Business

Page: 148

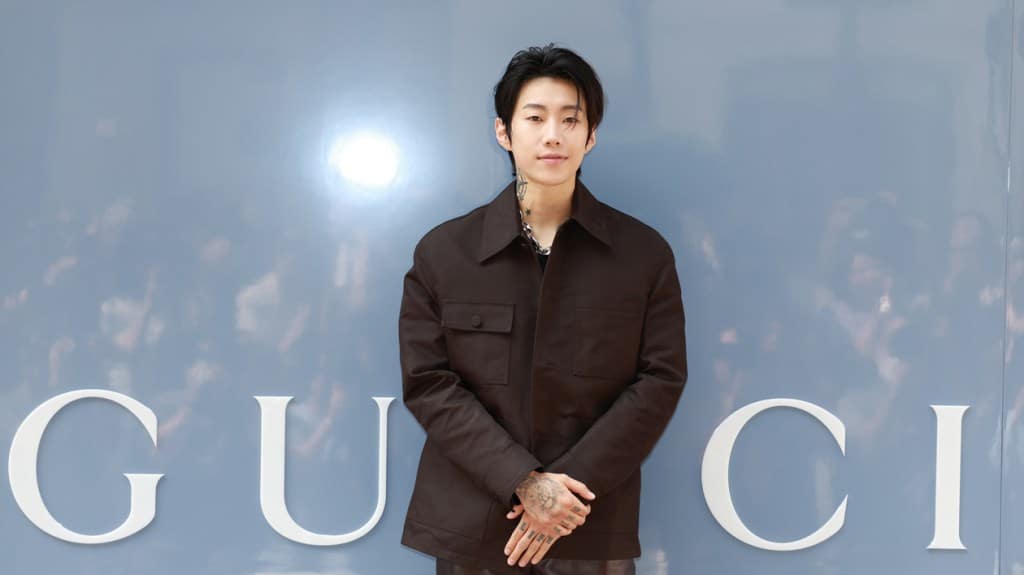

K-hip-hop star Jay Park is asking a U.S. court to force Google to unmask an anonymous YouTube user so he can sue in Korean court, citing allegedly defamatory internet videos linking him to drug traffickers and disparaging Korean-Americans.

Attorneys for the American-born Park say a YouTube account transliterated as Bburingsamuso has subjected the artist to a “malicious” campaign of videos, including one claiming he works with Chinese mobsters to import drugs and another suggesting Korean-Americans like Park “exploit” the country with illegal activities.

Park’s lawyers have already filed a defamation lawsuit in Korea, but in a petition filed Thursday (Jan. 9) in California federal court, they say that the foreign lawsuit “cannot proceed” without a U.S. subpoena forcing Google to hand over the user’s identity.

Trending on Billboard

“The defamatory statements falsely accuse Jay Park of being involved with organized crime, drug trafficking, and unethical conduct, all of which have caused significant harm to his reputation and professional endeavors,” the singer’s attorneys write. “Despite extensive efforts to identify the anonymous YouTuber through publicly available information, Jay Park has been unsuccessful to date. Consequently, Jay Park now seeks the assistance of this court.”

Google could legally object to such a request, including by potentially arguing that the subpoena would violate the First Amendment and its protections for anonymous speech. But Park’s attorneys say the U.S. Constitution simply doesn’t apply since they “strongly” believe the poster lives in Korea.

“Jay Park is not attempting to infringe on the anonymous YouTuber’s First Amendment rights because the anonymous YouTuber appears to be a citizen of Southern Korea,” the filing says. Park’s lawyers cite an earlier precedent that says U.S. legal protection for free speech “doesn’t reflect a U.S. policy of protecting free speech around the world.”

As K-pop and other Korean music have exploded in global popularity over the past decade — and with it an intensely enthusiastic online fan culture — numerous stars have turned to Korea’s strict defamation laws to fight back against what they say are false statements about them on the internet.

In 2019, HYBE (then Big Hit Entertainment) filed criminal cases alleging “personal attacks” on the superstar band BTS. In 2022, Big Hit did so again over “malicious postings” about BTS, even asking the group’s famous fan “army” to help gather evidence. YG Entertainment, the label behind BLACKPINK, has also filed its own complaint against “internet trolls,” accusing them of “spreading groundless rumours about our singers.”

It’s also not the first time such litigants have turned to the U.S. courts to help. In March, the K-pop group NewJeans filed a similar petition in California federal court, seeking to unmask a YouTube user so that the band could press for criminal charges in Korea over “derogatory” videos.

In that case — filed by the same lawyer who represents Park in his case filed this week — a judge eventually granted the subpoena. But it’s unclear from court records the extent to which Google has complied with it.

A Google spokesman did not respond to a request for comment on Park’s petition. But in a policy statement regarding government requests for personal information, the company says: “Google carefully reviews each request to make sure it satisfies applicable laws. If a request asks for too much information, we try to narrow it, and in some cases we object to producing any information at all.”

First, the elephant in the room. Justin Trudeau resigned as Prime Minister after a decade as leader of the country. He’ll stay on until a leadership race elects the new head of his Liberal Party on March 9. What could this period of transition mean for Canada’s music industry and arts funding? Read more:

Meanwhile…

Warner Music Group has formed another strategic partnership to elevate and develop Punjabi music in Canada.

ADA, the company’s independent label and artist services arm, announced a worldwide distribution deal with EYP Creations INC. EYP is a major management and content company in Punjabi music and is based in both Canada and India.

Trending on Billboard

Canada has emerged as a global hub for Punjabi music, which is one of the fastest growing global genres. Artists including Karan Aujla, Shubh and Diljit Dosanjh have achieved chart success and set records in the country.

Warner has been on the forefront of the Punjabi Wave, uniting Warner Music Canada and Warner Music India to launch 91 North Records in 2023. But this partnership with EYP also aims to foster the next wave of talent so that they can eventually achieve the same heights.

The new deal includes EYP’s record label, UrDebut Canada, which has helped launch new artists like Kushagra and Tanishqa, who have had songs with millions of streams in the last year. The goal, they say, is to open emerging artists to a similarly broad and growing audience of hungry international fans.

“This partnership with EYP Creations marks a strategic step in expanding WMG’s presence within the Punjabi music landscape,” says Warner Music Canada president Kristen Burke in a statement. “This alliance not only supports the growth of Punjabi music in Canada, but also opens doors for discovering and nurturing emerging talent in this vibrant community.”

EYP Creations CEO Nikhil Dwivedi says he’s excited about the potential of working with ADA and talks about the quality distribution and marketing it can open to South Asian artists in Canada.

“We are focused on nurturing young South Asian talent together through launching them at UrDebut Canada label and building them through distribution, management, live events and collaborations around the globe,” he says.

ADA has also partnered with other Punjabi music companies in recent years, including Punjabi music content aggregator, Sky Digital, and Punjabi record label, Geet MP3.

“We’re excited to bring this Punjabi music leader into the Warner Music Group family,” says Cat Kreidich, President of ADA. “Our team is looking forward to partnering closely with Nikhil and everyone at EYP Creations to mine new opportunities in the market and bring new voices into the mix.” -Richard Trapunski

≈

East Coast Music Association Parts Ways With CEO

On Monday (Jan. 6), the East Coast Music Association (ECMA) issued a press release stating that “the board has conducted a thorough review of our leadership and operations, leading to the decision to part ways with CEO Blanche Israël.” The change has been made ahead of the East Coast Music Awards show in St. John’s, Newfoundland this spring.

The Canadian Press reports on the “clash over the future of the East Coast Music Awards” that led to the decision. In an online petition launched late 2024, some members called for “transparency and stability” amid changes that affected the awards and its associated festival, citing a lack of clarity and consultation around applications and other “significant modifications.” Former ECMA CEO Andy McLean has been installed as interim managing director as the search for a new CEO begins.

ECMA’s stated mission is “to develop, advance and celebrate East Coast Canadian music, its artists and its industry professionals throughout the region and around the world. We advocate for our members to ensure they can sustain music careers while based in Canada’s Atlantic region.”

This year’s ECMA awards honoured folk-rockers The East Pointers with the most awards, followed by Jenn Grant, Morgan Toney, and Tim Baker. –Kerry Doole

≈

Lady Gaga And Bruno Mars Score The First Post-Holiday No. 1 On The Canadian Hot 100 in 2025

Lady Gaga and Bruno Mars have plenty to smile about this week.

The superstar duo have landed the first post-holiday No. 1 song of 2025, topping the Billboard Canadian Hot 100 “Die With a Smile.” The sentimental ballad has had a slow burn to the top, hitting No. 1 in its 20th week on the chart, though it’s been a mainstay on the Global 200. The song also climbed to the top of the U.S. Billboard Hot 100 for the first time this week.

Bruno Mars holds both the No. 1 and No. 2 spot this week on the Canadian Hot 100, with his Rosé collab “Apt.” at No. 2. Shaboozey’s record-breaker “A Bar Song (Tipsy)” is also back in the top 3, holding the third spot.

There’s also a pair of first-timers making their chart debuts. U.K. singer Chrystal arrives with “The Days” at No. 95. The minimalist dance track got a boost from a high-energy remix by rising Bristol producer Notion, as well as a feature on the popular TikTok account Jaxon’s Journey.

American psych-pop singer Chezile lands on the chart at No. 98 with the melancholic “Beanie,” a psych-pop song with hints of Mac DeMarco that has become a popular cover choice on TikTok. Chezile also had a bump from popular content creator Mr. Beast using the song to soundtrack his proposal announcement.

Claiming the final spot on the chart is Imogen Heap’s “Headlock.” She’s not a first-timer but the acclaimed singer-songwriter is getting some love for her 2005 track, which is also seeing a lot of traction on TikTok.

None of those songs are on the U.S. Hot 100 this week, in keeping with a trend of viral TikTok tracks showing up on the Canadian charts first. Heading into 2025, it looks like the app is still one of the leading career-boosters out there, though it is facing potential existential threats on both sides of the border. –Rosie Long Decter

Dust off that old Pioneer or Thorens — there’s a guy below who can set it up for you — and check out the year’s first edition of Executive Turntable, Billboard’s compendium of promotions, hirings, exits and firings — and all things in between — across the music business.

There’s a full slate of personnel news this week, which of course has been dominated by the devastating fires across Los Angeles. We have a running list of organizations offering relief for musicians and music industry professionals, plus a tally of affected industry events. More coverage on the wildfires can be found here.

Sphere Entertainment appointed Robert Langer as executive vice president, chief financial officer and treasurer, effective Jan. 13. Langer, with over 30 years of experience, will work closely with the management team to support the company’s long-term direction, providing strategic financial insights and overseeing financial matters, strategy and business development. He will be based in Burbank and report to CEO James L. Dolan. Langer arrives from The Walt Disney Company, where he most recently served as head of corporate strategy and financial planning. During his 25-year tenure at Disney, he held various financial leadership roles, including CFO of Disney ABC Television Group and Disney Consumer Products. He also has significant global experience, having served as country manager for Germany, Switzerland and Austria. Dolan expressed confidence in Langer, saying the UCLA grad’s “multifaceted finance and strategy experience across the media and entertainment industry, both domestic and international, will be an asset as we continue to pursue our long-term goals and advance key initiatives.”

Trending on Billboard

Live Nation appointed Milly Olykan as senior vp of artist development and global touring, starting in January. Reporting to Omar Al-Joulani, president of touring, Olykan will spearhead the global expansion of Live Nation’s Country and Americana strategy. In this capacity, she’ll work with promoters worldwide to identify new touring opportunities, strengthen artist relationships and drive growth in the international country music market. Olykan arrives from the Country Music Association (CMA), where since 2018 she served as vp of international relations and development, and also as interim festival director. At CMA, she expanded the international strategy, built industry networks and increased global awareness of country music. Previously, Olykan was Vice President of Live Music and Major Arena Events at AEG Presents in the UK, co-founding the Country to Country (C2C) festival and establishing country touring for AEG Presents. Al-Joulani praised Olykan’s experience and connections across the wide worlds of country and Americana, saying they “make her a great asset to support our efforts in continuing to expand touring of those genres worldwide.”

Patrick Donnelly, longtime executive vp, general counsel and secretary of SiriusXM, has telegraphed a slow-burn retirement after 27 years. According to a filing with the SEC, Donnelly’s employment agreement was allowed to expire earlier this month, however, he will remain a full-time employee until April 4. Afterward, he’ll transition to a part-time role through the last day of the year, assisting with the handover of his responsibilities. During the full-time period, Donnelly will maintain his current salary of $1,025,000 while continuing in his existing roles until a successor is appointed. Afterward, he’ll transition to an advisory role for the new GC. In the part-time stretch, he’ll provide continued support, with compensation including a pro-rated 2025 bonus and part-time salary of $615,000 through years-end. He joined the company in May 1998 following stints at ITT Corporation and Simpson Thacher & Bartlett.

Warner Music Belgium hired Youssef Chellak as the label’s new general manager, effective immediately. Based in Brussels, Chellak will report to Niels Walboomers, president of recorded music and publishing for WMG Benelux. His role focuses on expanding Warner Music Belgium’s domestic roster, fostering innovative collaborations and driving cultural curiosity within the team. Chellak brings over 20 years of experience in the music industry, having started around 2000 as a producer, executive producer and publisher, collaborating with artists across Belgium, France, and Germany. In 2018, he became GM of Top Notch Belgium, where he developed artists like Dikke and Stikstof. Most recently, he served as A&R director at Universal Music Belgium, nurturing talents such as Aaron Blommaert and Berre. Chellak expressed enthusiasm for Warner Music’s entrepreneurial culture and commitment to supporting Belgian artists. Walboomers praised Chellak’s “proven track record, culturally curious approach and inspiring vision for the local music industry” for making him ideal for the role. “I’m confident that he’ll create an inspiring environment where local artists, emerging as the voices of their generation, can collaborate, excel and reach their full creative potential,” he said.

iHeartMedia elevated Nicky Sparrow to executive vp of multicultural sales and Dee Dee Faison to vp of multicultural partnerships and alliances, effective immediately. Both report to Tony Coles, president of multicultural business and development. Sparrow will use iHeart’s radio, podcast and events assets to drive results for advertising partners while focusing on The Black Effect and My Cultura Podcast Networks. With a 25-year tenure at iHeartMedia, she previously served as svp of multicultural sales and is active in philanthropy. Faison, with 24 years in media and entertainment, will expand iHeartMedia’s multicultural initiatives, having joined the radio giant in 2020 as director of client success and has worked with major clients such as Toyota and McDonald’s. “These talented leaders bring a wealth of experience and a fresh perspective that will be instrumental in driving our mission forward of connecting our clients and partners with iHeartMedia’s multicultural audiences,” said Coles.

Jody Gerson // John Michael Fulton

BOARD SHORTS: Project Healthy Minds, a mental health tech non-profit, named UMPG chairman and CEO Jody Gerson to its board of directors. As the first woman to lead a global music company, Gerson aims to forge pacts within the music and entertainment industries to enhance access to mental health resources. “Anxiety and other mental health issues often walk hand-in-hand with artistry, and it’s my responsibility to let the creative people I work with know that they don’t have to deal with these issues on their own,” Gerson said. “In turn, artists can help to publicly dispel the notion that surviving in an often lonely and isolating world is just a matter of toughening up. Life is not easy, and seeking care for good mental health needs to be both destigmatized and encouraged.” Gerson joins a board that includes Carson Daly, Lisa Licht, Kalen Jackson and Sally Yates, among others … The Copyright Alliance added two new board members on Jan. 1: Alicia Calzada from the National Press Photographers Association and Jessica Richard from the Recording Industry Association of America. Both will serve two-year terms … Brian Magerkurth has been appointed chairman of the board for SongwritingWith:Soldiers. A board member for the past four years, Magerkurth succeeds Gary Leopold, who has served as chairman since 2018. Leopold will remain actively involved with the organization as a director.

Ben Sharman is the new director of booking at Co-op Live, Oak View Group’s much-hyped arena in Manchester, England. Sharman brings over a decade of experience in the live events industry, having managed British Athletics’ commercial partners for the London 2012 Olympics and secured major sponsorships for Aston Villa Football Club. He joined the NEC Group in 2014, transitioned to arena programming in 2017, and was promoted to head of programming for Utilita Arena Birmingham and bp pulse LIVE in 2022. Gary Hutchinson, executive vp of Oak View Group International, praised Sharman’s expertise and industry relationships, expressing confidence in his ability to elevate the venue as a premier destination. In 2025, Co-op Live will host global talents such as Sabrina Carpenter, Tyler, the Creator, Bruce Springsteen, Lionel Richie and Hans Zimmer. OVG also announced that Katie Musham, Co-op Live’s director of strategic programming, will be moving to its international unit to aid their expansion efforts across Europe and beyond.

TuneCore, the Believe-owned digital music distributor, named Mike Ceglio as vp of operations strategy. Reporting to CEO Andreea Gleeson, Ceglio will oversee a wide swath of business operations, including the content review, trust/safety and copyright teams, while collaborating with the product team to enhance operational processes. Ceglio brings over a decade of experience in digital operations and rights management. Before joining TuneCore, he served as vp of creator operations at SoundCloud, where he managed creator services, among other duties. He has also held leadership roles at UnitedMasters and Vydia. Gleeson praised Ceglio’s industry insight and ability to build high-performing teams. “His leadership will enable us to be even more proactive in working alongside DSPs, tackling new industry challenges and streamlining workflows to create a smoother, more efficient experience for both DSPs and artists,” she said. “By deepening these partnerships, Mike will further enhance TuneCore’s position as a trusted partner that continuously delivers operational excellence in the evolving digital music landscape.”

AEG Presents named Weston Hebert as vp of global touring, reporting to Rich Schaefer, the president of global touring. Based in Nashville, Hebert will lead global touring strategies and initiatives. Hebert previously worked as a talent buyer at Live Nation, managing bookings for venues in the Great Lakes region and promoting tours for emerging artists like The Red Clay Strays and Gavin Adcock. He began his career at WME Nashville, where he focused on expanding the country touring business internationally. Hebert praised the global team’s “exceptional sense of collaboration & community with the artists, managers & agents they work with,” while Schaefer highlighted Hebert’s “strong relationships with artists, managers, and agents, as well as his exceptional taste in music.”

Across the pond, Emma Bownes was promoted to senior vp of venue programming at AEG Europe, where she’ll lead programming strategy for prominent venues, including The O2 in London, Barclays Arena in Hamburg and Berlin’s Uber Arena. Bownes, a 25-year veteran of the live business, joined AEG in 2010 and has played a pivotal role in building successful event calendars. “At AEG, our vision is to be the best-in-class live entertainment business and Emma’s work is fundamental to this,” said John Langford, chief operating officer at the AEG subsidiary. The live giant also announced other team promotions: Jo Peplow-Revell as director of corporate and special events and Marc Saunders as head of programming at The O2, both reporting to senior programming director Christian D’Acuna.

Jose Nova // Complex

Jose Nova is the new head of Latin at Complex, where he will oversee music, content strategy and artist collaborations to help the brand drive growth in the Latin music space. Previously, Nova was global Latin industry relations lead at Amazon Music, spearheading campaigns for top Latin artists like Bad Bunny and Karol G. His work, which scaled major tours, live-streaming events and marketing campaigns, got Nova recognized on Billboard’s 2023 Latin Power Players list. Nova’s career also includes roles at Spotify and Interscope, where he curated strategies for U.S. Hispanic and Latin American audiences. “I’ve always regarded Complex as a brand that pushes boundaries and redefines culture, creativity, and storytelling,” he said. “After discussing our shared vision with (Complex CEO) Aaron Levant and the team, it became clear how aligned we are in driving meaningful impact for Latin audiences, artists, and creators.”

NASHVILLE NOTES: Brown Sellers Brown, which includes Quartz Hill Records, Stone Country Records and BSB Management, hired Ash Bowers as director of artist management and A&R support, where he will also lead management strategy for BSB artists including Ben Gallaher and Spencer Hatcher. Wendy Buckner joins as day-to-day manager for artists including Gallaher and Hatcher, while Abby Driscoll joins as day-to-day manager for artist Annie Bosko. Angela Wheeler has been promoted to director of content and creative … Universal Attractions Agency added booking agent Ryan Slone to its rock & pop division, led by Matt Rafal. Slone brings to UAA artists including Danielle Nicole, dada, 7Horse, LOVE with Johnny Echols, Talking Dreads, Scott Mulvahill, Black Circle, and Monkeys on a String. Slone’s previous career stops include Bonfire Touring, Ovation Artist Group and New Frontier Touring. —Jessica Nicholson

EastCoast Entertainment promoted Brad Strouse to managing partner, recognizing his contributions since joining the full-service agency in 2016. Strouse, who began his career in Nashville specializing in artist booking, touring and live event production, previously served as location managing director for ECE’s Richmond and DC offices. He has played pivotal role in expanding the company’s National division, overseeing large-scale productions and booking acts like Darius Rucker, Trace Adkins and Sister Hazel at venues including Levi’s Stadium and the Rock & Roll Hall of Fame. ECE President John Wolfslayer commended Strouse’s leadership, integrity and dedication to artists, adding he has “qualities of a true role model for the next generation, with his unwavering integrity, tireless work ethic, and deep commitment to our community of artists.”

Music finance firm Sound Royalties promoted Allison Portlock to executive vp of marketing and Bryan Field to director of royalty analysis. Portlock, who has been with Sound Royalties since 2018, most recently as vp of marketing, is based in West Palm Beach, Fla. and reports to Michael Bizenov and Alex Heiche. As a key executive team member, she oversees marketing, business development and customer experience, while also guiding company strategies and expanding the brand into new markets. She focuses on long-term customer relationships and leads the marketing team’s growth. Fried joined SR in 2014 and was most recently the senior royalty analyst. Based in WPB and reporting to Barbara Ocasio, he manages the royalty analyst team, performs in-depth analysis of royalty earnings, identifies risks and produces projections.

Believe beefed up its UK team with the appointments of Paul Trueman as director of artist services and Joe Edwards as head of marketing. Trueman, formerly COO at un:hurd music and GM at AWAL, brings extensive expertise in marketing, promotions and audience development. At Believe, he’ll lead A&R, new business, commercial strategy and global marketing campaigns, reporting to UK managing director Alex Kennedy. Edwards, previously senior director of marketing at AWAL, has worked marketing strategies and award-winning campaigns for artists such as Jungle, Djo and Bombay Bicycle Club, and will now report to Trueman.

Brad Parscale, the digital director for Donald Trump’s winning 2016 campaign who later had a lengthy stint as campaign manager in 2020, is the new chief strategy officer of Christian conservative media company Salem Media Group. SMG recently stuck a fork in its music ambitions by selling off its seven remaining Contemporary Christian-formatted radio stations to the Educational Media Foundation (EMF) for $80 million.

Acoustic Sounds reappointed turntable specialist Chad Stelly to their team. Stelly, who initially joined Acoustic Sounds in 2005, is feted for his expertise in HiFi equipment sales and turntable setup. After leaving in 2019, he worked at Musical Surroundings, providing dealer training and supporting phono cartridges, preamps and turntables, as well as contributing to product development. Later, he joined Bluebird Music, focusing on SME support and repair. Acoustic Sounds, founded by Chad Kassem and based in Salina, Kansas, is home to Quality Record Pressings, its in-house record pressing plant, and Analogue Productions, its vinyl reissue label. The company also operates an original production label, APO Records, along with Acoustic Sounds Printing, its dedicated print shop. Additionally, Acoustic Sounds boasts Blue Heaven Studios and The Mastering Lab, specializing in recordings and LP mastering.

Emerald City Music, a Seattle-based chamber music series, appointed Sean Campbell as its new executive director, effective Feb. 3. Campbell, formerly the artistic planning manager at the Chamber Music Society of Lincoln Center, will work alongside ECM’s founding artistic director, Kristin Lee. His responsibilities include providing administrative leadership, supporting the board of directors, developing engagement events and educational programs, fostering partnerships with community organizations and local businesses, serving as a community ambassador, and creating a strategic plan for ECM. Campbell aims to enhance ECM’s innovative programming for audiences in the Pacific Northwest and beyond.

ICYMI:

Derek Chang

Lyndsay Cruz left her post as executive director of ACM’s philanthropic arm … Liberty Media named Derek Chang as its new president and CEO … Kobalt tapped Rani Hancock to be its new executive vp and head of U.S. creative … Wasserman Music scooped up Kevin Shivers, James Rubin and Cristina Baxter — plus the artists they represent — from rival agency WME … Lauren Davis was promoted at NYU’s Clive Davis Institute … SALXCO named a new CEO and co-presidents.

Last Week’s Turntable: Warner Records’ New Head of International Marketing

LONDON — The British government has launched a public consultation into the ticketing industry, including the heavily criticized use of dynamic pricing for popular tours, as part of wider efforts to stop music fans from “being fleeced” by “greedy ticket touts.”

The 12-week consultation was announced by the Department for Business and Trade and Department for Culture, Media and Sport on Friday (Jan. 10). It sets out a range of measures to transform the U.K.’s secondary ticket market, including a proposed cap on the price of ticket resales and new legal regulations for ticket platforms around transparency and the accuracy of information they provide to fans.

“From sports tournaments to Taylor Swift, all too often big events have been dogged by consumers being taken advantage of by ticket touts,” said business secretary Jonathan Reynolds in a statement. “These unfair practices look to fleece people of their hard-earned income, which isn’t fair on fans, venues and artists.”

Trending on Billboard

Government ministers are additionally reviewing pricing practices across the entire live events business, including the use of dynamic pricing by primary vendors whereby prices surge based on demand.

The use of dynamic pricing for concert tickets came to the fore in the U.K. in September when it was used on the U.K. and Ireland legs of Oasis’ Live ‘25 reunion tour, prompting hundreds of complaints from fans after tickets unexpectedly soared from around £150.00 ($200) for standard admission to £355.00 ($470) without prior warning.

The angry consumer backlash was accompanied by fierce condemnation from British politicians, including the Prime Minister, Sir Keir Starmer, and culture secretary, Lisa Nandy, who called the “vastly inflated” prices “depressing to see.”

Soon after, the U.K. competition regulator launched an investigation into Ticketmaster examining whether the Live Nation-owned company broke consumer protection laws and engaged in “unfair commercial practices” by failing to notify ticket buyers in advance about the price rises. Ticketmaster has consistently stated that ticket prices are set by the artist team and event organisers, not itself.

Starmer had previously vowed to cap resale prices on secondary ticketing platforms, such as Viagogo and StubHub, in the run up to July’s election win.

According to the Competition and Market Authority (CMA), around 1.9 million tickets were sold through secondary platforms to British consumers in 2019, accounting for between 5% and 6% of all tickets sold that year. Tickets sold on secondary sites are typically priced more than 50% higher than their face value, reports CMA, which estimated the U.K. secondary ticketing market to have been worth around £350 million ($430 million) a year pre-pandemic.

“For too long fans have had to endure the misery of touts hoovering up tickets for resale at vastly inflated prices,” said Nandy announcing the three-month-long consultation, which closes April 4.

The government said it was seeking views from live industry stakeholders and music fans on a number of proposed measures designed to make ticket resales fairer and more transparent.

They include capping the price of resale tickets at up to 30% above face value and banning resellers from listing more tickets than they can legally buy on the primary market. These measures would disincentivise industrial scale touting, said the government.

Ministers are also proposing to pass tougher regulations for ticket resale companies and issue tougher fines for offenders. At present, the maximum fine that can be issued by Trading Standards against companies that breach ticketing sale rules is £5,000 ($6,100). The consultation will investigate whether this cap should be increased.

The primary ticketing market is also under scrutiny with ministers calling for evidence on whether fans are protected from “unfair practices,” including the use of new technologies and dynamic pricing.

Rocio Concha, director of policy and advocacy at consumer protection organization Which?, said the government must use the consultation “to regulate the industry properly, ensure ticket resales don’t exploit fans and decide when the use of dynamic pricing is unfair and shouldn’t be allowed.”

As in other countries, the practice of dynamic pricing is commonly used in the U.K. by travel companies, taxis and hotels, but it has only been fleetingly used in the British touring market with Oasis’ comeback tour – which is being jointly promoted by Live Nation, SJM Concerts, MCD and DF Concerts – marking its most high-profile roll out for live music concerts in the United Kingdom and Ireland so far.

The British government’s probe of the ticketing business is the latest attempt by authorities to tackle the persistent issue of large-scale ticketing touting in the U.K.

In 2021, watchdog the Competition and Markets Authority (CMA) concluded its long-running investigation into secondary ticketing platforms by making a series of recommendations to government on how to fix the sector. Those recommendations were rejected by the then Conservative government, but now form the basis of the Labour Party’s proposals.

There has also been a number of investigations by the Advertising Standards Authority (ASA) into secondary sites, with a particular focus on Viagogo.

When reached for comment, a Viagogo spokesperson insisted the company will “continue to constructively engage with the Government and look forward to responding in full to the consultation and call for evidence on improving consumer protections in the ticketing market.”

Responding to the public consultation, a spokesperson for Ticketmaster U.K. said the company was “committed to making ticketing simple and transparent” and supported plans to introduce an industry-wide resale price cap.

“We also urge the government to crack down on bots and ban speculative ticket sales,” said the U.K. arm of Ticketmaster, which has capped resale prices to face value on its platform since 2018. StubHub did not respond to a request to comment.

Adam Webb from U.K. campaign group FanFair Alliance called the government’s proposed measures “potentially game-changing” and highlighted the success of other countries, including Ireland, in passing legislation that has effectively banned ticket scalping. “The U.K. simply needs to follow their example,” said Webb.

As the devastation from the wildfires in Los Angeles continues to unfold, the Recording Academy and MusiCares have launched the Los Angeles Fire Relief Effort to support music professionals impacted by the crisis, making a combined pledge of $1 million to kick off the efforts. “The entire Grammy family is shocked and deeply saddened by […]

In one of the most important cases of the social media age, free speech and national security collide at the Supreme Court on Friday in arguments over the fate of TikTok, a wildly popular digital platform that roughly half the people in the United States use for entertainment and information.

TikTok says it plans to shut down the social media site in the U.S. by Jan. 19 unless the Supreme Court strikes down or otherwise delays the effective date of a law aimed at forcing TikTok’s sale by its Chinese parent company.

Working on a tight deadline, the justices also have before them a plea from President-elect Donald Trump, who has dropped his earlier support for a ban, to give him and his new administration time to reach a “political resolution” and avoid deciding the case. It’s unclear if the court will take the Republican president-elect’s views — a highly unusual attempt to influence a case — into account.

Trending on Billboard

TikTok and China-based ByteDance, as well as content creators and users, argue the law is a dramatic violation of the Constitution’s free speech guarantee.

“Rarely if ever has the court confronted a free-speech case that matters to so many people,” lawyers for the users and content creators wrote. Content creators are anxiously awaiting a decision that could upend their livelihoods and are eyeing other platforms.

The case represents another example of the court being asked to rule about a medium with which the justices have acknowledged they have little familiarity or expertise, though they often weigh in on meaty issues involving restrictions on speech.

The Biden administration, defending the law that President Joe Biden signed in April after it was approved by wide bipartisan majorities in Congress, contends that “no one can seriously dispute that (China’s) control of TikTok through ByteDance represents a grave threat to national security.”

Officials say Chinese authorities can compel ByteDance to hand over information on TikTok’s U.S. patrons or use the platform to spread or suppress information.

But the government “concedes that it has no evidence China has ever attempted to do so,” TikTok told the justices, adding that limits on speech should not be sustained when they stem from fears that are predicated on future risks.

In December, a panel of three appellate judges, two appointed by Republicans and one by a Democrat, unanimously upheld the law and rejected the First Amendment speech claims.

Adding to the tension, the court is hearing arguments just nine days before the law is supposed to take effect and 10 days before a new administration takes office.

In language typically seen in a campaign ad rather than a legal brief, lawyers for Trump have called on the court to temporarily prevent the TikTok ban from going into effect but refrain from a definitive resolution.

“President Trump alone possesses the consummate dealmaking expertise, the electoral mandate, and the political will to negotiate a resolution to save the platform while addressing the national security concerns expressed by the Government — concerns which President Trump himself has acknowledged,” D. John Sauer, Trump’s choice to be his administration’s top Supreme Court lawyer, wrote in a legal brief filed with the court.

Trump took no position on the underlying merits of the case, Sauer wrote. Trump’s campaign team used TikTok to connect with younger voters, especially male voters, and Trump met with TikTok CEO Shou Zi Chew at Trump’s Mar-a-Lago club in Palm Beach, Florida, in December. He has 14.7 million followers on TikTok.

The justices have set aside two hours for arguments, and the session likely will extend well beyond that. Three highly experienced Supreme Court lawyers will be making arguments. Solicitor General Elizabeth Prelogar will present the Biden administration’s defense of the law, while Trump’s solicitor general in his first administration, Noel Francisco, will argue on behalf of TikTok and ByteDance. Stanford Law professor Jeffrey Fisher, representing content creators and users, will be making his 50th high court argument.

If the law takes effect, Trump’s Justice Department will be charged with enforcing it. Lawyers for TikTok and ByteDance have argued that the new administration could seek to mitigate the law’s most severe consequences.

But they also said that a shutdown of just a month would cause TikTok to lose about one-third of its daily users in the U.S. and significant advertising revenue.

As it weighs the case, the court will have to decide what level of review it applies to the law. Under the most searching review, strict scrutiny, laws almost always fail. But two judges on the appellate court that upheld the law said it would be the rare exception that could withstand strict scrutiny.

TikTok, the app’s users and many briefs supporting them urge the court to apply strict scrutiny to strike down the law.

But the Democratic administration and some of its supporters cite restrictions on foreign ownership of radio stations and other sectors of the economy to justify the effort to counter Chinese influence in the TikTok ban.

A decision could come within days.

This story was originally published by The Associated Press.

Songwriters Jessi Alexander, Amy Allen, Jessie Jo Dillon and RAYE will not be attending or performing at Spotify’s Songwriter of the Year Grammy party slated for Jan. 28, with Allen and Dillon citing Spotify’s treatment of songwriters as the reason for their absence. As a result, four out of five nominees in the Songwriter of the Year category at this year’s Grammys will be opting out of the event. (A representative for the fifth, Edgar Barrera, has not responded to Billboard‘s request for comment.)

Representatives for Allen (“Espresso” by Sabrina Carpenter, “Adore You” by Harry Styles and “greedy” by Tate McRae) and Dillon (“10,000 Hours” by Dan + Shay, “Lies Lies Lies” by Morgan Wallen and “Am I Okay?” by Megan Moroney) confirmed to Billboard that they both made the decision not to attend due to Spotify cutting royalty rates on premium streams for songwriters and publishers in April of last year, which Billboard estimated will lead to a $150 million decrease in royalties over 12 months compared to how much they would have made had the royalty rate not been reconfigured.

Trending on Billboard

Spotify believes it qualifies for a lower mechanical royalty rate for songwriters and publishers because it has added audiobooks to its premium subscription tiers and reclassified those services as “bundles,” with multiple services included in one price. Now, the royalty originally intended for songwriters and publishers alone is split between paying for music and audiobooks.

“After some thought, I couldn’t in good conscience support this initiative given their approach to bundling royalties,” said Dillon in a statement to Billboard. “It is very nice to be individually honored, but it is better for me and my entire songwriter community to be paid fairly for our art. There are no songs without songwriters.”

A representative for RAYE (“Escapism.” by RAYE, “Dancing With a Stranger” by Sam Smith & Normani, “Secrets” by One Republic) says the singer/songwriter never committed to attending or performing at this event, so “there’s nothing for her to back out of at present,” but adds that RAYE has been “an outspoken advocate on behalf of songwriters’ rights igniting an industry-wide dialogue on the topic.” A representative for Alexander (“Ain’t No Love in Oklahoma” by Luke Combs, “The Climb” by Miley Cyrus, “You, Me and Whiskey” by Justin Moore & Priscilla Block) confirmed to Billboard that she will not be attending the event but did not provide a reason for dropping out.

A representative for Spotify declined Billboard’s request for comment.

Spotify started its Songwriter of the Year Grammy event to celebrate the nominees for the prestigious writing award, which the Recording Academy established in 2023. Each Songwriter of the Year nominee has been invited to take the stage at Spotify party and sing the songs they wrote for other artists in a room full of their peers.

Other songwriters have taken to social media to express their dismay about Spotify’s upcoming event after receiving Save the Dates from the streamer. Songwriter Ross Golan said, via an Instagram Story, “If you are a songwriter, you cannot go to this. Do not let Spotify f— you on bundling and then give you free booze.” A 2023 Grammy Songwriter of the Year nominee Laura Veltz said in her own Instagram Story, “Spotify is robbing you. Songwriters: do not fall for this horse s—.”

In April 2024, Spotify officially added audiobooks as an offering to its premium tiers (which include premium, family and duo plans). By adding audiobooks, the streaming service claimed it now qualifies to pay a discounted so-called “bundle” rate to songwriters for premium, duo and family tier streams.

At the time, a Spotify representative said that “changes in our product portfolio mean that we are paying out in different ways based on terms agreed to by both streaming services and publishers” and called its decision to reclassify premium tiers as bundles as “consistent” with “multiple [other] DSPs.” Other competitors like Apple Music and Amazon Music do have bundled offerings — including Amazon bundling Prime and Amazon Music and Apple bundling Apple Music and Apple News — but Spotify’s move to make its popular premium tiers into bundles has a much larger impact than its competitors, given that Spotify is the most popular streaming service in the U.S. and the premium tiers are a widely used offering.

“Spotify is on track to pay publishers and societies more in 2024 than in 2023,” the Spotify representative added at the time, citing the company’s Loud and Clear report that says the streamer has paid nearly $4 billion to publishers, PROs and collection societies in the last two years.

The National Music Publishers Association (NMPA), The Mechanical Licensing Collective (MLC), and various songwriters did not take the news lightly. The MLC filed a lawsuit against Spotify in May, claiming the streamer “improperly” classified its premium tiers as bundles. The NMPA’s CEO/president David Israelite said Spotify had “declare[d] war” on songwriters and launched a multi-faceted attack that included sending a cease-and-desist for unlicensed lyrics, video and podcast content; unveiling a legislative proposal; and filing complaints with the FTC and nine other consumer trade groups.

Israelite has also voiced his disapproval over Spotify’s Songwriter of the Year party, saying in an Instagram post: “Is this a joke? Spotify declares war on songwriters. Is attempting to gut what they pay them. Is being sued by the MLC. And they think they can throw a party honoring songwriters? I’m at a loss for words. Actually, I’m not. Hubris. Audacity. Crassness. Hypocritical. Cynical. Forward this and add your own word.”

Megan Thee Stallion won a restraining order against Tory Lanez on Thursday (Jan. 9) after tearfully testifying before a Los Angeles judge that she’s scared he’ll “shoot me again” when released from prison and “maybe this time I won’t make it.”

A month after the star’s lawyers warned that Lanez has continued to “terrorize her” with a “campaign of harassment” even as he sits behind bars, Judge Richard Bloom granted her a civil restraining order that will bar Lanez from any harassing conduct for the next five years.

The ruling came after emotional testimony from Megan herself, who fought back tears as she told Bloom that she hasn’t “been at peace since I was shot” and is “just tired of being harassed.”

“It just seems like I have to relive it every day. The person who shot me won’t let me forget it,” Megan told the judge via livestream video conference. “I’m scared that when he gets out of jail he’s going to still be upset with me … I feel like maybe he’ll shoot me again and maybe this time I won’t make it.”

Judge Bloom issued the order from the bench, saying that Megan had shown a “credible threat of violence” and other potential wrongdoing that “seriously harasses the petitioner and serves no lawful purpose.” The order bars a wide range of conduct, including any contact or harassment through any means.

After Bloom issued the order, the star briefly unmuted her microphone: “Thank you, judge.”

Lanez was convicted in 2022 on three felony counts over the violent 2020 incident, in which a drunken argument in the Hollywood Hills escalated into a shooting. After Lanez allegedly yelled “Dance, bitch!,” he proceeded to shoot at Megan’s feet with a handgun, striking her multiple times. In 2023, he was sentenced to 10 years in prison; he has filed an appeal, which remains pending.

In recent months, Megan’s attorneys have fought what they call an unlawful campaign by Lanez to spread misinformation about the case on the internet — like a viral story that circulated on X in October falsely claiming an appeals court had declared him “innocent.”

In October, Megan’s lawyers filed a federal lawsuit against YouTuber and social media personality Milagro Gramz, who she claims has served as a “mouthpiece and puppet” for the convicted singer. In later filings, they alleged that discovery in the case had revealed prison phone calls in which Lanez coordinated payments to Gramz.

And last month, Megan’s attorneys demanded the civil harassment restraining order in Los Angeles court, arguing Lanez had conspired with people outside the prison to “harass, bully, and antagonize” her. They said they had only recently learned that the criminal restraining order from the shooting case was no longer in place and that it could not now be reimposed.

“Mr. Peterson’s attempts to retraumatize and revictimize Ms. Pete recognize no limits — indeed, they continue even while he is behind bars,” Megan’s lawyers wrote at the time. “While Mr. Peterson distorts and recklessly disregards the truth in his desperate attempt to appeal his conviction, his false assertions have reignited a slew of negative, harmful, and defamatory comments directed to Ms. Pete.”

Attorneys for Lanez responded late last month, calling the petition a “frivolous request” and accusing Megan of trying to “weaponize the justice system” because she “disagrees with free speech” and couldn’t handle criticism: “Rather than rebut the commentary or debate the issues … Plaintiff has succumbed to the current trend of using the legal system in an attempt to cancel those opinions she disagrees with.”

At Thursday’s hearing, Lanez’s attorney Michael Hayden reiterated those arguments, saying his client was “not threatening the petitioner in any way.” Instead, he argued that Megan was simply upset about criticism from internet bloggers with “their own independent minds” who Lanez cannot control — and he warned that such a restraining order would violate the First Amendment.

“This is about an attempt to chill free speech based on prior restraint,” the attorney told the judge.

At one point, Megan herself returned to the virtual witness stand to rebut that point, saying she was “not trying to take anyone’s free speech away” but rather to stop Lanez from continuing to drive harmful harassment from behind the scenes.

“I understand that being a public figure comes with hearing a lot of people from all over the world talk about you,” she told the judge. “The problem that I have is that the man that shot me is orchestrating other people and paying people … to put out lies and smear campaigns against me.”

In issuing his ruling, Judge Bloom seemed to avoid the issue of online smears and instead focus on the potential for violence, citing the 2020 shooting that lay at the heart of the case.

“We have a shooting that took place … and with a violent act like that there’s a ripple effect that continues on,” the judge said. “In some cases, it may be small ripples that go away with time, and in other cases, it could be ripples that grow with time. Ms. Pete’s testimony here seems to make clear that the ripple effect here has been significant.”

Since Tuesday (Jan. 7), ferocious wildfires have been blazing through the greater Los Angeles region, causing extensive damage to life and property, including those of many individuals working in the music business. With nearly 180,000 residents impacted by evacuation orders, at least five dead and thousands of structures damaged or destroyed, music industry organizations are finding ways to provide relief for impacted music workers.

Below, find a list of some of the music organizations offering relief for L.A. industry owrkers. We will continue to update this list as more announcements are made.

(For health alerts, evacuation updates and shelter information, check out L.A. County’s emergency website here.)

MusiCares

The Recording Academy’s philanthropic arm MusiCares say it “can consider emergency funds related to evacuation and relocation costs, instrument replacement/repair, home damage, medical care, mental health services, & other essential living needs,” according to a statement released to social media. Further details have yet to be announced.

Reach out to: musicaresrelief@musicares.org or call 1-800-687-4227

Backline

Mental health non-profit Backline is sharing resources for musicians in Los Angeles via social media and offering its own services. “Know that Backline is here for you and that you are not alone,” the organization wrote on Instagram. “You can reach out to us via our case submission form and a Case Manager will contact you to help you get the long-term support you need. If you need immediate assistance, please reach out to the Disaster Distress Hotline for free 24/7 support by calling 1-800-985-5990.”

Sweet Relief Musicians Fund

Sweet Relief Musicians Fund, the non-profit helping musicians and music industry workers in need, has launched a natural disaster relief fund for those in Los Angeles County and the surrounding areas. Applications are also open for those seeking relief, with funds raised going toward loss of music-related equipment, medical bills related to the fires and other vital living expenses.

Head here to donate or fill out an application.

Instrumental soul music is not in high demand in 2025. But last summer, Fat Beats Records quietly moved hundreds of copies of El Michels Affair’s ‘Enter the 37th Chamber‘ — an anniversary edition of an album containing instrumental soul versions of the Wu-Tang Clan’s iconic hit “C.R.E.A.M.,” Ol’ Dirty Bastard’s “Shimmy Shimmy Ya,” Ghostface Killah’s “Cherchez La Ghost” and more.

The majority of direct-to-consumer sales came through TikTok Shop, an e-commerce platform inside the short-form video app that allows users to easily buy items without having to leave for another site. “We found some cool creators, sent them the vinyl, and they did an unboxing video, or talked about some of the tracks while playing the music in the background, and then linked directly to TikTok Shop,” explains Molly Bouchon, director of digital at Rostrum Records, which acquired Fat Beats in 2024. The El Michels Affair reissue is now sold out.

Trending on Billboard

TikTok Shop is relatively new and thus often overlooked by many artists and record labels, according to Itai Winter, vp of commercial partnerships at the marketing platform Genni, which helps match creators with music promotion campaigns. The fact that TikTok’s fate in the U.S. remains uncertain probably hasn’t helped; the Supreme Court will hear arguments on Friday (Jan. 10) about whether the app should be sold or shut down in the U.S.

Still, Winter estimates that “probably about a fifth of the For You page [on the app] are TikTok Shop-related posts” now. And harnessing that attention can pay off handsomely, at least when it comes to driving vinyl purchases: “We’re doing $15,000 to $20,000 in sales every month” through the platform, Bouchon says.

And she hopes there might be room to do more: “How do we make TikTok Shop a $40,000 or $50,000 a month revenue builder for us?”

TikTok officially rolled out TikTok Shop in September 2023 as part of a push into the lucrative world of e-commerce. “We have a very aggressive plan to make a splash in the industry and make sure that people out there understand that TikTok is a place for shopping,” Nico Le Bourgeois, head of U.S. operations for TikTok Shop, told The New York Times.

“With the number of people shopping on TikTok Shop every month nearly tripling since officially launching in September 2023, TikTok Shop is leveling the playing field so that any creator, merchant, brand and product can become a huge hit on our platform,” Le Bourgeois added in a recent statement to Billboard.

Genni became an official TikTok Shop partner as soon as it launched. “I got a really in-depth look and a chance to see what is actually driving sales,” Winter says. He frequently saw success when creators, rather than artists, posted about merchandise like records. Creators are incentivized to do so because they receive a commission on sales from links they share. Sellers can set commissions as they see fit; they’re often between 12% and 16%, according to Winter.

Alex F., who goes by plastic.disc on TikTok, is a self-professed “huge music nerd” who posts all manner of vinyl-related videos on the platform — “my $7,000 turntable set-up“; “more weird and unusual records in my collection!” He now often includes links to TikTok Shop and appreciates the commissions he receives from sales because they help feed back into his vinyl habit. (Though he would post the videos “even if I wasn’t making money — it’s what I love,” he says.)

These clips can spread far and wide: A plastic.disc post about Mac Miller’s 7″ single “The Spins” earned more than 2 million views, helping to move 744 copies of the record through TikTok Shop in a single week in October.

Winter has worked out a rough rule of thumb: A million views on a TikTok video with a TikTok Shop link usually translates to around $6,000 to $8,000 in LP sales. “It’s really convenient for people to see an unboxing video, think, ‘That’s cool,’ and go buy it,” says Alex F. TikTok has “primed their users to make transactions quickly,” adds Carly Redford, former director of e-commerce at Manhead Merch.

“I unfortunately know that,” Bouchon jokes. “I swear every day I get something from TikTok Shop.”

While TikTok Shop has the potential to turbocharge sales, many merchandise companies are not yet equipped to pivot rapidly to meet unexpected geysers of demand. They tend to work on months-long time horizons leading up to a release date. But release dates don’t matter as much on TikTok, which has consistently rejuvenated older songs.

As a result, “A lot of the fulfillment centers are having difficulty,” according to Johnny Cloherty, co-founder of the digital marketing company Songfluencer. “TikTok requires you to ship within two business days, and that’s tough for larger merchandise companies.”

One record that Winter was promoting went out of stock five times over the course of three months. In a way, this is a good problem to have. Still, “It can be frustrating,” he says. “You wake up to a viral video, and you’re selling 10 units an hour. Call the distribution center, and they’re like, ‘Don’t worry about it, we’ll send you another batch in two weeks.’ I’m like, ‘I need that yesterday.’”

Those delays mean that acts are leaving money on the table. On top of that, other TikTok Shop users may be siphoning off money that should go into artists’ pockets. Although TikTok Shop policy “expressly prohibits the unauthorized use of any third-party intellectual property rights,” Redford says, “There is so much bootleg merch [on the platform].”

This is a common problem on e-commerce sites. “That happens on Etsy, on Pinterest, on Facebook Marketplace, wherever,” Cloherty says. However, “None of those platforms drive even close to the degree of consumption and discovery that TikTok does,” he continues, which could make bootlegs on TikTok Shop more detrimental.

According to TikTok Shop’s Intellectual Property Rights report, published in October, the platform “implements proactive measures to identify and prevent potential infringements, significantly reducing their occurrence. Between July 2023 and June 2024, more than 5,254,000 products were prevented from going live.” In addition, “497,026 products were taken down after going live for IPR violations.”

Copyright owners can report infringement notices to TikTok Shop. In Redford’s experience, though, the most effective way for artists to combat bootlegs is to sell their own official products.

Despite success stories like El Michels Affair’s Enter the 37th Chamber, Redford still hasn’t seen many artists experimenting with TikTok Shop campaigns. “I feel like labels aren’t really focusing enough on it,” says Amy Hart, a digital marketer and co-founder of prairy, a new indie label. “We’re actively talking about it and figuring that side of things out.”

As with all things TikTok, it’s nearly impossible to determine in advance what products — and what videos — are going to cause users to smash the “buy” button. “TikTok Shop is tricky,” acknowledges Tyler Melton, who posts vinyl-focused videos of his own as tyler.fortherecord. “It will either not care about your video at all, or maybe the way you do your title or your intro will hook people.”

Winter’s biggest wins so far have come with vinyl. “We tried selling sweatshirts a couple of times, with only limited success,” he notes.

He believes the merchandise needs pizzazz — users may be unmoved by a simple T-shirt with an artist’s logo. (The El Michels Affair LP was described in one TikTok video as “a sick black-and-yellow” pressing, while a recent Wiz Khalifa vinyl reissue featured eye-catching “retro video game inspired artwork.”) “You can’t look at TikTok Shop like you’re uploading everything in your merch store,” Cloherty says. “It’s more like, what merch items can spark a TikTok-worthy moment?”

“This is all pretty new,” Bouchon adds. “Now I think we’re all realizing, ‘Oh shit, we need to prioritize this.’”

State Champ Radio

State Champ Radio