Business News

Page: 25

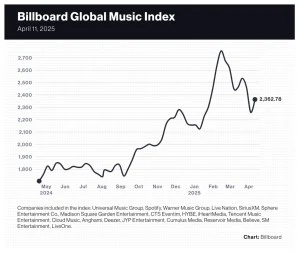

Led by Spotify and Live Nation, music stocks surged on Wednesday (April 9) after the U.S. Treasury placed a 90-day pause on most tariffs and recaptured some of the losses from the chaotic previous week.

A week after losing $12 billion in market value, Spotify was one of the top-performing music stocks of the week, gaining 8.0% and offsetting most of the previous week’s 10.3% decline. A 9.8% gain on Wednesday helped improve the streaming company’s two-week loss to 3.1%.

The 20-company Billboard Global Music Index (BGMI) gained 4.6% to 2,362.78 on Wednesday’s 90-day tariff pause. That welcome news recaptured only a fraction of the previous week’s losses, however, and music stocks were hurt by a weakened U.S. dollar and growing fears the U.S. could slip into a recession. After losing 8.2% in the previous week, the index’s two-week loss stands at 4.0%.

Trending on Billboard

U.S. markets rebounded after a miserable week. The Nasdaq rose 7.3% to 16,724.46, bringing its two-week loss to 3.5%. The S&P 500 rose 5.7% to 5,363.36, giving it a two-week decline of 3.9%.

Many markets outside of the U.S. were down, however. In the U.K., the FTSE 100 dropped 1.1%, giving it a two-week loss of 8.0%. South Korea’s KOSPI composite index was down 1.3%, adding to the previous week’s 3.6% decline. China’s SSE Composite Index dipped 3.1% a week after falling 0.3%.

Music streamer LiveOne was the week’s biggest gainer after jumping 18.0% to $0.72. The company’s preliminary results for fiscal 2025 released on Monday (April 7) showed the music streaming company had revenue of more than $112 million, while subscribers and ad-supported listeners surpassed 1.45 million. Even after the large increase, LiveOne shares have fallen 47.4% year to date.

Live Nation, which jumped 7.2% to $129.52 this week, is the only music company to post a gain over the past two weeks. The concert promoter’s share price dropped 3.4% the previous week but, with the help of a 10.9% jump on Wednesday, recovered well enough for a two-week gain of 3.6%.

Record labels and publishers finished the week in the middle of the pack. Warner Music Group fell 1.5% to $29.03, bringing its two-week decline to 8.0%. Universal Music Group was down 1.6%, giving it a two-week decline of 10.7%. Reservoir Media rose 0.7% to $7.10, giving it a two-week deficit of just 2.1%.

Sphere Entertainment Co. is one of the worst-performing music stocks over the past two weeks with an 18.5% decline. The company’s shares finished the week up 1.3%, barely offsetting the previous week’s 19.5% decline. A spike on Wednesday was partially offset by declines of 4.3% and 7.7% on Tuesday (April 8) and Thursday (April 10), respectively.

Most radio companies, which are heavily exposed to slowed advertising spending during recessions, had another down week. Cumulus Media dropped 22.5% to $0.31, bringing its two-week loss to 34.0%. iHeartMedia fell 4.2%, which took its two-week decline to 29.9%. Townsquare Media was down 4.9% this week and 13.6% over the past two weeks. Satellite broadcaster SiriusXM, which was upgraded by Seaport to buy from neutral, gained 2.6% this week, narrowing its two-week loss to 12.0%.

The two Chinese music streaming companies on the BGMI fared poorly despite the recoveries by Spotify, LiveOne and Deezer, which gained 2.3%. Tencent Music Entertainment fell 5.5% to $12.24 but was likely helped by Nomura initiating coverage this week with a buy rating and a $17.20 price target. Cloud Music shares dropped 5.7% to 141.50 HKD ($18.24).

K-pop companies, which bucked the downward trend the previous week, posted declines as well. SM Entertainment fell 8.2%, HYBE dropped 8.1%, JYP Entertainment sank 5.8% and YG Entertainment dipped 4.1%.

Billboard

Billboard

Billboard

Canadian music is good for more than just the economy — it’s central to the country’s national identity.

That’s the crux of a new open letter written by Erin Benjamin, president/CEO of the Canadian Live Music Association. The letter anticipates the Canadian federal election on April 28 and advocates for elected officials to understand the cultural significance of music to the country. Liberal leader Mark Carney recently became Prime Minister of Canada after Justin Trudeau’s resignation, while Pierre Poilievre is running for the Conservative party and Jagmeet Singh for the New Democratic Party (NDP).

The letter doesn’t mention the U.S. President by name or refer explicitly to tariffs or talk of Canada as the “51st state,” but it situates the country in a moment of national uncertainty, reflecting on what it means to live in Canada and what the country will look like going forward.

Within that context, Benjamin writes, it’s crucial that policymakers understand both the economic and cultural benefits of Canada’s live music sector.

Trending on Billboard

“In the face of today’s generational challenges, on the doorstep of our nation’s future, the time has come to fully integrate and interlace this formidable industry into the systems and policies that shape our society, for the benefit of all Canadians,” Benjamin writes.

The letter cites CLMA’s recent Hear and Now study, the first-ever economic impact assessment of live music in Canada, which found that live music contributed $10.92 billion to Canada’s GDP in 2023 and supported more than 100,000 jobs. But music’s impact can’t just be measured monetarily, Benjamin writes.

“It’s central to our cultural fabric, shaping how we connect and define ourselves as Canadian,” the letter continues. “As we face growing uncertainty and instability — we risk losing not just critical economic opportunities but the very essence of our national identity.”

“Who are we if our artists can’t continue to create and perform due to financial pressures brought on by the cost of touring, access to performance opportunities, and shrinking resources and supports? What happens to our sense of community, our shared experiences, if we lose our cultural infrastructure…the venues, festivals, and spaces that live music provides?”

Benjamin’s letter is part of a broader conversation happening amidst a swell in national pride in the face of threats from the U.S. The music industry has tapped into that pride, which was on display at the 2025 Junos.

Beyond hockey slogans and beer ads, Canadian cultural leaders are emphasizing the importance of the arts and culture sector in maintaining Canadian sovereignty.

Read more here. — Rosie Long Decter

Billboard Canada Partners with Music Managers Forum

Billboard Canada is teaming up with Music Managers Forum (MMF Canada) to highlight vital, yet often under-recognized, drivers of the music industry.

Behind many great artists is a dedicated and strategic music manager working tirelessly. For nearly three decades, MMF Canada has been the voice of music managers and self-managed artists in the country. The organization builds community and empowers managers with opportunities and mentorship.

MMF Canada also presents the Honour Roll, an annual celebration of outstanding Canadian music managers and self-managed artists. This award acknowledges the critical role managers play in shaping the success of Canadian artists and celebrates those who have made a lasting impact. This year, the honour will be presented during NXNE, the longstanding and well-loved music festival that is also beginning a strategic partnership with Billboard Canada.

“We are excited about this partnership with Billboard Canada and NXNE,” says MMF Canada executive director Amie Therrien. “One of our goals at MMF Canada is to ensure that the work managers do, largely behind the scenes, is recognized and celebrated. As the artist’s representative and support system, the contributions of managers is crucial for a thriving and sustainable music industry. To have a partner that understands and champions that work is invaluable.”

The organization has a thriving network and community of managers representing some of the biggest success stories in Canadian music, and some artists who are well on their way to joining them.

“At Billboard Canada, we recognized a significant gap in the industry: a lack of industry-wide support and recognition for the vital work that music managers do every day,” says Mo Ghoneim, president of Billboard Canada and Artshouse Media Group, the co-owner of NXNE. “Understanding their role as the foundation of the music industry, we felt a responsibility to fill that gap by creating a space to tell their stories, highlight their contributions and provide them with the recognition they deserve.”

The MMF Honour Roll has been presented annually since 2007, though this is the first year it will move to NXNE. The award is given to a Canadian music manager for outstanding career achievements.

Previous recipients have included industry legends and current stalwarts, from Bernie Finklestein, Bruce Allen and Ray Danniels to Jake Gold, Chris Smith, Susan de Cartier, Sandy Pandya and Lascelles Stephens. Whether or not you know their names, you do know the results of their work. Together, they’ve guided the careers of artists including Nelly Furtado, Bruce Cockburn, Bachman Turner Overdrive, Bryan Adams, Rush, Colin James, Sarah MacLachlan, kd lang, The Tragically Hip, Haviah Mighty and many more.

Read more here. — Richard Trapunski

Neil Young Will Play a Rare Solo Concert Near His Hometown in Lakefield, Ontario

Neil Young‘s status as a hometown hero in the Peterborough/Lakefield region in Ontario just took another giant leap forward.

On May 23, the Canadian rock icon will play an outdoor benefit concert at Lakefield College School’s Northcote Campus to raise funds for the restoration of the historic farmhouse on the Northcote property — a project that fits with Young’s commitment to the values of preserving history and community.

Young’s roots in this area run deep, as he spent formative childhood years (from ages 4 to 11) in the small community of Omemee, 20 kilometers west of Peterborough and close to Lakefield. “There is a town in north Ontario,” goes a Young-penned line featured in the Crosby, Stills, Nash & Young classic “Helpless” that was inspired by Omemee.

Young’s journalist/novelist father, Scott Young, bought a family farm there that was in the family until the late 1980s. The Ptbotoday website reports that “Neil’s connection to the area deepened in recent years when he and his wife, actress Daryl Hannah, relocated to a 116-year-old cottage near Lakefield in September 2020. According to updates on his Neil Young Archives website, the couple winterized the property and spent nearly six months there during the pandemic, embracing the solitude of the Kawarthas.”

This is not the first Neil Young benefit concert in the area. In 2017, he played a solo acoustic show at Omemee’s Coronation that was live-streamed worldwide and raised $18,000 for the music program of the town’s Scott Young Public School. He will also perform solo at the upcoming show.

The Lakefield concert, scheduled to begin at 7 p.m., will have a restricted capacity of approximately 2,000 concertgoers.

Read more here. — Kerry Doole

Are we having fun yet? It’s time to rally for another spin ’round the Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. There’s been a whole mess of news this week, so let’s get to it.

Madison Square Garden Entertainment appointed David Collins as executive vice president and chief financial officer, effective April 14. Collins will oversee all financial functions at MSG Entertainment, including financial planning and analysis, controllership, treasury, investor relations, tax and procurement, reporting directly to executive chairman and CEO James L. Dolan. MSG Entertainment’s portfolio includes Madison Square Garden, Radio City Music Hall and the Beacon Theatre in NYC, and the Chicago Theatre in take-a-guess. With over 30 years of experience, Collins brings expertise across live entertainment, sports, energy, transportation and restaurant industries. He previously served as CFO and EVP at Harris Blitzer Sports and Entertainment, managing finance, accounting, analytics, and ticket operations for the Prudential Center, Philadelphia 76ers, and New Jersey Devils. Collins also held c-suite roles at Base Entertainment and began his career as a CPA at Ernst & Young. Dolan expressed confidence in Collins’s broad financial experience, particularly in live entertainment and sports, as MSG Entertainment advances key initiatives and long-term goals.

Danny Buch, a promo veteran with decades under his belt who helped break artists from Stone Temple Pilots to Brandi Carlile plus a fair share of “hair” (bands), announced he has departed Sony Music after a 20-year run at two of the label’s indie distribution arms and is launching his own shop, Danny Buch Promotion. Until recently, Buch was senior vp of promotion at Sony’s The Orchard, where he worked artists like BTS, Kelsea Ballerini, Walk off the Earth, Jack White and Bad Bunny at radio. Pre-Orchard, he helped pioneer independent artist promotion by launching RED Distribution’s promo arm in 2005 and stayed there until Sony merged RED into Orchard, starting in 2017. (The RED name was retired later.) During his RED days, Buch helped break Phoenix, Ingrid Michaelson, Alabama Shakes and more indie darlings. But before he saw RED, Buch clocked 25 years at Warner, where he played an integral role in Atlantic Records’ promotion department between 1980 and 2004. Co-heading promo for much of his tenure, Buch lead efforts on behalf of Atlantic giants like AC/DC, INXS, Rush, Genesis, Led Zeppelin, CSNY, Hootie & the Blowfish, STP and more. In the mid-to-late 1980s he broke a chunk of hair/glam metal hits of the day, given Atlantic was home to RATT, Skid Row, White Lion, Winger, Twisted Sister and more. On his next chapter, Buch said: “In launching my new venture, I recognize the opportunity to tap into my years of relationships, in helping both artists & labels. I’m excited about the incredible prospects that lie ahead.” Contact: dbuchmail@gmail.com

Trending on Billboard

Sarah Gabrielli has been promoted to head of A&R at Sony Music Publishing UK, where she will lead the UK A&R team, strengthen creative strategies, and create new opportunities for songwriters. Based in London, she continues to report to president and co-managing director David Ventura. Over her eight years at SMP, Gabrielli has signed and worked with artists including Artemas, Beabadoobee, Cian Ducrot, Jordan Rakei, Arlo Parks and Two Inch Punch, and her most recent wins include Charli XCX’s 2024 album BRAT. Ventura praised Gabrielli’s passion, leadership, and deep commitment to artist development, calling her promotion a natural next step. Co-managing director Tim Major echoed the sentiment, saying “she is someone who leads with heart, empathy, passion and dedication.”

Michelle Bower joined The Neal Agency as president of strategic partnerships. Bower most recently served as associate sr. vp at LaForce, leading campaigns for companies/brands including Madewell, YSL Beauty, Motorola and Tinder. Bower previously held roles at Jonesworks, Dittoe Public Relations and Fleishman-Hillard. The Neal Agency’s roster includes Morgan Wallen, HARDY, Ernest and more. –Jessica Nicholson

Paul Dworkis is poised to become Berklee‘s new executive vp and chief financial officer, starting next Tuesday (April 15). In this role, he’ll oversee finance, accounting, budgeting, real estate, facilities, risk management and more business matters. Dworkis brings extensive experience in higher education, having served as CFO at Emerson College, the University of Maryland, and in senior roles at Columbia University. At Emerson, he supported academic initiatives, managed public safety and launched the unCommon Stage in Boston Common. Dworkis also spent part of his early career at Newsweek. Berklee president Jim Lucchese praised Dworkis for his “unparalleled” credentials and commitment to student-focused operations. “We share the philosophy that everything we do comes back to our students and how to best meet their needs,” he said. Dworkis expressed enthusiasm for joining Berklee, calling it a “truly special—an institution whose mission, creativity, and global impact are unmatched.”

Electric Feel Entertainment appointed Chandler Nicole Sherrill as senior director of creative, reporting to company founder and CEO Austin Rosen. Based in Nashville, Sherrill brings a strong background in music publishing, beginning her career at Little Extra Music in 2015 and later joining MV2 Entertainment, where she helped contribute to over 20 No. 1s for major artists like Morgan Wallen and Jason Aldean. In her new role, she’ll lead creative strategy and collaboration among artists, producers and songwriters. Rosen, who just joined the board of Outback Presents, praised Sherrill’s passion and vision, calling her a valuable addition to the team. “We look forward to seeing the impact she will have as we continue to push boundaries and shape the future of entertainment,” he said.

NASHVILLE NOTES: Big Loud promoted Brianne Deslippe to head of marketing from senior vp of global marketing and strategy. She fills the vacancy left by the recent departure of senior vp of marketing Candice Watkins … Megan Wise was named vp of new business at Anotherland Agency, a music label and marketing startup. With over 15 years of industry experience, including roles at the Country Music Association and Creative Artists Agency, she’ll lead brand collaborations, sales strategies and partnership initiatives to drive growth.

Amigo Records appointed Carina Petrillo as product manager / marketing director and promoted Jillian Rutstein to head of digital. Petrillo, with experience at Elektra Records, MTV and Hulu, brings strategic marketing expertise and a strong background in digital engagement, including launching MTV’s TikTok presence. At Amigo, she’ll focus on building artist-fan connections through comprehensive campaigns. Rutstein, who previously split her time between Amigo and Prescription Songs, brings over a decade of experience in digital strategy, contributing to the success of tracks like LU KALA’s “Pretty Girl Era.” Amigo is home to artists such as Scoot Teasley, SNOW WIFE, Kim Petras and Ethel Cain. Petrillo and Rutstein both expressed enthusiasm about working together to shape a new era at the imprint. “Together we are ushering in a new era of Amigo Records while focusing on building comprehensive marketing campaigns for our roster that meet fans where they are – both online and in person,” said Petrillo.

Audible Treats, a New York-based independent music publicity firm, appointed major label veteran Cheyenne Beam as their new director of public relations. Beam was previously the director of PR at Interscope Records and has over ten years of experience in the music, entertainment, fashion and lifestyle industries. He has worked with artists such as Erykah Badu, Toni Braxton, Chaka Khan, Sean Paul, Swae Lee, Juice WRLD and more. Audible Treats’ current clients include artists like Sexyy Red, Chief Keef, Key Glock and events such as Baja Beach Fest and Sueños. Co-founder Michelle McDevitt praised Beam’s deep network, highlighting his ability to address client needs and manage teams effectively, adding, his “broad experience across both agency and major label systems makes him the ideal fit to usher Audible Treats into its next chapter.”

Oak View Group elevated Nick Vaerewyck to senior vp of programming and hired Danny Cohen as director of programming at Seattle’s Climate Pledge Arena, home of the NHL’s Kraken. Vaerewyck will lead strategic content development across the Pacific Northwest and oversee programming, private event sales, service and ticketing. He joins the executive leadership team and brings experience from roles at Brooklyn Sports and Entertainment and Nassau Coliseum on Long Island, NY. Vaerewyck has managed over 200 events annually and aims to further elevate Seattle as a premier entertainment market. Cohen, with 15 years in the industry, will support all event programming. Previously, he led programming at Colorado Chautauqua in Boulder. Vaerewyck expressed excitement for the arena’s continued growth, highlighting Seattle’s rise as a top-tier venue and welcoming Cohen to help expand their world-class programming and industry impact.

Big Machine Music named Preston Berger as senior manager of publishing. Berger will join the publishing creative team in representing the BMM catalog and management of the company’s roster of songwriters. Berger previously spent three years at Black River Entertainment’s publishing arm. Prior to Black River, he spent time as an agent assistant at CAA. At the 2025 NSAI Member Awards, he was honored with the friend of NSAI award. –J.N.

BOARD SHORTS: The Nashville Songwriters Association International recently completed its board of directors elections and held the first meeting of the new term. New members Deric Ruttan, Lydia Vaughn and Dan Wilson joined the board, with Jimmy Yeary returning. Eight current members were re-elected, including Kelly Archer and Jessie Jo Dillon. Roger Brown was re-appointed legislative chair, with Rhett Akins and Caitlyn Smith as artist writer board members and Brett James as industry liaison. Officers for the year include Lee Thomas Miller as president and Jenn Schott as vice president.

Select Management Group, a top management firm for next-gen digital creators, announced several strategic promotions and new hires to enhance its services for digital creators. Lauren Fisher has been promoted to director of strategic partnerships, where she will work with top brands like Disney, Uber, Netflix, and Google. Emily Rifanburg joined as a talent manager, bringing over a decade of experience from ICM Partners and Strand Entertainment. Payton Booker and Natasha Trepel have also been promoted to talent managers, focusing on supporting clients across various verticals. Additionally, Katie Josiah has been promoted to talent coordinator, and Madison Dailey and Daisy Wright have been hired as talent coordinators.

Beatchain, an AI-powered A&R and artist services platform, appointed Holly Hutchison, Umesh Luthria and Nick Hamman as regional brand ambassadors for North America, Asia and Africa, respectively. They’ll support Beatchain’s global expansion by strengthening partnerships and driving business development in their regions. Beatchain’s tech helps artists retain their music rights while offering insights into audience growth and performance. Hutchison brings over 35 years of A&R experience; Luthria, based in Mumbai, has over three decades of business expertise and helped launch Muzartdisco Arena; and Hamman, a digital strategist and radio presenter in Johannesburg, has significantly impacted South Africa’s music scene. Said Beatchain CEO Ben Mendoza: “This expansion will help build stronger connections between artists and the global music ecosystem, making it easier for the industry to discover, develop and monetize talent on a global scale.”

The Zach Sang Show appointed Allie Gold as its new social media director, strengthening its digital and multi-platform presence. In her new role, Allie will lead content creation, community management, and multi-platform strategy to further engage fans with the show. Gold brings valuable experience in content creation and audience engagement, having previously served as social media strategy director at iHeartRadio LA and digital marketing strategist at Live Nation. She also played a key role in social media strategy for The Elvis Duran Show and Z100 New York.

ICYMI:

David Massey

Danny Hayes is stepping down from his role as chief executive and partner at Danny Wimmer Presents after more than ten years … Marshall Nolan has been promoted to executive vp and head of commercial strategy at Island Records … Sony Music announced that David Massey, who has served as president of Arista Records since its relaunch in 2018, will retire at the end of June. The company has not yet named his successor. [Keep Reading]

Last Week’s Turntable: Board Buildups at ASCAP and iHeart

Longtime dance/electronic world agent Maria May of CAA will be honored with the Legends Award at IMS Ibiza 2025 for her notable contributions to electronic music culture.

With her career extending back more than three decades, May helped develop and legitimize the electronic music scene, bringing it out of warehouses to large-scale venues and events worldwide.

May currently represents a flurry of dance world stars, including David Guetta, Sara Landry, Marlon Hoffstadt, Róisín Murphy, Paul Kalkbrenner, Robin Schulz, Icona Pop, The Chainsmokers, Jonas Blue and Black Eyed Peas, among others. She’s also worked with artists including Frankie Knuckles, David Morales, Layo and Bushwacka, Hercules and Love Affair, Azari and III, Moloko, Soulwax, 2manydjs, Lee Burridge, and X-press 2.

“To receive this recognition is both humbling and very exciting,” May said in a statement. “Not merely because of what it represents for my career, but because of what it stands for in the wider culture of electronic music. The first woman to be publicly recognized for her efforts with an award of this gravitas has been a long time coming. Watching electronic music evolve from underground rebellion to a global movement and being one of the many architects of the global business phenomenon that we have created and now being recognized for these efforts is something I never imagined when I went to my first rave.”

Trending on Billboard

Beyond her work as an agent, May is being honored for advocacy work that includes her role as a board member of Lady of the House, a collective that works to amplify women in the dance music industry. She has a position on the board of Beatport, a position on the advisory board of the Frankie Knuckles Foundation, was a founding advisory board member of the Association For Electronic Music (AFEM) and has been a longtime board member of the Night Time Industries Association.

May has also been included multiple times on Billboard‘s International Power Players and Women In Music power lists.

The award will be presented during The Beatport Awards, happening at Atzaró Agroturismo on the evening of April 24. It’s one of the many gatherings happening on the island in conjunction with IMS Ibiza. There will also be an industry lunch in May’s honor during the three-day dance industry gathering.

“I have enjoyed watching Maria’s career grow from my first meeting with her in the offices of ITB in 1994, seeing her develop with her acts into a global force of nature when it comes to agenting talent,” says IMS and AFEM co-founder Ben Turner. “Her role behind the scenes in affecting how the industry operates may not be seen by so many, but is felt by everybody. She challenges the industry to think and be better. She cares as much today as she did as a passionate agent in her early 20s on the dancefloor at Liquid in Miami listening to Frankie Knuckles and David Morales — which is how I will always visualize her! Both IMS and the clubbing industry of Ibiza are truly proud of her achievements. Electronic music is in a better place because of the person that is Maria May.”

“Maria May has been a transformative force in electronic music for over three decades,” adds Robb McDaniels of The Beatport Group, which acquired a majority stake in IMS in 2023. “Her work behind the scenes has helped shape the careers of some of the most iconic artists in our culture. At Beatport, we’re proud to recognize her contributions and leadership, especially her tireless advocacy for women in our industry. Maria has not only opened doors, she’s helped rebuild the very rooms where decisions are made. She embodies the spirit of this award.”

IMS Ibiza happens at the Mondrian Ibiza and Hyde Ibiza hotels this April 23-25. The event will feature three days’ worth of panel discussions from experts across many sectors of the industry, along with mixers, networking opportunities, performances, a robust wellness program and much more. See the complete IMS Ibiza 2025 schedule here.

President Trump’s global tariffs, which were paused for 90 days shortly after going into effect on Wednesday (April 9), have set global markets on a rollercoaster downhill and put on hold many of the year’s most-anticipated IPOs. Although markets rebounded strongly after the U.S. Treasury Department lowered most tariffs to a flat 10% — China is a notable exception — some anticipate the market volatility could present an opportunity for music catalogs and debt in the coming months, as investors look for more stable ground.

Both sectors — investing in music intellectual property and buying asset backed securities (ABS) collateralized by music rights — could see more demand from institutional investors looking to stockpile cash and safeguard against equities, several royalty investors, music valuation experts and entertainment bankers tell Billboard. For over a decade, music catalog returns have held relatively steady even during economic downturns, which may appeal to investors looking for assets they can easily cash out of in a pinch, those sources said.

Trending on Billboard

“The royalties space has been relatively calm over the last week given the volatility seen elsewhere, with many investors expecting their portfolios to remain resilient as they have been through other macroeconomic and geopolitical events, although it’s still early days,” says Stephen Otter, managing director at the Swiss-based private equity firm Partners Group. An investor in Harbourview Equity Partners, Round Hill Music and Lyric Capital Group, Partners launched its own royalty investment strategy in February to acquire music, healthcare, renewable energy and other royalties, with the aim of accumulating $30 billion in assets under management by 2033.

“As investors reassess their portfolio allocations in today’s environment, we expect many may consider casting their net wider to incorporate other asset classes, such as royalties,” Otter adds.

The rise of paid music streaming, which accounted for 51% of global recorded music revenues in 2024, according to the IFPI, has helped stabilize music royalties and make their returns more predictable into the future. While rights holders have some exposure to recessionary changes such as advertising spending and consumer discretionary spending, “Music streaming tends to perform well and has historically offset other declines,” says Brad Sharp, senior managing partner at Virtu Global Advisors.

Shot Tower Group, a Baltimore-based boutique investment bank, said that investor interest in music assets remains high despite industry reports of slowing streaming growth, although that outlook could change if macro-economic uncertainty persists, or a trade war were to take hold.

Brian Richards, managing partner at the music-focused investment bank Artisan, tells Billboard, “We haven’t seen any evidence of pullback in the music market during this past week of turbulence.”

Two sources said they expect more activity in the near-term in the credit markets for music. In the past 18 months, a growing number of music companies, like Concord, HarbourView and Recognition, formerly Hipgnosis, have raised money in the debt markets by selling asset backed securities backed by the songs they own in their portfolios.

These sources anticipate more esoteric debt like this to become available to investors because corporate bonds have been rallying since the beginning of the year, driving a narrowing in the difference between the yields of Treasury bonds and corporate bonds. A narrow, or tight, spread between those bonds typically signals optimism.

Shot Tower says it expects at least one music company to issue an asset-backed security in April, which could provide a gauge of investor sentiment. If the chaotic market mood and global uncertainty stick around, however, it could mean fewer music catalogs come up for sale and financing becomes more selective, Shot Tower says.

At least one industry group expressed fears over the possibility of retaliatory tariffs on digital services companies, such as Apple Music, Amazon, Meta and YouTube, and maybe even issues collecting royalties.

“Since creative industries are among the few American industries that have a positive balance of trade with other nations, we will be watching closely to see if other countries target American music in any retaliation, which could include tariffs or other actions like withholding royalty payments,” A2IM president/CEO Richard Burgess wrote in an email to members this week.

The withholding of royalties is unlikely, says Sharp, or may be limited to countries such as China that have higher tensions with the U.S.; on Wednesday, the Treasury raised the tariff on goods from China to 125% following the country’s imposition of retaliatory tariffs on U.S.-made goods.

“A rise in global economic tensions may result in an increase in consumption of more localized content on a by-country or by-region basis,” says Sharp. Economic policy could also result in higher inflation, he adds, “which will potentially impact interest rates and have a knock-on effect on valuations.”

Additional reporting by Ed Christman.

Seeker Music has partnered with Blackheart, the independent company founded by Joan Jett and longtime collaborator Kenny Laguna, to acquire what is described as a “substantial share” of Jett’s publishing and recorded music rights, it was announced on Thursday. This collaboration aims to enhance the Joan Jett and the Blackhearts catalog, with plans for releasing unreleased music, reimagining classic albums and launching new campaigns tied to her global tours.

The Rock and Roll Hall of Fame inductee (class of 2015) has left quite a mark on rock music with hits like “Bad Reputation,” “Crimson and Clover,” “Do You Wanna Touch Me (Oh Yeah)” and “I Hate Myself for Loving You.” Formed in 1979 following the breakup of The Runaways, Joan Jett and the Blackhearts have achieved eight platinum and gold albums and nine Top 40 singles, including her sneering hit “I Love Rock ‘N Roll,” which topped the Hot 100 for several leather-clad weeks in early 1982.

Trending on Billboard

Seeker Music, founded in 2020 by M&G Investments and led by Evan Bogart, manages a diverse catalog of over 15,000 copyrights, including works by artists like Run The Jewels, Jon Bellion, Christopher Cross and others.

The partnership between Blackheart and Seeker Music represents a full-circle moment of sorts, connecting two storied rock and roll family legacies. Carianne Brinkman, Laguna’s daughter and the president of Blackheart, and Evan Bogart, son of legendary record executive Neil Bogart, who signed Jett to his Boardwalk Records, are key figures in this collaboration.

“Seeker joining forces with Joan, Kenny, Carianne and Blackheart isn’t just a partnership, it’s a personal, powerful reunion… reigniting a legacy and carrying the torch forward with the same rebellious spirit that ignited it,” said Evan Bogart.

Kenny Laguna, Steven Melrose, Joan Jett, Evan Bogart and Carianne Brinkman.

Brandon Young

Brinkman and Laguna echoed Bogart’s sentiment on the serendipity of the collaboration.

“I can’t imagine a better partnership that is at once completely new but a return to a shared legacy that began with the belief in Joan Jett and the Blackhearts,” said Brinkman.

Laguna added: “It’s too coincidental to be a coincidence, so I am so overwhelmed to see how fate brought Carianne and Evan Bogart at Seeker together 58 years after I had my first hit with Neil Bogart.”

The partnership was negotiated by LaPolt Law, P.C., and Reed Smith, LLP, with support from Seeker’s chief creative officer Steven Melrose and Blackheart’s head of distribution and operations Hubert Górka.

“At Seeker, our celebrated creative and innovative approach to catalog means that our focus is on super-serving Joan’s current fans, whilst growing her fandom year on year – essentially taking Joan’s music into millions of new homes globally,” said Melrose. “For a catalog as expansive and legendary as Joan Jett and the Blackhearts’, we’re working on plans to release incredible archival moments, activations around her best-selling global tours, reaching new fans through global and cross-genre campaigns, and creative re-releases of beloved albums utilizing new platforms around the world.”

The companies did not disclose financial aspects of the deal, nor the specifics of the “substantial share” of the acquired catalog.

HYBE Interactive Media (HYBE IM) secured an additional KRW 30 billion ($21 million) investment, with existing investor IMM Investment contributing another KRW 15 billion ($10 million) in follow-on funding. Shinhan Venture Investment and Daesung Private Equity joined as new investors in the company, which plans to expand its game business using HYBE’s K-pop artist IPs. To date, HYBE IM has raised a total of KRW 137.5 billion ($100 million). With the new money, the company plans to enhance its publishing capabilities and execute its long-term growth strategy by allocating it to marketing, operations and localization strategies to support the launch of its gaming titles.

Live Nation acquired a stake in 356 Entertainment Group, a leading promoter in Malta’s festival and outdoor concert scene that operates the country’s largest club, Uno, which hosts more than 100 events a year. The two companies have a longstanding partnership that has resulted in events including Take That’s The Greatest Weekend Malta and Liam Gallagher and Friends Malta Weekender being held in the island country. According to a press release, 356’s festival season brought 56,000 visitors to the island, generating an economic impact of 51.8 million euros ($56.1 million). Live Nation is looking to build on that success by bringing more diverse international acts to the market.

Trending on Billboard

ATC Group acquired a majority stake in indie management company, record label and PR firm Easy Life Entertainment. The company’s management roster includes Bury Tomorrow, SOTA, Bears in Trees, Lexie Carroll, Mouth Culture and Anaïs; while its label roster boasts Lower Than Atlantis, Tonight Alive, Softcult, Normandie, Amber Run, Bryde and Lonely The Brave. Its PR arm has worked on campaigns for All Time Low, 41, Deaf Havana, Neck Deep, Simple Plan, Travie McCoy and Tool.

Triple 8 Management partnered with Sureel, which provides AI attribution, detection, protection and monetization for artists. Through the deal, Triple 8 artists including Drew Holcomb & the Neighbors, Local Natives, JOHNNYSWIM, Mat Kearney and Charlotte Sands will have access to tools that allow them to opt-in or opt-out of AI training with custom thresholds; protect their artist styles from being used in AI training without consent by setting time-and-date stamp behind ownership; monetize themselves in the AI ecosystem through ethical licensing that can generate revenue for them; and access real-time reporting through Sureel’s AI dashboard. Sureel makes this possible by providing AI companies “with easy-to-integrate tools to ensure responsible AI that fully respects artist preferences,” according to a press release.

Merlin signed a licensing deal with Coda Music, a new social/streaming platform that “is reimagining streaming as an interactive, artist-led experience, where fans discover music through community-driven recommendations, discussions, and exclusive content” while allowing artists “to cultivate more meaningful relationships with their audiences,” according to a press release. Through the deal, Merlin’s global membership will have access to Coda Music’s suite of social and discovery-driven features, allowing artists to engage with fan communities by sharing exclusive content and more. Users can also follow artists and fellow fans on the platform and exchange music recommendations with them.

AEG Presents struck a partnership with The Boston Beer Company that will bring the beverage maker’s portfolio of brands — including Sun Cruiser Iced Tea & Vodka, Truly Hard Seltzer, Twisted Tea Hard Iced Tea and Angry Orchard Hard Cider — to nearly 30 AEG Presents venues nationwide including Brooklyn Steel in New York, Resorts World Theatre in Las Vegas and Roadrunner in Boston, as well as festivals including Electric Forest in Rothbury, Mich., and the New Orleans Jazz & Heritage Festival.

Armada Music struck a deal with Peloton to bring an exclusive lineup of six live DJ-led classes featuring Armada artists to Peloton studios in both New York and London this year. Artists taking part include ARTY and Armin van Buuren.

Venu Holding Corporation acquired the Celebrity Lanes bowling alley in the Denver suburb of Centennial, Colo., for an undisclosed amount. It will transform the business into an indoor music hall, private rental space and restaurant.

Secretly Distribution renewed its partnership with Sufjan Stevens‘ Asthmatic Kitty Records, which has released works by Angelo De Augustine, My Brightest Diamond, Helado Negro, Linda Perhacs, Lily & Madeleine, Denison Witmer and others. Secretly will continue handling physical and digital music distribution, digital and retail marketing, and technological support for all Asthmatic Kitty releases.

Symphonic Distribution partnered with digital marketing platform SymphonyOS in a deal that will give Symphonic users discounted access to SymphonyOS via Symphonic’s client offerings page. Through SymphonyOS, artists can launch and manage targeted ad campaigns on Meta, TikTok and Google; access personalized analytics for a full view of fan interactions across platforms; build tailored pre-save links, link-in-bio pages and tour info pages; and get AI-powered real time recommendations to improve marketing campaigns.

Bootleg.live, a platform that turns high-quality concert audio into merch, partnered with Evan Honer and Judah & the Lion to offer fans unique audio collectibles on tour. Both acts are on tour this fall. The collectibles, called “bootlegs,” are concert recordings taken directly from the board, enhanced using Bootleg’s proprietary process, and combined with photos and short videos.

A trio of in-depth environmental impact reports are set to be presented for the first time each at next week’s Music Sustainability Summit in Los Angeles.

Representatives from MIT will be at the event to present their Live Music Emissions in the UK and US report, a comprehensive study of the live music industry’s carbon footprint.

The report aims to create a comprehensive assessment of the relationship between live music and climate change, identify primary areas where the industry and concert goers can make tangible improvements to reduce emissions and provide analysis of the latest developments in green technology and sustainable practices. This study has been co-funded and supported by Warner Music Group, Live Nation and Coldplay.

Additionally, Madeline Weir, director of impact at REVERB will present the longstanding organization’s Concert Travel Study, which highlights concert travel — one of the largest sources of live music-related emissions — and shows how the broad music community can address it through collective action. This report is based on insights from more than 35,000 fans at over 400 shows and offers practical, scalable solutions to create more sustainable concerts.

Trending on Billboard

Finally, representatives from sustainability programs at Columbia University will present a report analyzing current practices, surveying the regulatory landscape and identifying challenges and opportunities related to implementing sustainability practices in venues. An accompanying toolkit will offer tips on how venues can integrate sustainability into their business operations. This report was done in partnership with the Music Sustainability Alliance, with support from OVG and AEG.

The second annual Music Sustainability Summit happens on April 15 at Solotech Studios in Los Angeles. The day-long gathering will offer a robust schedule featuring talks, panel discussions, networking opportunities, performances and more. See the complete program here.

Passes for the Summit are available here. Billboard is the official media sponsor of the event.

“Providing a platform for our partners to present their research at MSS25 is about turning knowledge into momentum,” says Amy Morrison, CEO and Co-founder of the Music Sustainability Alliance. “Whether it’s fan travel, venue operations, or the emissions footprint of live music, these studies help identify where the biggest challenges and the greatest opportunities exist. At MSA, we’re here to ensure the industry has the tools and insights it needs to lead on climate.”

At last month’s Billboard Women in Music ceremony in Los Angeles, Breakthrough honoree Ángela Aguilar took a moment to express her solidarity with the Latin immigrant community, dedicating her award to women who cross the border to the United States “with nothing but hope in their hearts, only to find themselves living in uncertainty and fear,” she said in a poignant speech that prompted a standing ovation. “You deserve safety, dignity, the right to dream.”

Aguilar is part of a growing group of Latin artists — including Shakira, Maná and Alejandro Fernández — who are using their platforms to speak up for immigrants after President Donald Trump took office in January and immediately launched an aggressive crackdown on immigration, pledging to carry out mass deportations.

Trending on Billboard

But it was perhaps regional Mexican artist Tony Aguirre who addressed the situation more bluntly. “I’m scared that no one will show up to my shows,” he said during an interview with a Mexican podcaster when asked how things were going with Trump as president. Aguirre tells Billboard he is genuinely worried.

“Regional Mexican events have been directly impacted, and it’s not just me going through this, many of my colleagues feel this way,” says Aguirre, who tours mainly in the U.S. “When it all started, we were reaching out to each other just to see how things were going and everyone was saying the same thing, low attendance. People are scared to go out because of mass deportation threats, and I wanted to speak up because it seems like no one in our industry is willing to really to talk publicly about how this has impacted our industry, and it’s important that we do.”

While the effects of Trump’s policies on Latin music still remain to be seen on a larger scale, there is a real concern about the impact.

Abel DeLuna, California-based member of the veteran Mexican music association Promotores Unidos and founder of Luna Management, is once again dealing with a situation that’s historically effected regional Mexican bailes, which are small but mighty shows (and for many years the backbone of the genre) predominantly held in nightclubs catering to a specific demographic and booked by indie promoters. In 2007, Billboard’s Leila Cobo interviewed DeLuna about “stepped up” immigration enforcement under the George W. Bush administration, where he said then that the immigration situation alone accounted for 20% to 25% of the drop in his concert promotion business. He relived the same scenario 18 years later when Trump took office for a second term earlier this year, with that fourth week of January and first week of February being particularly brutal. DeLuna says shows in those weeks sold only around 10% to 15% of tickets, which ultimately led him to cancel some shows in Northern California.

“Our people are worried,” says DeLuna, speaking over the phone just weeks after Trump took office. “Many are afraid to go out, afraid to go out to work, afraid to go to the bailes, concerts, several having to get canceled because people are not buying tickets. I don’t know how long this is going to last, if it is really going to calm down soon or if it is going to go on for a long time and if it does, then our people are going to suffer a lot and the whole business is going to suffer.”

Low concert attendance aligns with a decrease in foot traffic in predominantly Hispanic neighborhoods around the country since Trump took office, says Maria Teresa Kumar, president of Voto Latino, a non-profit organization that aims to encourage young Hispanic and Latino voters to register to vote.

“People are scared that they’re going to be targeted and rounded up, creating a chilling effect happening around a community that is getting internalized mentally but also physically in their decisions to not go shopping or go to concerts,” says Kumar, who in the past has teamed up with artists like Maná and Los Tigres del Norte to get Latinos more politically involved.

The Latin music industry thrives on a diverse fan base, and while it’s reaching a global audience now more than ever, its core listeners are still Latinos, and a significant portion of them are immigrants. Just as with previous administrations, when there are increased reports of immigration raids in U.S. cities, businesses inevitably suffer. That includes everything from flower shops and restaurants in Chicago seeing a notable decline in sales to schools and churches feeling the “chilling effect,” as The New York Times put it in a report about “immigrants in hiding” over fear of deportation.

DeLuna says the sobering topic came up at the annual conference for Promotores Unidos, a long-standing Latin concert promotion association with more than 300 members, in Las Vegas in January.

“[Immigration] is the most important conversation right now,” DeLuna says categorically. “With those I have talked to among the association, I recommend the same thing: We must take care of ourselves, but we have to work harder and try to do better promotion to get people to come to our events, even if that means keeping prices low. What I’m personally doing is lowering prices to see if people feel encouraged to come out.”

Enrique Ortiz of Luz Record, a management, promotion and booking agency based out of L.A., also attended the Promotores Unidos conference in Las Vegas and says that while misinformation on social media about alleged raids in certain cities has also affected concert attendance, he’s been following the situation closely. “We’ve been noticing that ICE is arresting those with a criminal record, yes, but also those who don’t [have one]. And that’s concerning. It has a direct impact on all of us as managers, promoters, musicians.”

Billboard’s reporting confirms that this is an ongoing topic of conversation in important Latin music spaces and is top of people’s minds — although many in the industry prefer not to speak on the record about it. Over the course of two months, Billboard reached out to more than a dozen industry leaders, from managers to agents to promoters, for this story, with the majority declining to give an interview about just how much the Trump administration could impact the business of Latin music. Some who agreed to speak on background on the condition of anonymity expressed the same sentiment: uncertainty. One source, a manager to a well-known regional Mexican act, said they had already seen the impact on live shows in certain markets, particularly concerts that mainly book more traditional (i.e. older) regional Mexican acts.

Josh Norek, president of Regalias Digitales, refuses to stay silent and blasted a wide email to his contacts in March with the subject line: “Latin music industry — the time to speak is now.”

“From venues and record labels to artists and crews, deportations create instability that threatens the economic power of Latin music,” Norek’s email reads, with messaging crafted by Voto Latino for artists and executives to share. “If our audiences and communities are at risk, our industry suffers.”

Norek is particularly focused on the impact Trump’s administration will have on royalties should his promise of mass deportations come to fruition. “I project in the next four years we’ll see a significant decrease in earnings,” he tells Billboard. “I care tremendously on a humanitarian standpoint, but when you think about the economic impact, it’s very simple math: A stream coming from Mexico is worth about 2% of a stream coming from the U.S. So, if you deport 5 million streamers and put them in places like Mexico, Guatemala or Venezuela, you go from paying $10 a month for Spotify to [the] free ad-supported tier in Mexico, and it will generate almost nothing. Meanwhile, Pandora exists only in the U.S. and if you take away those users, it will impact SoundExchange royalties. You shouldn’t have to be a Democrat, Republican or independent to be thinking about the economic impact of deportations.”

Adding to the precariousness of it all, Trump’s global tariffs, announced on April 2, could also affect the U.S. music industry, from musical instrument manufacturers to the vinyl business. They could also lead to a potential decrease in local tourism, directly impacting concert and festival attendance in the U.S.

“During these times [of uncertainty], people are double-thinking how to spend their expendable income and, sadly, concerts are one of those pieces that are disposable income,” adds Kumar. “It’s been only two months and we’re already seeing the implications in the music industry, in hospitality, retail industry — this is not tenable.”

Norek reached out to Voto Latino to help craft messages for industry leaders and artists to share, although the shareable posts have yet to garner wider traction. “I understand that it’s tough for some people to speak out because they don’t want to be demonized,” says Norek. “However, now there’s just outward hostility toward Latinos and immigrants. The least we can do is show our clients that we care. This is our audience.”

Charli XCX appointed PPL for the collection of her international neighboring rights royalties, joining a client list that includes Ice Spice, Kenya Grace, London Grammar, Becky Hill, Sigala, Joel Corry and Lewis Thompson.

Downtown Artist & Label Services announced a trio of new deals including with Capital Cities (“Safe and Sound”), which partnered with the distributor to support the band’s catalog and future releases, including the release of the band’s A Hurricane of Frowns album on Feb. 14. Downtown also signed with Sofi Tukker for the U.S. rights to the duo’s catalog and upstreamed Twenty One Pilots‘ self-titled debut album, originally released via Downtown-owned distributor CD Baby in 2009.

Indian singer Sid Sriram signed a joint venture with Warner Music India that encompasses recorded music, management, live performances, brand collaborations and strategic ventures focused on non-film Indian-language music. Sriram and Warner Music India will “scout and nurture a new wave of global talent” under the agreement. The first release under the deal is Sriram’s “Sivanar,” which was released on Thursday (April 3).

Trending on Billboard

Indian star Guru Randhawa also signed with Warner Music India, which will release his next album, Without Prejudice. The first single, “Gallan Battan,” was released on March 28. Randhawa’s deal covers recorded music, live experiences, fan engagement and more. The deal includes new management led by Gurjot Singh, who founded BeingU Studios.

Chicago pop-rock quintet The Walters (“I Love You So”) signed a licensing deal with Amuse, which released the band’s debut album, Good Company, late last month. Amuse is providing frontline support, including DSP optimization, playlisting, editorial relationships, marketing, design support and UGC monetization help.

Indie singer-songwriter Alice Phoebe Lou signed with Nettwerk, which will release her first self-produced single, “You and I,” on Friday (April 11). Lou is managed by Gorka Odriozola at Independent Artists Management and booked by Brian Greenwood and Carly James at CAA.

Country band LANCO signed with UTA for representation in all areas. The band released its debut album, We’re Gonna Make It, in January; recently completed its We’re Gonna Make It tour; and is slated to play multiple fairs and festivals this summer. LANCO is managed by Bryan Coleman and Eleanor Kohl at Union Entertainment Group/Red Light Management.

Caroline Jones, a country singer-songwriter and member of Zac Brown Band, signed a recording deal with Big Machine Label Group’s Nashville Harbor Records & Entertainment. The label released her latest track, “No Tellin,’” on March 28.

Former We The Kingdom member Franni Cash is launching a solo career and has formed her new team, which included signing a label deal with Capitol Christian Music Group and aligning with WME for booking representation. She is managed by Round Table Management’s Hannah Gifford. As part of We The Kingdom, Cash has earned two Grammy nominations and won three GMA Dove Awards. – Jessica Nicholson

Americana band The Brudi Brothers signed with Mom+Pop Music on the heels of its viral single “Me More Cowboy Than You.”

Emerging country singer-songwriter Tyler Nance signed a management deal with Redline Entertainment in Nashville. Nance will be managed by the firm’s Larry Blackford and Wes Mayers. He released his debut EP, Wasted Chances, last year.

Ohio native and country-rock artist Preston Cooper has signed with The Neal Agency for booking representation. Cooper has released songs including “Numbers on a Mailbox” and Weak” and will release his debut album, Toledo Talkin’, on May 30. The Neal Agency’s roster also includes Morgan Wallen, Ernest, HARDY, Bailey Zimmerman, Ella Langley and Anne Wilson. – Jessica Nicholson

State Champ Radio

State Champ Radio