Business News

Page: 14

When Chappell Roan called on the music industry to pay artists a living wage and give them health insurance during her Grammys acceptance speech in February, she sparked a debate about labels’ responsibility to the acts they sign, including the artist’s potential — and the label’s investment — that is put at risk if mental health struggles take center stage.

Nearly three-quarters of some 1,500 independent musicians reported struggling with mental illness, according to a 2019 survey by the digital distribution platform Record Union. Even among unionized musicians and performers, rates of mental health problems and substance use disorder are higher than among the general population, according to Sound Advice, a book written by music journalist Rhian Jones and performance coach Lucy Heyman.

Trending on Billboard

Over the past several months, Billboard asked more than a dozen artists, managers, financial planners, music executives and therapists about creatives’ single biggest out-of-pocket health care expense, and the answer was consistently the same: therapy.

Sobriety coaches, on-tour therapists and mental skills training offer potentially career-saving — even lifesaving — support for singers battling anxiety so intense it can rob them of their voices.

But they come with eight-to-10-figure medical bills, these sources say. And health insurance, for those fortunate enough to have it, often covers just a fraction of the cost.

“It’s $250 a session for someone who is good and qualified,” says Chief Zaruk, joint-CEO of The Core Entertainment, an entertainment company launched with Live Nation that represents Bailey Zimmerman, Nate Smith, Nickelback and others. “If you’re a beginner artist without a record deal, maybe a publishing deal, you’re making $2,500 a month, and you’re like, ‘Wait, I’m going to take more than a third of that and put it toward a therapist?’ They just can’t do it.”

Zaruk and Core co-founder and CEO Simon Tikhman provide their employees with 10 free sessions with a therapist, a life coach or business coach each year. Tikhman says they extend the service to many of their artists, including those just starting off, because, “If you help yourself now when you are playing in 200-300 person venues, it will give you the tools to help you manage [feelings of] overwhelm when you are in arenas.”

Ariana Grande, who has made millions of dollars of free counseling available to fans through a partnership with app-based therapy company Better Help, called on record labels in February to include therapy coverage in young artists’ contracts.

At least one major music company explored the cost of providing those services, according to a former executive from the company who spoke on condition of anonymity. That former executive, who advocated that the company offer therapy as a recoupable expense, says internal researchers determined around 2020 that coverage was ultimately too costly.

While therapy is expensive, the cost of foregoing needed mental health care is enormous, says Dr. Terry Clark, director of The Conservatory at Canada’s Mount Royal University.

For more than two decades, Clark has studied how mental skills training is used to equip classical musicians and dancers with tools to cope with stage fright and anxiety after failed auditions. Some of the lessons involve setting goals and picturing oneself achieving those goals on stage, like an imaginary rehearsal where the artist can make mistakes and envision how the show could go on.

“Careers can go on a long, long time,” Clark says. “But if you burn yourself out and there isn’t a later, the cost is enormous when you look at what you’ve lost.”

In a recent interview with Rolling Stone, Lorde described successfully treating her paralyzing stage fright with the psychoactive drugs MDMA and psilocybin, a therapy commonly used to treat post-traumatic stress disorder, though that is still awaiting approval for use in the United States.

For others, substance use disorders can be part of their mental health struggles.

Kristin Lee, founder of the Los Angeles-based business management firm KLBM, says her musician clients’ biggest out-of-pocket health care expense is treatment for addiction and substance use disorders.

A number of organizations, including MusiCares, Music’s Mental Health Fund, Sweet Relief and Backline, provide financial assistance to help independent artists pay for mental health care. Lee estimates 35 percent to 40 percent of her clients get subsidized health insurance through SAG-AFTRA, and those who don’t qualify for it often pay $700 to several thousand every month for private insurance for themselves and employees.

“Touring is probably the absolute worst thing to do while you’re trying to be sober. It’s a rigorous way of life with no downtime, and it’s entertainment, so it’s supposed to be fun,” Lee says. She says some of her clients have hired sobriety coaches to go on tour with them at a cost of $70,000 a year.

Sobriety coaches are meant to be a resource a patient needs less over time, and so the cost eventually declines. Regardless, the investment for many is worth it.

“Rehab is expensive, too,” Lee says.

Dr. Chelsey Green is the first Black woman elected as the Recording Academy’s chair of the board of trustees. She succeeds Tammy Hurt, who has served in that role since 2021. This marks the first time in Recording Academy history that two women have served back-to-back in the top post.

Dr. Green, 39, is also the youngest person ever elected chair. Dr. Green, who was vice chair last term under Hurt, was selected at this year’s annual board of trustees meeting. Her term officially began on Sunday (June 1). At the same time, Evan Bogart was elected vice chair; Jennifer Blakeman was elected secretary/treasurer; and Hurt was elected chair emeritus.

In Academy history, just two other women (besides Hurt and Green) have served as chair. Leslie Ann Jones was chairwoman (the title at the time) from 1999-2001. Christine Albert was chair from 2013-15.

Trending on Billboard

Green is the third Black officer to be elected chair, following Jimmy Jam (2007-09) and Harvey Mason jr. (2019-21). Mason went on to become the academy’s CEO.

“I am honored to welcome both our newly elected board and national officers to the Recording Academy, made up of passionate, talented leaders who care deeply about music and the people who create it,” Mason said in a statement. “Together, their extensive background in the industry will help us to continue to push the Academy forward and drive meaningful change.”

The Recording Academy’s elected officers dedicate their time in service to the academy and play an important role in helping to shape the organization’s strategic direction. They collaborate with the CEO and senior academy management, who work to fulfill the organization’s mission of serving music people through advocacy, education, and direct assistance and by shining a spotlight on musical excellence.

Here’s a closer look at the top four officers:

Dr. Chelsey Green is a recording artist, entrepreneur and educator. As the bandleader, violinist, violist, and vocalist behind her ensemble Chelsey Green and The Green Project, Dr. Green fuses her classical training with jazz, R&B, soul and funk. She has released five studio projects, with one (2022’s Chelsey Green & the Green Project) landing on Billboard‘s Contemporary Jazz Albums chart in 2014. Dr. Green has performed alongside artists such as Kirk Franklin, Lizzo, Samara Joy, Stevie Wonder, The War and Treaty, and Wu-Tang Clan, and has made orchestral debuts with the National Symphony Orchestra, the Alexandria Symphony, the United States Air Force Band, and more. An advocate for music education and equity, she leads educational concerts, artist residencies, and community workshops, and is an associate professor at Berklee College of Music.

Evan Bogart is a songwriter, producer and creative executive, who has had a hand in creating hits for Beyoncé, Britney Spears, Madonna, Rihanna and more. Son of legendary Casablanca Records founder Neil Bogart (who died in 1982 when Evan was just four), Evan got his start in the music industry as a teenager in the Interscope Records A&R department, working on projects by 2Pac and Eminem, before moving into artist management and booking, representing such acts as Maroon 5 and OneRepublic. Currently, he is CEO of Seeker Music. Bogart has been named to Billboard’s 40 Under 40 list twice and to Billboard’s R&B/Hip-Hop Power Players list. Bogart recently served as the executive music producer and composer for Spinning Gold, an independent feature biopic based on his father, and for the musical-feature film, Juliet & Romeo, for which he co-wrote and produced all of the original music. Bogart also serves as chair of the academy’s Songwriters & Composers Wing.

Jennifer Blakeman is the chief rights and royalties officer at Seeker Music. For more than four decades, she has fostered the careers of some of the world’s most popular artists and songwriters. She has served in numerous senior executive and creative roles for major and indie publishers, record labels and film studios, including Atlantic Records, one77 Music, Universal Music Publishing, Universal Pictures, and Zomba Publishing. An accomplished musician and ASCAP songwriter and publisher, Blakeman was signed with her band to Warner Bros. Records and subsequently toured in the ‘80s as a keyboardist for Billy Idol, Brian Wilson and Savage Garden, among many others. For two decades she has been an adjunct professor at New York University and has taught more than 1,000 students in the music business degree program.

Tammy Hurt is a TV producer and drummer. She made history as the first openly LGBTQ+ officer in Recording Academy history. She serves on the boards of the Latin Recording Academy, the Grammy Museum and MusiCares. Hurt is the founder of Placement Music, a boutique entertainment firm specializing in custom music and scoring for high-profile clients including FOX Sports, Paramount Pictures, CBS and the NFL. Her passion project, Sonic Rebel, fuses high-fidelity soundscapes with mashups and live drum remixes. Hurt was honored in early 2025 by Billboard, Alicia Keys’ She Is the Music and the Atlanta City Council. Additional accolades include Catalyst Magazine’s Top 25 Entrepreneurs and the Atlanta Business Chronicle’s Most Admired CEO award.

Every two years, the voting and professional members of the academy’s 12 chapters vote in their respective chapter board elections to elect their chapter’s governors. Of the trustees that serve on the national board, eight are elected by voting or by professional (non-voting) members of the academy and 30 are elected by the chapter boards. The remaining four seats are composed of the national trustee officers serving the roles of chair, vice chair, secretary/treasurer, and chair emeritus, and are elected by the board of trustees once every two years. National officer positions on the board of trustees are subject to two, two-year term limits.

The academy also released the names of the members of its 2025-27 board of trustees, including 19 newly elected or re-elected members. The full body includes seven Grammy winners: artists Ledisi and Avery Sunshine; songwriter Jonathan Yip; arranger Sara Garzarek; music supervisor Julia Michels; producer Cheche Alara; and engineer/mixer Reto Peter.

2025-27 Board of Trustees

Here is the full list of the Recording Academy’s 2025-27 board of trustees in alphabetical order by first name. An asterisk signifies those who were elected or re-elected this year. Others are midterm.

Dr. Alex E. Chávez*

Armand Hutton*

Ashley Shabankareh

Avery*Sunshine*

Carl Nappa*

Cheche Alara

Dr. Chelsey Green

Dani Deahl

Dave Gross

Divinity Roxx*

Donn Thompson Morelli “Donn T”*

EJ Gaines

Evan Bogart

Fletcher Foster

HENNY

Jennifer Blakeman

Jessica Thompson

Jonathan Yip*

Julia Michels*

Julio Bagué*

Ken Shepherd

Lachi*

Ledisi*

Maggie Rose*

Marcella Araica*

Maria Egan

Matt Maher*

Ms. Meka Nism

Mike Knobloch

Nikisha Bailey

Reto Peter*

Sara Gazarek

Sue Ennis*

Tamara Wellons

Tami LaTrell*

Tammy Hurt

Taylor Hanson

Teresa LaBarbera*

Terry Jones

Torae Carr

Wayna*

The performance this week by Nigerian star TEMS is one eagerly awaited moment at the inaugural SXSW London, which opens Monday (June 2) and runs through Saturday (June 7), building on the four-decade legacy of the South By Southwest music, arts, film and tech conference and festival launched by four young colleagues in Austin, Texas, in 1987.

TEMS will headline The Stage at SXSW London on Thursday (June 5) in an exclusive concert presented by Billboard at London’s iconic music venue Troxy. She was featured on the cover of the magazine’s May 17 issue.

London is some 4,900 air miles from Austin where, in the mid 1980s, the idea of a conference and festival, initially focused on music, was hatched by the co-founders of SXSW: Roland Swenson, Louis Jay Meyers, Louis Black and Nick Barbaro. At the first event, held in March 1987, an expected 150 registrants reached 700 on the opening day.

In 2021, following the challenges of the pandemic, SXSW gained an investment partner in Penske Media Corporation (which also owns Billboard) and the film and production company MRC. Two years later, Penske took majority ownership of SXSW.

Under its new owners, SXSW has gone global. The third SXSW Sydney will take place in Australia’s largest city from Oct. 13-19.

This first SXSW London takes place at a time when the creative industries of the United Kingdom are more vital than ever, with the music business finding global success with superstars like Dua Lipa, Charli xcx, Coldplay and others. The event also follows the publication by Billboard of its annual Global Power Players list and its first U.K. Power Players list, whose honorees will be recognized at an invitation-only gathering.

Here are seven highlights to watch for at SXSW London.

By the Numbers

The Billboard Summit is launching in Canada with a global superstar who made history in the country.

Diljit Dosanjh will be a special speaker at the event, which will launch at NXNE in Toronto’s TIFF Lightbox on June 11, 2025.

The record-setting artist made history with his Dil-Luminati tour last year, with his stadium concerts at Vancouver’s BC Place and Toronto’s Rogers Centre going down as the biggest ever Punjabi music events outside of India. The musician and movie star has continued to spread Punjabi culture worldwide, recently bringing historic fashion to the Met Gala.

At the summit, Dosanjh will sit down for a special interview with another influential figure in the international music industry: Panos A. Panay, president of the Recording Academy, the organization behind the Grammys.

Billboard Canada has also announced two big performers for The Stage at NXNE.

Daniel Caesar is returning to where he played his first major headlining show: The Mod Club in Toronto on June 14.

Trending on Billboard

The venue will be reverting back to its original name of The Mod Club, rebranded by owner Live Nation from the name Axis Club for the first time since 2021.

When he first played the venue, Caesar was a golden boy with a golden voice, gaining buzz with his EP Pilgrim’s Paradise and still a year away from his classic 2017 debut, Freudian.

In 2023, Caesar graduated to arenas, playing Madison Square Garden in New York and Scotiabank Arena in his hometown of Toronto. The Mod Club performance is a special, intimate show for his fans who have been with him from the beginning. A year after he played The Mod Club in 2017, Caesar also played NXNE — then an up-and-coming talent, and now, with the festival turning 30, an artist who has reached undeniable headliner status.

After the last girls have left the party for their special DJ set on June 12, The Beaches will also play a special concert at a well-known Toronto venue on June 15.

It’s a big summer for the breakout Canadian band, with a recent festival set at Coachella and another big one this summer at Osheaga in Montreal. The Beaches’ new album, No Hard Feelings, comes out Aug. 29 on AWAL.

The band has also just announced the Canadian dates on its No Hard Feelings Tour, including its first hometown arena show at Scotiabank Arena on Nov. 6. The Beaches’ special Billboard Canada Live show will be considerably more intimate, a chance to get up close and personal with the band at a surprise venue. – Richard Trapunski

Quebec to Impose Quotas for French-Language Content on Streaming Platforms

Quebec may soon be getting stricter language regulations on streaming services.

Quebec Culture Minister Mathieu Lacombe tabled a new bill on May 21 that aims to add more French-language content to major streaming platforms, as well as increase its discoverability and accessibility by establishing quotas. The bill will directly impact platforms that offer media content such as music, TV, video and audiobooks, including giants like Netflix and Spotify.

Lacombe wants to push French-language and Quebecian content to the forefront on these apps, saying it is not always readily available. He pointed out that consumption of local and French-language content is low, comprising just 8.5% of the music streamed in Quebec.

In accordance with the bill, platforms would have to display their default interfaces in French within the province, also including platforms that produce original French-language content within that selection. Companies that disobey the rules could face financial penalties, although Lacombe says that those who cannot comply due to their business model can enter a deal with the Quebec government to establish “substitute rules.”

The bill states that the Quebec government would have to establish content proportions or quotas on how much content needs to be produced or featured on these platforms, although no numbers were specified.

Bill 109 — officially titled “An Act to affirm the cultural sovereignty of Quebec and to enact the Act respecting the discoverability of French-language cultural content in the digital environment” — will be closely tied to existing Quebec legislation and institutions. All platforms will be required to register with the Minister of Culture and Communications, and the bill will amend the right to access French-language cultural content in the Quebec Charter of Human Rights and Freedoms.

While Quebec is tightening regulations, the streaming services are already pushing back against existing content policies, arguing that the Canadian Radio-television and Telecommunications Commission (CRTC) should not impose content obligations upon them. A CRTC hearing is currently underway from May 14 to 27 to outline a new definition of Canadian Content (CanCon), including regulations.

Major companies have been pushing back against the CRTC’s implementation of the Online Streaming Act in the hearing, which includes a plan to require major foreign streaming companies to invest in Canadian Content funds. – Stefano Rebuli

Amidst new reports about a South Korean investigation into its chairman, HYBE shares fell 6.8% to 266,000 KRW ($192.69) during the week ended May 30. That was the biggest decline for a music stock in a week marked by modest gains and losses.

Reports out of South Korea this week said police in Seoul have resubmitted a search and seizure warrant for HYBE chairman Bang Si-hyuk in an investigation into allegations of fraudulent stock transactions by the music mogul. Bang allegedly misled previous shareholders about HYBE’s intention to go public, which caused them to sell HYBE shares ahead of the company’s initial public offering in 2020. Sources told Yonhap News Agency that Bang netted $291 million in 2020 from deals with private equity firms to share a portion of the gains from HYBE’s IPO.

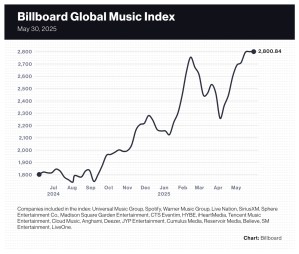

The 20-company Billboard Global Music Index (BGMI) was unchanged at 2,800.84 as the index had an even number of winners and losers. In a week with a remarkable amount of unremarkable movement, the majority of companies fell within a narrow band between a 2% gain and a 1% loss.

Trending on Billboard

Music stocks underperformed numerous market indexes. In the U.S., the Nasdaq gained 2.0% to 19,113.77 and the S&P 500 rose 1.9% to 5,911.69. The U.K.’s FTSE 100 climbed 0.6% to 8,772.38. South Korea’s KOSPI composite index jumped 4.1% to 2,697.67. China’s SSE composite was flat at 3,347.49.

But music stocks have posted big gains in 2025. The BGMI is up 31.8%, far surpassing the gains of the Nasdaq (14.2%) and the S&P 500 (up 12.0%). Spotify, the index’s most valuable component, has risen 42.8%. Universal Music Group (UMG), the BGMI’s second-largest company, has gained 17.8%.

The lone music company to report earnings this week, Reservoir Media, rose 7.9% to $7.80. The quarterly earnings released on Wednesday (May 28) showed a 10% revenue gain and a 14% improvement in adjusted EBITDA. Meanwhile, the only company to post a double-digit gain was Cumulus Media, which rose 15.4% to $0.15. Cumulus tends to have wild swings, however, since it was delisted from the Nasdaq on May 2 and began trading over the counter.

iHeartMedia jumped 6.5% to $1.31. Spotify, the BGMI’s fourth-best performer, rose 1.9% to $666.25. Madison Square Garden Entertainment improved 1.5% to $37.11, and UMG gained 1.4% to 28.16 euros ($31.95).

Live Nation fell 5.4% to $137.24, lowering its year-to-date gain to 6.0%. On Thursday, the company fell 2.9% on heavier-than-average trading volume following reports that it canceled concerts at Boston’s Fenway Park by Shakira and Jason Aldean due to safety concerns about the venue’s stage.

Both Chinese music streamers had off weeks that reduced their stellar year-to-date performances. Tencent Music Entertainment (TME) fell 4.0% to $16.82, lowering its year-to-date gain to 50.9%. Netease Cloud Music, the BGMI’s biggest gainer of 2025 at 88.2%, fell 2.9% to 211.20 HKD ($26.94).

Billboard

Billboard

Billboard

In her letter on Friday (May 30) announcing she achieved a long-time goal of owning the master recordings to all of her songs, Taylor Swift described herself as “endlessly thankful” to the private equity firm Shamrock Capital that sold Swift their holdings of her early music. In fact, Swift is “so grateful to everyone at Shamrock” that she jokingly said her “first tattoo might just be a huge shamrock in the middle of my forehead.”

Swift has not always spoken so warmly about the California-based investment firm — until they struck the deal she says she’d been seeking for years.

Trending on Billboard

When news broke in November 2020 that Shamrock Holdings purchased Swift’s Big Machine Label Group catalog from Scooter Braun’s Ithaca Holdings — marking the second time in 17 months that Swift’s first six albums had changed hands — the superstar said “it was the second time my music had been sold without my knowledge.”

In a letter Swift wrote to Shamrock Holdings at the time, which she shared on Twitter, she said she was initially hopeful for her “musical legacy and our possible future together.” But she said she could not partner with them because of certain undisclosed terms that Swift said would enrich Braun, related to her “music masters, music videos and album artwork.”

“I simply cannot in good conscience bring myself to be involved in benefiting Scooter Braun’s interests directly or indirectly,” Swift wrote in the letter.

Braun, who has disputed many of Swift’s assertions in the past, said simply on Friday (May 30), “I am happy for Taylor.”

In Shamrock’s statement after announcing its acquisition back in 2020, the company expressed admiration and respect for Swift’s work and professionalism, describing her as a “transcendent artist” with a “timeless catalog.”

“We made this investment because we believe in the immense value and opportunity that comes with her work,” Shamrock said in a statement at the time. “While we hoped to formally partner, we also knew this was a possible outcome … We hope to partner with her in new ways moving forward.”

At least publicly, that was that for about five years. But behind the scenes, Swift kept Shamrock abreast of her plans to re-record albums, according to statements from Swift. And privately, Shamrock explored selling Swift’s catalog, according to sources.

What prompted the sale now is not known. While Swift’s Taylor’s Versions of four of the albums Shamrock held the original recordings to had pulled some fans away from the originals, Swift’s overwhelming dominance as a global superstar resulted in the catalog held by Shamrock still generating nearly $60 million in average annual global revenue between 2022 and 2024, according to Billboard’s estimates based on Luminate data.

“The way they’ve handled every interaction we’ve had has been honest, fair, and respectful,” Swift wrote in her letter on Friday (May 30). “This was a business deal to them, but I really felt like they saw it for what it was to me: My memories and my sweat and my handwriting and my decades of dreams.”

Shamrock did not respond to requests for comment.

Now that all the major music companies have reported earnings for the quarter ended March 31, it’s a good time to reflect on the notable performances in the bunch. Most companies posted good results and showed that music is a reliable business during times of uncertainty, with nearly all trending in the right direction (though companies not mentioned here didn’t necessarily have something to crow about). But because companies naturally experience ebbs and flows — a slow new release schedule or heavy sales of low-margin vinyl records can wreak havoc on market perceptions — the results for any one quarter won’t tell the entire story.

Below, I run down a few notable and/or interesting highlights from the latest earnings releases. For a full recap of earnings reports, refer to Billboard’s 2025 Q1 earnings roundup, which provides quick summaries of music companies’ earnings reports issued from April 29 to May 28. Best top-line revenue growth: 22% by CTS Eventim

Trending on Billboard

German concert promoter and ticketing company CTS Eventim’s top-line revenue got a boost from its 2024 acquisitions of See Tickets and France Billet, as consolidated revenue jumped 22.0% to 499 million euros ($525 million). Growth of the existing business was “slightly higher” than a strong prior-year period, CFO Holger Hohrein said on the May 22 earnings call. Ticketing revenue improved 16.9% to 214 million euros, a record for the first quarter. Retail tickets sold improved 42.1% to 40.5 million. Live entertainment revenue increased 24% to 292 million euros ($316 million), also a first-quarter record. Best streaming growth, record label: 9.5% by Universal Music Group (UMG)

Subscriptions helped offset a lackluster 2.9% increase in other streaming revenue, including ad-supported streaming, resulting in overall streaming growth of 9.5%. UMG executives have told investors they can achieve long-term recorded music subscription growth of 8% to 10% through 2028. While the figure bounces from quarter to quarter — and has fallen well below the target range — UMG landed above the high end of the target by achieving recorded music subscription revenue growth of 11.5% in the first quarter. The subscription growth was “driven primarily by growth in the number of subscribers, and to a much lesser extent, helped by certain price increases,” COO Boyd Muir said during the April 29 earnings call. Best subscription growth, streaming platform: 16.6% by Tencent Music Entertainment (TME)

TME’s subscription growth dominated the quarter for two reasons. First, average revenue per user improved 7.5% to $1.57, in part from the popularity of the Super VIP tier that costs five times as much as a normal subscription. Second, the number of subscribers grew 8.3% to 122.9 million. With more people paying a higher monthly fee, subscription growth rose to 17%. The ripple effects could be seen elsewhere: gross profit margin rose to 44.1% from 40.9% in the year-ago period, and the percentage of paying subscribers versus all music users improved to 22.1% from 19.6% a year earlier. Most surprising new business segment: Tencent Music Entertainment’s physical music sales.

In the first quarter, TME had a 10-day “head-start presale” of the Teens in Times album Beyond Utopia. TME also sold physical albums for One Hundred Thousand Volts by Silence Wang. For the K-pop artist G-Dragon, TME conducted a presale of light sticks and other products and offered limited-edition merchandise to buyers of his digital albums. Most impactful executive quotes: Sphere Entertainment Co. Executive chairman/CEO James Dolan and Vivid Seats CEO Stan Chia

Two vastly different companies provided contrasting takes on the state of live music demand. Amidst reports of falling international tourism to the U.S., Sphere Entertainment Co. CEO James Dolan downplayed concerns about visits to Las Vegas and attendance at the Sphere venue. Even if tourism took a hit, Dolan explained that “demand exceeds capacity, so we have room to absorb any issues from that.”

On the other hand, Stan Chia, CEO of secondary tickets marketplace Vivid Seats, described a more challenging landscape. The quarter “fell short of our expectations,” he said during the May 6 earnings call. Chia blamed the shortfall on “robust competitive intensity” and “softening industry trends amidst consumer uncertainty.” What’s more, he added, “economic and political volatility has impacted consumer sentiment, and this uncertainty can also impact how and when artists and rights holders go to market.” A 14% decline in revenue, combined with Chia’s comments and the company’s suspension of full-year guidance, caused a 38% one-day decline in Vivid Seats’ share price.

When Chappell Roan accepted her trophy for best new artist at the 2025 Grammy Awards in February, she asked a question that quickly went viral. The pop star used her speech to advocate for livable wages and health care for recording artists, concluding with the line, “Labels, we got you, but do you got us?”

Tatum Allsep, founder and CEO of the nonprofit Music Health Alliance, posted the speech to her Instagram account that night. “THIS!!!! Music Health Alliance has got you, your band, crew, team, songwriters, engineers, etc. #HealTheMusic,” read her caption.

“At first, I was jumping up and down and elated,” Allsep recalls, “and then, after I started reading the articles coming out, I was like, ‘Wait a minute. Chappell lost a record deal in 2020. We were here.’ We could have helped her in two seconds, but she didn’t know. And that’s on us.”

Trending on Billboard

By Feb. 13, Music Health Alliance and Universal Music Group partnered to launch the Music Industry Mental Health Fund, with the goal of providing mental health services to music industry professionals. The two organizations first started working together during the pandemic, creating a concierge program for UMG artists, songwriters and employees. Yet the Mental Health Fund is the latest step in Allsep’s decadeslong career as an advocate for health care in the industry, and on June 4, she will be honored with the Impact Award at Billboard’s Country Power Players event in Nashville.

“[Awareness] has got to come from the industry internally,” she says. “Just letting people know that we’re a safe space and we exist. All the funds we raise go right back into our programs and services. We want it to be that way, but we also want those that need us to know we’re here.”

How were the Music Health Alliance and UMG able to move so quickly following Chappell Roan’s speech?

We were already working with [UMG], and six months before the Grammys, we had started to talk about doing something in the mental health space. Chappell’s speech [made us say], “OK, now’s the time. This is what we need to do.” It was a great opportunity for the industry, for the label and for us to do something really meaningful at a time when people were listening.

You founded the Music Health Alliance in 2013. Why is it still necessary for an artist like Roan to give the speech she did 12 years later?

It’s not black and white. It’s a complicated issue. You get health insurance by being an employer of an organization — and you can negotiate anything, I understand that. But talking about Chappell specifically, if she was going to be an employee of UMG, they would own her creativity. And that’s suffocating for artists. We’ve got to prioritize their health, and that needs to be equally as important as making sure their vocal cords work when they’re going out.

What kind of uptick in artists reaching out to you did you experience following the formation of the Mental Health Fund?

For February, March and April, it was a 250% increase over last year. And that’s specifically for mental health.

The first Music Health Alliance fundraising event was hosted with Jack Clement for his “living wake” in 2013. What are more recent examples of working alongside an artist to create change?

Dierks Bentley is a great example. We went to college together and started in the music industry the same week. He was in the tape room at [The Nashville Network] and I was the receptionist at MCA Records in the promotion department, and we thought we had arrived. I think we were each making like $12,000 a year. And so, when I started Music Health Alliance, he was one of the first people that was like, “I support this.” About two years in, his team called and they were like, “Dierks wants to provide group health insurance for his band.” And I’m like, “I don’t know anything about group health insurance.” That was over Christmas break of 2016. By Jan. 1, we had a game plan, and by Feb. 1, his band and team were fully insured.

What are the goals for the Mental Health Fund in 2025 and beyond?

Where there’s a gap and a really serious need is for outpatient counseling. Vetting counselors is huge. You can’t just watch a 30-minute video and be music industry-informed. You have to understand the creative brain, and that is not the same. Once [an artist or executive] knows that they can trust us, we can help them for as long as they need.

This article originally appeared in the May 31, 2025 issue of Billboard.

It’s a better-late-than-never Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. Earlier this week, we revealed our annual list of executives driving the success of country music, and today welcomes a first-ever industry-wide Power List for our mates in the United Kingdom.

Big Machine Records promoted Rachel Burleson to senior director of streaming, recognizing her leadership and strategic impact since joining the label in 2021. In her new role, she’ll continue overseeing streaming initiatives for artists such as Tim McGraw, Carly Pearce and Midland. Burleson’s career began at Creative Nation after graduating from Belmont University, where she advanced to manager of records and management, focusing on artist development. At Big Machine, she rose from project manager to director of streaming and was named a 2024 MusicRow N.B.T. Industry Directory honoree. Executive vp and GM Kris Lamb praised Burleson’s platform relationships and influence on the label’s success since coming on board, adding, “Rachel continues to be a trusted voice in the room and a driving force behind our strategy.”

Trending on Billboard

Hallwood Media promoted Tal Meltzer to chief operating officer, based at the company’s West Hollywood headquarters. Formerly svp and head of A&R and business affairs, Meltzer will now oversee all operations and help drive expansion. Reporting to CEO Neil Jacobson, he has led the development of Hallwood’s record label, publishing and distribution divisions, and expanded its focus to include direct artist collaborations. With a background as both a producer and songwriter, Meltzer blends creative and business expertise, enabling him to scale A&R and marketing teams and boost artist development. “Tal’s deep understanding of both the creative and operational sides of our business has been instrumental to our growth,” said Neil Jacobson, CEO of Hallwood Media. “His leadership and vision will drive our continued success as we innovate in the music industry.”

Wasserman Music expanded its global hip-hop and R&B division with the addition of two new executives. Jazmyn Griffin joins as director on the global festivals team in New York, where she will focus on hip-hop and R&B festivals and help launch a new marketing arm. She brings valuable experience from roles at C3 Presents and Live Nation, where she helped develop major U.S. festivals. Tessie Lammle joins as a Los Angeles-based director and agent, representing a diverse roster of hip-hop and R&B artists. She previously spent nearly a decade at UTA, supporting artists and championing women in music. Wasserman execs praised both hires for their industry expertise and potential to “help fuel the surging growth of our Hip-Hop and R&B division.”

Pelle Eriksson, managing director of Border Music, is stepping down after over 40 years in the music industry. Starting in 1985 at Gothenburg’s FolkåRock record store, Eriksson helped transform it into Border Music Distributions AB in 1992. Under his leadership, Border grew from a local retailer into a leading Nordic indie distributor with offices in Oslo and Copenhagen. A breakthrough came in 1995 with its work to elevate The Offspring’s breakout hit “Self Esteem,” which topped the Swedish charts and helped launch Border into national prominence. Eriksson, a recent addition to Billboard‘s International Power Players list, has championed local and global acts, including First Aid Kit, Yung Lean, Nick Cave and Motorhead. He also played a key role in launching PIAS Nordic and oversaw Border’s acquisitions by Redeye in 2019 and Exceleration Music Group in 2023. His successor, Eric Andrén — Eriksson’s first hire as MD — will now lead the company. “It has been an incredible journey, and now that I am about to hand over, I remember (almost) only the fun times – all the people, the trips, the fairs, the artists, and of course – the records,” Eriksson reflected. “From the arrival of the CD to the digital boom and the vinyl revival, we’ve been there.”

Gutt Law, PLLC launched in Nashville to offer laser-focused legal services for the music and entertainment industries. Founded by Rachel Guttmann, the boutique firm combines legal expertise with industry insight to support artists, songwriters, and producers. Guttmann, a Tulane Law graduate and former partner at Taylor Guttmann, is joined by attorney Victoria Powell, a Belmont Law alumnus specializing in music publishing, and Morgan Brasfield, former Kobalt Music and NSAI executive, now head of operations. Together, they provide personalized counsel on creative rights, contracts and career strategy, guided by their client-first motto, “Go With Your Gutt.” Guttmann shared, ““I’m grateful every day to work with a team that’s as passionate about helping creatives succeed as I am.”

Frontiers Label Group appointed Tim Bailey as its new head of label for international. With nearly 20 years in the music industry, Bailey brings deep experience in both live and recorded music, a strong focus on artist development, and a record of commercial success. He began as a concert promoter in 2006, later producing major livestream events during the pandemic. At Earache Records, Bailey helped lead the label to a historic commercial peak, delivering multiple top-five albums in the UK, including a topper for Those Damn Crows. Founded in 1996 by Serafino Perugino, Frontiers has grown from an indie distributor in Italy to a major global rock label working with Megadeth, Def Leppard and more. Perugino praised Bailey’s forward-thinking leadership, asserting, “As we continue expanding our global footprint through exciting new imprints and artist partnerships, Tim’s leadership and vision will be a huge asset.”

Sara Yazdani was elevated to vp of PR and marketing partnerships at Creativ Company, where she oversees U.S. publicity for clients like 1stAveMachine, Ammolite Machine, SpecialGuestX and MOCEAN. Yazdani has worked on projects featuring Eminem, Ed Sheeran, Big Sean and OK Go, often collaborating with director Emil Nava. Previously, she was a national publicist at Biz 3, representing artists such as Chappell Roan and Ty Dolla $ign. She also held key roles at the Recording Academy, managing Grammy media operations, and at Disney Music Group, where she led campaigns for artists like Sabrina Carpenter. Beyond her agency work, she co-chairs the ThinkLA Entertainment Committee.

BeatBread, a music funding platform for artists and independent labels, announced two key hires to drive its next growth phase. Michelle Greener Goodman joins as head of sales and Zach Koche as director of sales, both based in Los Angeles. Goodman brings a background in sales strategy from Telesign and Granular, while Koche joins from FUGA with nearly 15 years of experience in business development, licensing, and artist management.

Tickets For Good, a platform offering free and discounted tickets to live events, appointed Derek DeVeaux as global chief operating officer amid major international expansion in 2025. With over 20 years in tech and operations, DeVeaux will oversee partnerships, platform delivery and daily operations, reporting to CEO Steve Rimmer. New hires include Jess Nesbitt (ticketing operations), Alex Deadman (communications), and UK-based staff Aaron Taylor, George Webb and Laura Harmer. Music partners for 2025 include Pixies, Yungblud and Robbie Williams, who, alongside Edwin van der Sar, became a TFG ambassador. The platform also launched in the Netherlands and was part of the BPI “Grow Music” accelerator.

SyncIt, a new AI-powered music discovery and licensing platform founded by Nathan Duvall, appointed producer and songwriter Patrick Patrikios as creative director. Known for his work with artists like Britney Spears and Little Mix, as well as brands including Hyundai and YouTube, UK-based Patrikios brings extensive industry experience to guide SyncIt’s creative strategy. The platform aims to propel sync licensing by using AI and intuitive search tools to connect artists with visual creators. SyncIt allows users to search for music using proprietary metadata and technology without training on user music. “In hiring Patrick, we have someone who understands the value of music and sound to a brand,” said Nathan Duvall, Founder and CEO of SyncIt. “He not only brings a wealth of experience working with brands, but a portfolio of names which further cements a solid launchpad for SyncIt.”

ICYMI:

Dean Ormston

Former Mojo Music executive Alan Wallis has launched a new music publishing company, Dynamite Songs, which already holds rights to tracks performed by major artists including Ed Sheeran, Kendrick Lamar, and Papa Roach … Dean Ormston, CEO of APRA AMCOS, has been elected chair of CISAC, becoming only the second Australian to hold the position in the organization’s 99-year history. [Keep Reading]

Last Week’s Turntable: Poo Bear Board

Hundreds of entertainment industry leaders, including several from the music world, have signed an open letter issued by the non-profit Creative Community For Peace (CCFP), calling for a rejection of extremist rhetoric and misinformation surrounding the Israel-Hamas conflict.

The letter comes in the wake of the fatal shooting of two young people outside the Jewish Museum in Washington, D.C., during which the assailant reportedly shouted “Free Palestine.” This act, the signatories argue, underscores the real-world consequences of anti-Israel rhetoric.

Signatories include major music industry figures such as Warner Records CEO Aaron Bay-Schuck, former Atlantic Music Group chief Julie Greenwald, Roc Nation’s Andrew Gould, YouTube’s Lyor Cohen, Rhino’s Mark Pinkus and UTA’s David Zedeck, among others. Other signatories include manager/TV host Sharon Osbourne, songwriter Diane Warren, producer Ron Fair, and actors Mayim Bialik and Julianna Marguiles.

Trending on Billboard

The letter responds to a series of open statements from the entertainment and literary communities — including one this week addressed to the U.K. government — that the CCFP says contain false claims and inflammatory accusations. It accuses Hamas, Iran and others of spreading antisemitic propaganda since the Oct. 7, 2023, Hamas attack on Israel, which killed approximately 1,200 people.

In the open letter, the CCFP calls on public figures to reject extremist rhetoric and misinformation targeting Israel and the Jewish people. The letter condemns Hamas, Iran, and their allies for spreading false narratives since the Oct. 7 Hamas attack, accusing them of manipulating well-meaning celebrities into amplifying falsehoods. The letter highlights how such misinformation incites real-world violence, referencing the May 21 killing of two people in D.C. The letter denounces Hamas for endangering civilians and using human shields, while accusing those critical of Israel of co-opting social justice causes to vilify the country. The signatories urge their peers in entertainment to reject falsehoods and work toward a lasting peace.

CCFP chairman David Renzer and executive director Ari Ingel highlighted the urgency of the message and warned that without responsible use of social media platforms by influential entertainers, anti-Israel rhetoric could lead to more violence and antisemitic targeting.

The letter concludes with a call for peace, urging colleagues to stand against misinformation and extremism in order to support a future where Israelis and Palestinians can live side by side in dignity.

The conflict began with Hamas’ attack in 2023. Since then, Israel’s military campaign in Gaza has resulted in an estimated 54,000 Palestinian deaths, according to the Gaza Health Ministry, which does not distinguish between civilian and combatant casualties. The Associated Press reports that of the 58 hostages still held in Gaza, Israeli officials believe about one-third may still be alive.

Read the open letter signed by Greenwald, Cohen, Bay-Schuck and more here.

State Champ Radio

State Champ Radio