody has a hot take on who should be in and who shouldn’t. What’s yours?

When I came over here, you would think about a certain artist, and most of them have gotten in. Back then, I thought Tom Waits should be in, of course — now he’s in. Stevie Ray [Vaughan] — now he’s in. Hall and Oates — now they’re in. That’s the debate we get to have all year long. At this moment, let’s celebrate this year’s inductees.

The new trustees have business backgrounds, not music backgrounds. Why is that the right criteria to lead the Hall of Fame?

What we look for is good trustees that will help advise us, help us think bigger and help us grow. Because the museum has such an economic impact in northeast Ohio, we do have quite a few of them from northeast Ohio, and they’re here to make sure this entity is terrific for this region while still being terrific for the world.

Related

Chris Kelly, the new board chair, was head of the Republican National Convention host committee in 2016. Did that come up in the process of choosing him for the Hall of Fame, since so many people involved in the organization are politically progressive?

The host committee is what every city has when they try to attract a political convention. That convention was in Cleveland in 2016, but the reason why cities want them is because they’re a massive economic boon to the local economy. It’s not a political statement. It’s about attracting these things, like attracting the Olympics to your town.

Early in your career, you went from founding the Philadelphia Record Exchange to studying folklore in Cooperstown, N.Y., which led you to the Baseball Hall of Fame, then here. What was that transition like?

When I discovered there were these people called folklorists who do oral history, they make documentary films, they produce records, I thought, “What a career, that’s me.” After the Record Exchange, I road-managed some bands. I went back to college and thought I’d go to law school and worked for a law firm, and it just wasn’t for me. That’s when I went heavy on the folklore and museum studies. The great thing is, it’s a history of everyday people, and in many ways that’s what rock ‘n’ roll is all about.

Anything I’ve missed?

One thing is to make sure fans tune in. Go online and watch the streams of the induction. Visit us in Cleveland. We’re open 363 days a year. We have an exhibit right now on Saturday Night Live, 50 years of music that contains every performance. You can watch all of them.

[Harris calls back 30 seconds after the interview.]

What I should’ve ended with was, I love all museums, but this is the greatest museum in the world, and the one place where every visitor has a memory tied to the songs. People come through, they hear a certain song or they remember something they heard in college, the greatest road trip of their life … all that is tied to the music we get to honor every single day at the museum.

Trending on Billboard

This article was created in partnership with VENU.

Billboard’s highly anticipated Live Music Summit presented by VENU made its return this year, marking its second gathering and celebration since its hiatus in 2019. The summit’s comeback is in response to high demand to refocus on the thriving touring industry.

Attendees experienced a dynamic mix of panel discussions, live performances, workshops, and industry mixers, all culminating in the Touring Awards Ceremony. Among the star-studded panel lineups were Usher, Rauw Alejandro, and top industry executives. It was an invaluable opportunity for those in the music business to gain insights from industry leaders while celebrating the milestones many touring artists have achieved this year.

Explore

See latest videos, charts and news

Rashida Zagon for Billboard

The Live Music Summit made its highly anticipated return with exciting new awards and recognitions including the Disruptor Award, presented to Khalid by visionary entrepreneur, J.W. Roth, Founder and CEO of premium live entertainment company, VENU. Over the past 9 years, Khalid has taken the industry by storm, embodying the very definition of a “disruptor.” His bold approach has challenged both fans and music executives to see artists through a new lens.

Accepting the award, Khalid said, “I can remember doing my first venue and there was 125 people at a coffee shop and to be able to see the things that I’ve seen in my career is just such a blessing.” adding, “It wouldn’t have been able to be done without support. So, I just want to thank everyone for supporting me. Especially, me coming into myself as an individual in the public but I’ve seen nothing but love and I hold it with grace and humility.”

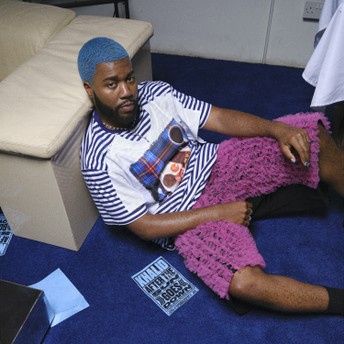

Khalid Donnel Robinson in the Green Room during the Billboard Live Music Summit at 1 Hotel West Hollywood on November 03, 2025 in Los Angeles, California.

Christopher Polk/Billboard

Also disrupting the live-music world is Venu Holding Corporation (“VENU”). It isn’t your typical live entertainment company. Rising fast throughout the live entertainment space, the company has built its brand around delivering premium experiences, opening multiple venues nationwide and redefining not only how audiences experience concerts, but how they can own a piece of live entertainment. They’re more than destinations to see your favorite artists. VENU is a fan-founded, fan-owned, artist-inspired movement creating unparallelled, immersive spaces, designed to elevate every part of the concert journey for fans and artists alike. Their mission is to create nationwide, top-tier live music destinations that change how the world experiences and connects with music, shaping the future of live entertainment.

Rashida Zagon for Billboard

After the Billboard Live Music Summit, some of the industry’s top executives gathered at the Sun Rose in West Hollywood for a Music & Money Dinner to reflect on the conversations of the day and engage in insights for the future of live entertainment. During which, VENU Founder, CEO, and Chairman J.W. Roth and industry veteran Tommy Ginoza engaged in a thought-provoking fireside chat, moderated by Billboard’s Editorial Director, Hannah Karp, about the state of the music industry, the evolution of live entertainment, and VENU’s continued expansion of its destination network across the United States. With over three decades of experience as a talent buyer, Ginoza spoke candidly about the future of artist development and the critical role of fan engagement in shaping the live music experience. Roth, meanwhile, highlighted that while recent investment trends have heavily favored music publishing catalogs and master recordings, the live music sector has seen comparatively less attention from investors in recent years.

Rashida Zagon for Billboard

Acknowledging this shift, Roth emphasized that the current landscape presents a unique opportunity to redirect investment toward live entertainment, such as VENU’s unique ownership opportunities in Luxe FireSuites, Aikman Clubs built in partnership with NFL Hall of Famer, Troy Aikman, or common shares, stating, “If you’re going to be innovative in this space, not only do you have to have a concept that is going to be attractive to our customer but you’ve got to figure out a way to finance it… So, we’re not just building amphitheaters. We’re building venues that are multiseasonal, multiconfigurational, and more importantly they are multisensory.”

The event was a true celebration for accomplishments in the live music world and the heights to which this community intends on taking the art of live entertainment in the near and distant future. The prospects of live music are looking bright and Billboard and VENU plan to be a part of every step of the way.

Trending on Billboard

If two artists are company and three are a crowd, then some Nashville stages are threatening overpopulation.

On three successive nights, Oct. 27-29, a total of 30 artists, three speakers and a pair of comedians assembled at three multi-artist shows with three different themes. For most cities, even one of those concerts would have been a major event, but in Music City, it’s de rigueur; ho-hum; par for the course; been there, done that.

Not to say that other communities can’t produce a big, multi-act show — music capitals such as New York, Los Angeles, Austin or Atlanta certainly do it — but Nashville may have a leg up on the phenomenon, particularly for multi-artist concerts.

Related

“If you’re in New York, the Friars Club will give you a roast,” says Larry Gatlin, who participated in two of the three Nashville events. “In Los Angeles, they have the Academy [Awards] and stuff. But I think Nashville is unique.”

The parade of large Music City productions started Oct. 27 with The Music of My Life: An All-Star Tribute to Anne Murray, with 14 performers doing one song each at the Grand Ole Opry House while Murray applauded from a floor seat. Collin Raye led with “Daydream Believer,” Shenandoah delivered “Could I Have This Dance,” Canadian Michelle Wright chipped in “Snowbird,” and k.d. lang mirrored Murray’s phrasing while performing “A Love Song” barefoot.

The next night, the Grand Ole Opry stacked six musical acts, including Warner Music Nashville signee Braxton Keith, who was surprised with his first gold record; The Forester Sisters, whose three songs included a cover of the 1950s girl group song “Mister Sandman”; and The Nitty Gritty Dirt Band, who ended the show with a song that’s central to country music history, “Will the Circle Be Unbroken.”

On Oct. 29, the annual Concert for Cumberland Heights raised money for a Middle Tennessee rehab center, with Gatlin and Christian artist Joseph Habedank kicking things off before The Warren Brothers MC’ed an eight-person songwriter round that ricocheted between comedic songs and profound material.

The camaraderie across all three nights was notable.

“This is so vibrant — you know, the sense of community,” says Dirt Band frontman Jeff Hanna, who spent time in Colorado and L.A. prior to moving to Nashville. “If you’re in the music business, you’re always going to have a competitive edge. Everybody wants to win, but you also root for your pals, and I just love that about this town.”

Not many towns could hope to pull off three straight nights of comparable multi-artist shows. They’re larger than a traditional two- or three-act concert, but smaller than a weekend music festival.

It’s not financially feasible — for the artist or the promoter — to have that many people travel long distances to play just a handful of songs. And few communities have the volume of local musical talent.

Other towns also don’t have the Grand Ole Opry. One of the side benefits of the program, which will celebrate 100 years on WSM-AM on Nov. 28, is the infrastructure it has created. The Opry is typically booked four or more nights a week. The artists who play it know ahead of time that they’re part of a big ensemble with lots of moving pieces — very different from a concert with one headliner and an opening act. And the crew has developed a routine for the quick changes that a barn-dance format requires.

“Everything has its challenges,” Opry senior vp/executive producer Dan Rogers allows, “but over the course of all those years and this many shows in a year, you begin to figure out the things that work and don’t work.”

The staff itself has a bigger impact on running a multi-artist show. If The Dirt Band is headlining a date, the group can make adjustments deep into the set by reading the audience. But it doesn’t necessarily know what the crowd is like when it pops out from backstage at the Opry, and since it only does two or three songs in that setting, there’s little opportunity to change the dynamic.

“You’re sitting around for a couple of hours,” Hanna says, “then they go, ‘You’re on in five minutes,’ and you’re plugging in these guitars.”

Related

Because the artist typically doesn’t have an opportunity to make adjustments, it’s up to the production team to read the room and keep the pace going.

“I’m a time person,” Cumberland Heights development events manager Lee Ann Eaton says. “Like, I’ve jerked Santa [Claus] off the stage because he was taking too long. You know what I mean? ‘Your time is over, Santa. Get up!’ ”

That doesn’t mean the artist is unable to influence a show with an adjustment or two. Rogers points to a recent Jamey Johnson Opry appearance, when an onstage mention of the late Vern Gosdin led him to play three Gosdin songs during his set. Gatlin notes that making the audience laugh can engage a sedate crowd.

“Self-deprecating humor is the secret sauce,” he says. “If you can go out there and, very quickly, make a little fun of yourself or pick on yourself a little bit, the audience immediately relaxes and they take you into their heart.”

Still, because the barn-dance format requires a large cast of performers, all of whom have plenty of downtime, there’s room for a lax production to go off the rails. Making it smooth for the talent and their teams while maintaining a sense of structure is what makes the show work.

“It requires a lot more organization on the back end,” Eaton says. “I’m dealing with eight artists and their dressing rooms and their backstage passes and their parking. But the Ryman makes it easy, too. I mean, they’re so good at what they do, I would say I could do my job from my car.”

It’s that institutional knowledge and experience that makes it possible for Nashville to handle three straight nights of multi-artist packages. The Opry has established an air of normalcy around lineups that would be a major undertaking in most other settings. The production teams know the drill, and the artists see it as part of the heritage in country music.

“This community, as much as any other community, loves to pay respect to the people who paved the way for them — and pay it forward,” Rogers says. “So somebody’s often going to say ‘yes’ when you ask, ‘Do you want to come tip your hat to an artist who you listened to growing up?’ Or ‘to come give a boost to [a young] artist who has said you did the same thing for them.’ ”

In just about any other locale, the production team would be in chaos trying to pull off a live music show with so many moving parts. But in Nashville, three straight nights of heavily populated stages — and backstages — is not such a big deal.

“They’re just so calm about it,” Eaton says of the Ryman team, “because it is commonplace.”

Trending on Billboard

Sounds Right, a charitable cross-DSP playlist featuring music that incorporates the sounds of nature, will now allow any artist to submit their music to the project, it was announced Wednesday (Nov. 5).

Sounds Right initially launched in April 2024 with a playlist featuring new and older tracks with sounds like bird calls, waves, wind and other greatest hits of the mother nature soundscape, woven into music by artists like David Bowie, Brian Eno, Hozier and Ellie Goulding. Royalties generated by this music, which includes 36 original songs that were added this past April, are directed to conservation efforts.

Related

Now, as scientists and activists from around the world gather in Belem, Brazil for the COP30 UN Climate Conference (Trump administration officials recently announced that no high-level representatives from the U.S. government will attend the event), Sounds Right has announced an update that allows artists to help fund conservation work by officially crediting “Nature” in their music and submitting it for inclusion on the playlist.

Accepted submissions will be incorporated into the Sounds Right playlist, with 50% of royalties raised from any given song going to the artist and the other 50% going to environmental causes. Submissions are open now.

This past Saturday (Nov. 1), Sounds Right announced that the project has so far raised a total of $400,000 for Indigenous and community-led conservation in the Amazon and Congo Basin regions, building on $225,000 it directed to projects in the Tropical Andes in 2024. The funds were announced on stage at Saturday’s Global Citizen Amazonia concert in Belem, which was broadcast throughout Brazil.

Related

Sounds Right has now added 14 new tracks to the playlist, all of which celebrate the natural world of the Amazon and Africa. The Amazonian contributions come from artists Alexia Evellyn, Pedrina, Antonio Sanchez, Chancha Via Circuito, Systema Solar and Monte (aka Simon Mejia), while the music of artists Juls, Phila Dlozi, Olivetheboy, Bien, Blinky Bill, and Lady Donli showcases the sounds of the Congo Basin region.

“This collection of tracks is a powerful expression of how artists can use their creativity to celebrate and protect the natural world at such a critical moment for our planet,” EarthPercent co-executive director Cathy Runciman tells Billboard. “From Alexia Evellyn recording the rhythms of the Amazon’s rivers and birds to Juls blending Congo Basin forest ambience into Afrobeats, and Antonio Sánchez turning birdsong into percussion, it’s inspiring to see such diverse artists uniting to honor these vital ecosystems and leading a movement to bring nature back into music and culture.”

“It’s an honor and a thrill to be part of Sounds Right,” adds the Grammy-winning Sanchez, whose contribution “Drumming with the Birds” explores the percussive rhythms of Amazonian birdlife. “I believe it’s vital to keep opening new avenues for people to connect with the importance of preserving and protecting Mother Nature. This collaboration, inspired by the Amazon and its remarkable avian life, celebrates that connection. I hope you enjoy it as much as I enjoyed creating it.”

Brazilian producer Alok will also soon release a special track for the Sounds Right project, with the artist saying in a statement that “nature has always played an essential role in music, and the time has come for it to be recognized for that.”

Trending on Billboard

MELBOURNE, Australia — Oasis won’t look back in anger at their first visit to Australia in two decades.

The Britpop era superstars on Tuesday, Nov. 4 wrapped up the Melbourne leg of their swing down under, a three-concert stand at Marvel Stadium which produced three sellouts, playing to 180,000 fans, reps say.

The rock ‘n’ roll stars have made themselves at home, and made their feeling clear on dodgy ticket resales, which didn’t materialize due to the state of Victoria’s tough anti-touting laws.

Related

Under those rules, tickets can’t be resold for more than 10 per cent above the face value, or face fines from A$908 to A$109,044 for individuals or A$545,220 to A$545,000 for corporations.

The Oasis tour was listed as a “major event,” and with it was protected under the Major Events Act 2009.

As a result, those fans were guarded from paying obscene fees through StubHub or Viagogo, which remains one of live entertainment industry’s mortal enemies.

Oasis has applauded the intervention. “It’s great to see Victoria’s Major Events Declaration doing exactly what it’s meant to — Viagogo can’t list our Melbourne shows — and that’s a huge win for real fans,” reads a statement from the band.

“When government and the live industry work together, we can stop large-scale scalping in its tracks. We’d love to see other states follow Victoria’s lead so fans everywhere get a fair go.”

The Sydney chapter of the Oasis Live ’25 tour begins Friday, Nov. 7 with the first of two back-to-back shows at Accor Stadium, tickets for which are also protected from secondary-market price gouging by New South Wales’ anti-scalping laws. In NSW, it’s an offence to resell a ticket for more than the original retail price, plus transaction costs up to a maximum 10 percent of the original price.

Those laws have “been really successful for the Melbourne show,” a rep for the band’s management tells Billboard.com. “And continues to be a really important thing for the band and team throughout the Live ’25 campaign.”

Scalpers were reportedly forced to try to sell tickets at a loss overseas because they couldn’t sell them in Australia.A limited number of tickets are available for the final Sydney shows, according to Live Nation Australia, which is producing the domestic swing, and fans can still sell tickets at face value on approved platforms, including Tixel, Twickets and Ticketmaster.

Oasis then heads to Argentina, Chile and Brazil, where the global tour wraps up Nov. 23 in São Paulo.

Read Billboard.com’s recap of Oasis’s opening night concert in Melbourne.

Trending on Billboard Bob Dylan’s “The Times They Are A-Changin’” scored New York City mayor-elect Zohran Mamdani’s final advertisement before his election night victory — but the campaign spot has now been removed from X amid a licensing rejection from Universal Music Publishing Group (UMPG). The ad, posted by Mamdani’s various social media accounts just […]

Trending on Billboard

MCA has signed country-rock band 49 Winchester to its Lucille Records imprint. On Friday (Nov. 7), the group will release its first new music since partnering with MCA: a cover of Black Sabbath‘s “Changes,” on which the group collaborated with MCA chief creative officer and Grammy-winning producer Dave Cobb.

49 Winchester is currently in the studio with Cobb, crafting a full-length project slated for release next year. MCA will team up with New West Records on the upcoming album, while all subsequent 49 Winchester releases will be released exclusively through MCA.

Related

With a lineup that includes Bus Shelton, Noah Patrick, Isaac Gibson, Justin Louthian, Tim Hall and Chase Chafin, 49 Winchester got its start in Virginia and has become known for songs including “Russell County Line” and “Everlasting Lover.” The group will headline two shows at Nashville’s Ryman Auditorium on Nov. 14 and 15. In 2023, they were nominated for duo/group of the year at the Americana Honors & Awards ceremony.

“We’re thrilled to be joining the MCA and Lucille family,” Gibson, 49 Winchester’s lead vocalist and guitarist, said in a statement. “Working with Dave Cobb is a dream, and we can’t wait for our fans to hear the new music we’re creating together.”

Chase Chafin, 49 Winchester’s bassist and co-founder, added, “So grateful to the fans and team who helped us build this to where it is today. We couldn’t be more excited for MCA to be the home of future 49 Winchester releases, and to share this next chapter with those who made it possible.“

“We are so excited to have 49 Winchester join Lucille Records,” said Mike Harris, president & CEO of MCA, in a statement. “Their mix of Southern rock is powerful and authentic, and we look forward to supporting them as they continue to evolve.”

“In working with 49 Winchester it felt like they laid it all out on the line,” added Cobb. “The record is pure heart and honesty, a lotta heart, soul and love went into making this album.”

“Watching 49 Winchester’s remarkable growth and success over the past several years has been incredibly rewarding,” said John Allen, president of New West Records. “Their achievements reflect the band’s extraordinary talent and relentless work ethic, as well as the dedication of everyone at New West. Partnering once again with my longtime friend Dave Cobb is always a pleasure, and MCA is the perfect home for 49 Winchester as we work together to reach even greater heights.”

In addition to 49 Winchester, Lucille’s roster includes Lamont Landers. In February, Cobb and Harris were named the new heads of UMG Nashville, which then rebranded as MCA.

Trending on Billboard

10K Projects, the Warner-owned label founded by Elliot Grainge, has been sued for allegedly hoarding millions of dollars owed to Taz Taylor’s Internet Money Records under a joint venture.

Internet Money’s lawsuit stems from its 2019 partnership deal with 10K, which was at that point a fast-growing indie hip-hop label started by Grainge three years earlier. The 31-year-old son of Universal Music Group chairman and CEO Lucian Grainge, Elliot is now a powerful music executive in his own right as CEO of Atlantic Records.

Related

The 2019 joint venture made Grainge’s 10K the exclusive label home for talent developed by Taylor (Danny Snodgrass Jr.) through his Internet Money producer collective, including Nick Mira, JRHITMAKER and KC Supreme. The two companies were supposed to split net profits 50/50, according to the lawsuit.

“Unfortunately, the defendants, in violation of their obligations to plaintiffs, have acted in such a manner that they are the only entities who have benefited from this relationship,” reads the complaint, filed Tuesday (Nov. 4) in Los Angeles federal court.

Internet Money claims 10K has “engaged in a pattern of misconduct, indeed breaching every promise and obligation that was owed to the plaintiffs.” The crux of this alleged misconduct is a series of maneuvers by 10K that allegedly deflated Internet Money’s share of the net profits by at least $4 million.

The lawsuit says 10K has hoarded these profits by improperly cross-collateralizing accounts and overcharging Internet Money for jacked-up expenses, which are categorized as deductions under the joint venture agreement.

Related

Additionally, 10K is accused in the complaint of diluting Internet Money’s cut from the collective’s hit Gunna collaboration “Lemonade,” which peaked at No. 6 on the Billboard Hot 100 in 2020. Internet Money also claims 10K has failed to share money made from the singer iann dior and withheld publishing royalties linked to various artists.

“As a direct and proximate result of the breaches, Internet Money Records has been denied millions of dollars in net profits to which it is entitled and continues to suffer ongoing damages due to 10K’s intentional misreporting and bad-faith conduct,” writes Internet Money’s lawyer, Sarah Matz.

The lawsuit brings a slew of civil claims, including breach of contract, breach of fiduciary duty and fraudulent inducement. Internet Money is seeking monetary damages and a court order requiring Warner Music Group (WMG), which acquired a controlling stake in Grainge’s label in 2023, to provide it with 10K’s financial statements for an audit.

Reps for 10K did not immediately return a request for comment on Wednesday (Nov. 5). The label has been run under the Atlantic Records umbrella since 2024, when Grainge was named CEO of the storied WMG operation.

State Champ Radio

State Champ Radio