Business

Page: 10

Trending on Billboard

HarbourView Equity Partners and Grammy Award-winning artist and producer Hit-Boy have joined forces in an exclusive partnership. Following the conclusion of Hit-Boy’s 18-year publishing agreement with Universal Music Publishing Group, the new alliance finds HarbourView collaborating on forthcoming titles written by Hit-Boy. Transaction terms were not disclosed.

In announcing the news, HarbourView founder and CEO Sherrese Clarke stated, “At HarbourView, we are committed to investing in the creators who shape culture and are actively moving it forward. Hit-Boy’s work has defined a generation of music, blending innovation with impact in a way few others have. We’re honored to partner with him and proud to help preserve, celebrate and continue his extraordinary legacy.”

Related

“This next chapter of my career is about ownership, being innovative and my creative freedom,” added Hit-Boy. “HarbourView will be a forward-thinking partner and that is exactly what I want when making decisions about my catalog and my future.”

Hit-Boy’s extensive catalog, amassed over nearly 20 years, encompasses collaborations ranging from Kendrick Lamar and Nicki Minaj to Ariana Grande and Doechii. Among the producer’s biggest hits are Jay-Z and Kanye West’s “N***as In Paris,” Travis Scott’s “Sicko Mode” with Drake, Beyoncé’s “Flawless” and the late Nipsey Hussle’s “Racks in the Middle.”

Three-time Grammy winner Hit-Boy also executive produced Nas’ Grammy-winning King’s Disease as well as the rap icon’s Magic Trilogy. His two other Grammy wins were for best rap song (“N***as In Paris”) and best rap performance (for his guest feature alongside Roddy Ricch on Hussle’s “Racks in the Middle”).

Related

As an artist, Hit-Boy’s most recent album is Goldfish with fellow producer The Alchemist. The project is complemented by a short film directed by Abteen Bagheri and executive produced by Hit-Boy, who also stars in the short with The Alchemist. Others featured in the film include Danny Trejo, Rory Culkin and rappers Big Hit, Conway the Machine and Lefty Gunplay.

HarbourView Equity Partners was established in 2021. Specializing in the sports, media and entertainment arenas, the investment firm’s music portfolio includes artists and producers such as Kelly Clarkson, T-Pain, Rodney “Darkchild” Jerkins, Luis Fonsi, Fleetwood Mac’s Christine McVie, Wiz Khalifa and Kane Brown, among others.

Trending on Billboard

Management collective The Circuit Group has launched Circuit Capital, a platform to acquire and scale music assets and cultural IP. Circuit Capital is being backed by Create Music Group, which is providing Circuit Capital with access to more than $500 million with which to execute its mission.

The fund will invest in catalogs, record labels, publishers and other music-driven ventures with a mission to build long-term sustainable value. Circuit Capital will provide capital to back upcoming projects by artists being managed by The Circuit Group, an initiative that involves back catalog investments and futures funding deals and providing artists with the resources to invest in their own music and careers.

Related

The Circuit Group launched in October of 2023, bringing together management companies Ayita and Seven20, whose combined rosters include electronic artists Fisher, Chris Lake, deadmau5, Cloonee, Aluna, Ninajirachi and many more. The company launched with the mission to acquire 50% ownership in artists’ IP portfolios and partner with them to build opportunities across verticals, while also offering traditional artist management.

The business was launched by dance industry executive and deadmau5’s longtime manager Dean Wilson and his wife/business partner Jessica Wilson, along with Brett Fischer, David Gray and Harvey Tadman. The Circuit Group team expanded in the summer of 2024 upon announcing seven new hires.

Now, Circuit Capital’s goal is to create a community atmosphere and serve as a home for artists, entrepreneurs and rights-holders who will work with a group of longtime professionals with a deep understanding of and footing in the electronic music industry.

“Our mission is to put culture at the center of everything we do,” The Circuit Group co-founder Harvey Tadman says in a statement. “Too often, the people buying into music don’t understand the world it comes from. We’ve built our careers inside this culture. Circuit Capital is our way of ensuring that when artists decide to sell or scale, they can do it with people who speak the same language and share the same values. We couldn’t imagine a better partner than Create Music Group.”

Related

Earlier this year, Create Music Group announced that it acquired the deadmau5 catalog, along with the catalog of the electronic producer’s longstanding label, mau5trap.

“We’re excited to announce this unique partnership with Circuit,” says Create Music Group CFO William Smith. “We have been impressed by their relentless focus as managers on partnering with their clients to build assets with substantial, enduring value, as exemplified by the recent deadmau5 transaction. Moving forward, we’re pleased to be backing Circuit’s strategy of investing into the same music catalogs and businesses that they’re helping to grow – in other words, ‘putting their money where their mouths are’ – by providing them with this fund.”

“Our partnership with The Circuit Group represents Create’s continued mission in building the leading technology, infrastructure, and capital platform for artists and entrepreneurs,” says Create Music Group co-founder and CEO Jonathan Strauss. “Circuit has evolved into one of the most respected and trusted management teams in the dance space, with a deep understanding of what artists need to grow, innovate, and create long-term value. Together with Circuit, we’re aligning resources, expertise, and vision to empower music entrepreneurs to build enduring, global businesses.”

Trending on Billboard

Spotify launched its first Artist Party in Sydney on Monday night (Nov. 17) featuring The Kid LAROI, marking the start of ARIA Week with a tightly programmed event centered on Australian talent ahead of the 2025 ARIA Awards.

Held at the Cell Block Theatre in Darlinghurst, the event functioned as Spotify’s primary on-the-ground activation during ARIA Week and drew a cross-section of nominated artists, emerging acts and industry figures. The Kid LAROI headlined the night with a short set that included a surprise appearance by Western Sydney drill group ONEFOUR for “Distant Strangers.” The performance marked a rare public pairing for the two acts in the lead-up to this year’s ceremony.

Related

LAROI, who has been home in Australia ahead of his next release cycle, addressed the crowd briefly, noting the significance of performing in Sydney during ARIA Week. The Kid LAROI said: “I grew up dreaming about nights like this, so to be back in Sydney, performing this party with Spotify and surrounded by so many Aussie artists I respect, is special.”

He added, “Australian music is having a massive global moment right now, it’s so cool to be part of that!”

Several 2025 ARIA nominees also appeared on the bill. Sons of the East (Best Blues & Roots Album) and Taylor Moss (Best Country Album) delivered unannounced acoustic performances, while Young Franco — nominated for Best Solo Artist and Michael Gudinski Breakthrough Artist — closed the night with a DJ set.

The event drew notable nominees, including Ninajirachi, this year’s most-nominated artist, as well as RedHook and Larissa Lambert. Members of The Wiggles were also seen in attendance, reflecting the wide footprint of ARIA Week programming across genres and generations.

This year’s ARIA Awards arrive with higher-than-usual audience participation following the introduction of Spotify’s in-app voting tool, which the ARIAs say has driven more than 250,000 public votes across the ceremony’s open categories. That figure surpasses combined tallies from the previous two years and indicates elevated visibility for this year’s broadcast and livestream.

The 2025 ARIA Awards will be held Nov. 19 at Sydney’s Hordern Pavilion, streaming live on Paramount+ from 5 p.m. AEDT before airing later that night on Network 10.

Trending on Billboard

Europe’s largest music market will soon be announcing a ban on ticket resale for profit, elating music fans while roiling investors in secondary ticketing companies like StubHub and Vivid Seats.

Multiple outlets in the United Kingdom are reporting that the Labour Party government of Prime Minister Keir Starmer will announce a plan to crack down on ticket scalping this week. Outlets like The Guardian are reporting that Starmer’s government had considered capping resale at 30% above a ticket’s original face value, but ultimately opted to ban the resale of tickets above face value following significant pressure from artists and industry groups.

Related

According to The Guardian, ticket holders for popular concerts like Coldplay and Dua Lipa will be able to resell tickets on sites like StubHub and Viagogo, but not charge more than they paid for the tickets. Resale sites would be allowed to charge fees on top of that price, but the fees would be limited and set by regulators. The resale ban would also cover social media sites, which some resale site operators have claimed would serve as fraud-heavy alternatives if markets like StubHub were shut down.

The new regulations will also include purchasing limits on tickets and mandates from the Competition and Markets Authority (CMA) that resale sites like StubHub will be responsible for policing their own platforms.

The news sent the share price for StubHub’s U.S. company, StubHub Holdings, tumbling on Monday (Nov. 17); the stock ultimately closed down 13.8 percent. StubHub has endured a brutal November, with shares down a combined 33% after the company failed to provide a financial forecast for the current quarter.

The publicly traded StubHub Holdings — which owns Viagogo — is a different company from the U.K. StubHub brand. The Competition and Markets Authority forced the firms to split into two companies following the merger of Viagogo and StubHub in 2020.

Representatives for Live Nation applauded the deal, telling Billboard in a statement that “Live Nation fully supports the UK government’s plan to ban ticket resale above face value. Ticketmaster already limits all resale in the UK to face value prices, and this is another major step forward for fans — cracking down on exploitative touting to help keep live events accessible. We encourage others around the world to adopt similar fan-first policies.”

Earlier this month, more than 40 British artists, including Sam Fender, Radiohead and The Cure, sent a public letter to Starmer urging the U.K. prime minister to “stop touts [scalpers] from fleecing fans” and cap the price of resale tickets at face value. The pressure campaign followed a recent CMA study that found U.K. tickets sold on resale sites were typically marked up 50 percent.

Trending on Billboard

Fresh off the heels of her third one-hour Netflix special, Upper Classy, actress and comedian Cristela Alonzo will embark on her multi-city Midlife Mixtape Tour beginning next January.

The North American tour showcase kicks off Thursday, Jan. 15 at Quezada’s Comedy Club in Santa Ana Pueblo, New Mexico, with additional stops in Chicago; San Diego; Houston; Scottsdale, Arizona; Spokane, Washington; and San Antonio, Texas before wrapping up in Las Vegas at the Westgate Resort on May 2.

Tickets will go on sale starting Friday at 10 a.m. local time. More information can be found at CristelaAlonzo.com

The tour will also land at the Moontower Comedy Festival in Austin, Texas, on April 9 and 10. Tickets for the festival, which are already on sale, can be found here.

A first-generation Mexican-American, Alonzo grew up in poverty in San Juan, Texas, learned English from watching TV, and in 2014 adapted her story into the ABC comedy Cristela, becoming the first Latina to create, produce and star in her own network sitcom.

Her latest Netflix special Upper Classy, which debuted in late September, recently landed in the streamer’s top 10 most-viewed programs, following her acclaimed hours Middle Classy and Lower Classy.

In October, Billboard contributor Joe Levy wrote of Upper Classy, “To say that Alonzo is in the tradition of observational comics who mine their life experience for comedy is to underestimate both her mastery of that tradition, as well as its impact on her.”

Alonzo also voices Cruz Ramirez in Pixar’s Cars 3 and appears in the Hulu series This Fool. In 2019, she published Music to My Years: A Mixtape Memoir of Growing Up and Standing Up.

Cristela Alonzo: Upper Classy. Cristela Alonzo at the Majestic Theatre in Dallas, Texas.

Lauren Smith/Netflix

Trending on Billboard

Spirit Music’s first catalog, which contains Pete Townshend’s publishing, T. Rex’s publishing catalog and masters, and Ingrid Michaelson’s music assets, might be coming up for sale, sources tell Billboard.

The catalog is currently owned by Northleaf Capital, which acquired it at some point since October 2021, when it provided $500 million in funding to Lyric Capital Group in a deal that was termed a “strategic alliance at the time. Lyric Capital was formed by Jon Singer and Ross Cameron, when they were still executives at Spirit Music, to buy Spirit Music and its catalog from original owner Pegasus Capital in 2018. Spirit Music is now the operational music company of Lyric Capital, and continues to serve as administrator for that catalog.

Related

According to some sources, Northleaf received an unsolicited bid and, as a fiduciary for the institutional investors who invest in the fund that owns the Spirit catalog, it had to present that offer to the catalog’s shareholders to see if it should explore a sale. It sounds like the shareholders decided to see what the catalog could get on the open market — specifically, whether it could fetch a higher price than the unsolicited bid — because sources say Northleaf has hired Brian Richards and his financial firm Artisan to approach potential suitors to see if they would be willing to make a bid. Sources suggest that Northleaf is seeking $500 million or more.

The catalog coming up for sale was initially assembled by Spirit Music founder Mark Fried, who founded the company in 1995 and left it in 2014. Back then, the catalog included songs by James William Guercio, Graham Nash, and Marilyn and Alan Bergman. The catalog was supplemented by David Renzer, who served as Spirit Music Group CEO from 2014 to 2018 and, during his tenure, acquired the Cal IV Entertainment company and song portfolio, which may be the reason sources say the Spirit Music catalog up for sale has a strong country music presence. Although it’s unclear if the Cal IV catalog is part of the sale, when Spirit acquired it in 2014, its catalog included numerous country hit records, including Faith Hill’s “Breathe,” Keith Urban’s “Stupid Boy,” Tim McGraw’s “Watch The Wind Blow By” and Jason Aldean’s “Big Green Tractor.”

Related

When Billboard reported on Lyric Capital buying and recapitalizing Spirit Music in 2019, the catalog contained songs from such artists and songwriters as Billy Squier, Charles Mingus, Doc Pomus, Henry Mancini, Lou Christie, Louden Wainwright III, Marshall Tucker Band, Phil Coulter, Boz Scaggs, T Bone Burnett, Frank Rogers, Gregg Wattenberg, David Paich, Tim Hardin, and Richie Cordell, Jonny Coffer, Zach Crowell and James Bay. Again, it’s unclear if these songwriters and their music are included in the catalog up for sale. But at the time Lyric acquired Spirit Music, Billboard reported that the catalog was generating about $21 million in gross profit, or, in music publishing parlance, net publisher’s share, and that the deal supposedly carried a $280 million valuation, which at the time implied a 13.33 times multiple.

When Lyric Capital came into the picture, sources suggested that it eventually became a significant majority owner of the first Spirit catalog, owning upwards of 95% or even more of the catalog, although sources suggest Lyric might still own a tiny sliver of it, in addition to retaining its role as the administrator following the Northleaf deal. Lyric Capital subsequently offloaded the backroom administrative functions to Downtown Music Publishing in 2024, although Lyric’s Spirit Music operation remains the official administrator and marketing force for the catalog’s music.

Related

Currently, sources suggest that the catalog is generating about $30 million gross profit, split between about 85% in net publisher’s share and about 15% in net label share from either owned recorded masters or recorded master royalties. If $500 million or more becomes the asking price for the catalog, at that amount of gross profit, that would imply Northleaf is seeking at least a 16.7 times multiple. However, just because Northleaf appears to be exploring a sale, that doesn’t mean it will sell. It will come down to what price the catalog can command from suitors and if the high bidder’s offer presents enough profit for the seller.

Beyond the first Spirit music catalog, Lyric Capital and its Spirit Music publishing arm remain active music investors, acquiring and managing music catalogs. In 2023, Lyric Capital raised $800 million to pursue further acquisitions. Recently, the Nashville arm of Spirit Music acquired select songs from singer-songwriter Hardy’s music publishing catalog while also signing the artist to a go-forward exclusive writing agreement with the firm.

Northleaf, Artisan and Spirit Music didn’t respond to requests for comment.

Trending on Billboard

For nearly 25 years, tech startups have tried to crack the code on a simple idea: Building a social network based on music. The timing wasn’t right for Napster, Imeem, MySpace Music, Lala, Apple’s Ping or Facebook’s Spotify integration, among others. “It’s like a math problem that goes unsolved for hundreds of years and one day a mathematician comes along and solves it,” says Matt Graves, a Marin County, Calif., communications consultant who was once an exec for music-streaming pioneer Rhapsody. “I’d like to think that brilliant young Turk exists.”

Gilles Poupardin, a San Francisco entrepreneur, believes he is that Turk (although he is French) — and believes that Airbuds, his app with 5 million monthly users and $10 million in venture capital, is that service. Airbuds allows friends to view what each other is listening to on Spotify, Apple Music and other music-streaming services in real time, and discuss the tracks or add emojis, “SLAY” stickers and cat gifs to now-playing pages. It’s all very Facebook-in-2009 or Snapchat-in-2015, only with music as the central focus and common user language.

Related

The timing is right, according to the Airbuds co-founder, some 15 years into the social-media and music-streaming eras. “Spotify is the access to the music. Airbuds is the social layer on top of it,” he says. “Gen Z, Gen Alpha, wants more than access. They want identity.”

The earlier music-plus-social services didn’t make it for several reasons. Some ran into technology-wary labels that, after winning battles against Napster and others over copyright infringement, were disinclined to license their content to startups. Others, like MySpace Music, lost out to more advanced tech models, like Facebook and Instagram, and wound up folding or selling out to bigger companies. Poupardin insists this won’t happen with his app. Airbuds connects to Spotify, Apple Music and others, so the company can piggyback on the music-streaming services’ content licenses and not have to worry about securing rights from labels and publishers.

Reps for all three major labels did not respond to requests for comment, but Seb Simone, Warner Music Group’s senior vp of global direct-to-fan services, is quoted in an Airbuds press release. “Airbuds isn’t just another app,” Simone said in part. “It’s a cult community of super-engaged fans expressing their love of music in a social, playful and creative way.”

Related

How does Airbuds make money? So far, mostly through venture capital investment — predominantly from Seven Seven Six, an investment firm run by Alexis Ohanian, a Reddit founder. In the future, Poupardin says, the app is working on a “one-stop shop for artist-superfan connection,” creating profiles for stars that will eventually enable merch and ticket sales. He adds that Airbuds is testing a subscription model that “unlocks customization features.” Also, he says, Airbuds “briefly experimented” with advertising before abandoning the plan.

After attending college in Paris, Poupardin helped create tech ventures, including DrinkEntrepeneurs and Whyd, a voice-controlled speaker that preceded Amazon’s Alexa. After building Capuccino, a social app for sharing audio clips with real-life friends, he and co-founder Gawen Arab hit on the Airbuds idea, launching in October 2022. “It took up slowly at first,” Poupardin says. “We started adding more features and it started growing way faster.”

Airbuds allows users to react to shared songs with stickers, badges and emojis — some of which are customized with artists’ images, including Pink Pantheress, Tame Impala and others. It also provides charts, Spotify Wrapped-style weekly recaps and, significantly, chat features. According to Poupardin, artists have picked up on fans sharing customized content on Airbuds and asked their managers and label reps to figure out how to work with the service.

“You could have built Airbuds a few years earlier, but it didn’t have the critical mass of folks on streaming. It didn’t have the AI-slop-infested Internet. So the culture wasn’t quite ready for it,” Ohanian says. “This is a way to share what you’re listening to with your actual friends. It’s fundamentally human.”

Trending on Billboard Lil Nas X and his legal team were in good spirits during the hip-hop artist’s first court hearing since leaving an inpatient treatment program following assault charges. The singer and rapper (Montero Hill) appeared in Los Angeles court on Monday (Nov. 17), two months after he was arrested for attacking police officers […]

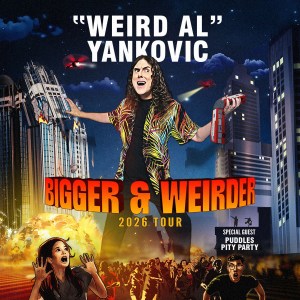

Trending on Billboard After going big and weird this year, “Weird Al” Yankovic is going even Bigger & Weirder again next year. In a cinematic Instagram video (watch below), the parody song superstar announced the dates for the next chapter of his ongoing tour on Monday morning (Nov. 17), which is slated to kick off […]

Trending on Billboard

A federal judge has held Tory Lanez in contempt of court on the eve of trial in a civil lawsuit filed by Megan Thee Stallion – a move that came after the singer said: “I’m a millionaire. I don’t care.”

In a ruling Sunday evening, the judge said that Lanez (Daystar Peterson) – currently serving a 10-year prison sentence for shooting Megan in 2020 – had behaved so poorly during three different depositions that he must now pay a $20,000 fine.

Related

According to U.S. Magistrate Judge Lisette M. Reid, that’s an outcome Tory already shrugged off during the most recent debacle: “When told his behavior could result in contempt of court and sanctions consisting of fines and additional jail time, Mr. Peterson then said, ‘whatever the fines are, I’ll pay them. I’m a millionaire. I don’t care’.”

The ruling came a day before the start of a jury trial in a civil lawsuit Megan filed last year against social media personality Milagro Gramz (Milagro Cooper). The star claims Gramz waged a “coordinated campaign” with Lanez to “defame and delegitimize” her in the wake of the shooting.

In addition to the monetary fine, the judge also said that jurors in that trial should be told about Lanez’s refusal to answer questions about whether he ever communicated with Gramz – an unwelcome development for her defense attorneys.

Lanez was convicted in December 2022 on three felony counts for shooting Megan in the foot in July 2020 during an argument following a pool party at Kylie Jenner’s house in the Hollywood Hills. In August 2023, he was sentenced to 10 years in prison. His appeal of the verdict and sentence was denied last week.

Related

Last year, Megan filed her civil lawsuit against Gramz, calling her a “mouthpiece and puppet” for Lanez who had been “churning out falsehoods” about the criminal case on his behalf: “Enough is enough,” her lawyers wrote at the time.

Unsurprisingly, Lanez is a key witness in that lawsuit, and Megan’s lawyers have repeatedly tried to depose him from prison. But each time, the singer has disrupted the proceedings and refused to answer questions; Megan’s lawyers have said he’s “made a mockery of the proceedings.”

In her ruling on Sunday, Judge Reid echoed those claims. She said Megan’s lawyers had been “unable to ask more than two questions before Mr. Peterson stormed out of the room.” The judge said Tory later made “derogatory comments” and hurled “multiple expletives” toward Megan’s lawyers and never answered any questions.

Lanez’s attorney, Crystal Morgan, also drew the judge’s ire. Judge Reid said she had objected to questions that were “clearly relevant” during the brief deposition, and had engaged in “coaching the witness.” The judge ordered her to pay $5,000 as her fine.

Related

State Champ Radio

State Champ Radio